The Chase Sapphire Lounge at LaGuardia Airport, accessible only to Sapphire Reserve customers.Benji Stawski / CNBCJPMorgan Chase is betting that ...

A customer exits a Cava restaurant in New York City on June 22, 2023.Brendan McDermid | ReutersAs some consumers pull back on spending amid econo...

President Donald Trump last week increased the pressure on Apple over foreign-made iPhones in a scathing social media post that also intensified ...

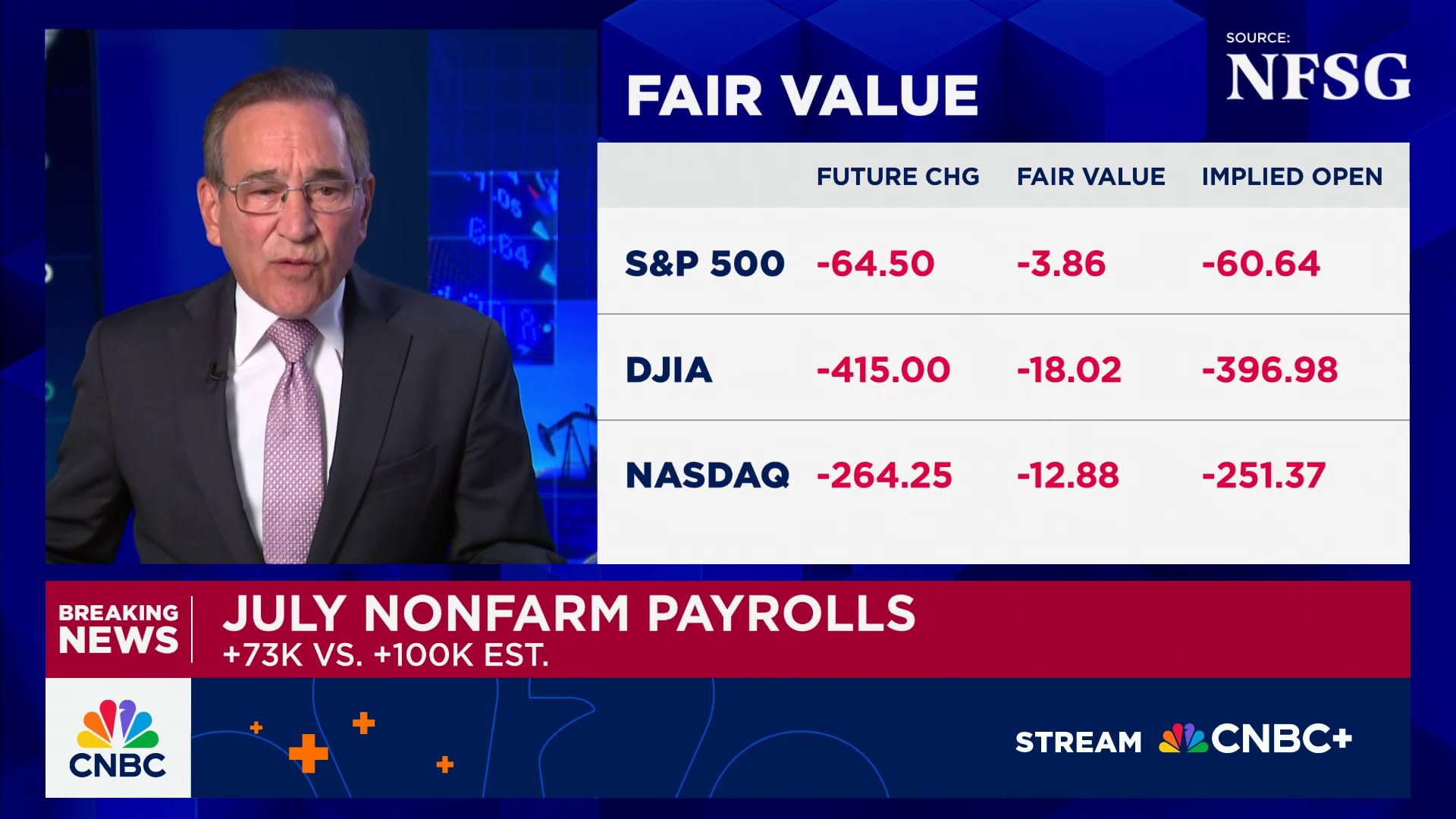

Legislative Hall, the Delaware State Capitol, in Dover, DelawareAimintang | Istock | Getty ImagesState and local government job growth powered th...

Business

PIF will become the title sponsor of revamped golf series.Severn ImagesSaudi Arabia is deepening its investment in women's professional golf.The ...

Palantir topped Wall Street's estimates Monday, surpassing $1 billion in quarterly revenue for the first time, and hiking its full-year guidance....

U.S. President Donald Trump, U.S. Health and Human Services (HHS) Secretary Robert F. Kennedy, Jr., Dr. Mehmet Oz, Administrator for the Centers ...

A detail shot of the Lombardi Trophy next to Kansas City Chiefs and Philadelphia Eagles helmets prior to a news conference on February 03, 2025 i...

Attendees arrive at the auditorium of the CHI Health Center during the Berkshire Hathaway annual meeting in Omaha, Nebraska, US, on Saturday, May...

Speaker of the House Mike Johnson, R-La., speaks to reporters as he walks back to his office as the House of Representatives waits to vote on Pre...

The Chase Sapphire Lounge at LaGuardia Airport, accessible only to Sapphire Reserve customers.Benji Stawski / CNBCJPMorgan Chase is betting that ...

Shares of Kroger rose more than 9% on Friday as the supermarket operator raised its full-year sales outlook and said it's drawing shoppers seekin...

Ray Dalio, founder of Bridgewater Associates LP, speaks during the Milken Institute Asia Summit in Singapore, on Wednesday, Sept. 18, 2024. The s...

Caution tape hangs near the steps of Federal Hall across from the New York Stock Exchange in New York.Michael Nagle | Bloomberg | Getty ImagesTho...

Palantir topped Wall Street's estimates Monday, surpassing $1 billion in quarterly revenue for the first time, and hiking its full-year guidance....

An American Eagle advertisement featuring actress Sydney Sweeney on billboards in New York, US, on Monday, Aug. 4, 2025. Michael Nagle | Bloomber...

Two Federal Reserve officials who voted this week against holding a key interest rate in place explained their decisions Friday, both indicating ...

Jose Luis Pelaez Inc | Digitalvision | Getty ImagesHealth care remained a resilient sector for jobs in July even as the broader labor market show...

Warren Buffett speaks during the Berkshire Hathaway Annual Shareholders Meeting in Omaha, Nebraska, on May 3, 2025.CNBCBerkshire Hathaway on Satu...

The future ticket counter at JFK's new Terminal 1.Leslie Josephs/CNBCIt's far from finished but the new, $9.5 billion Terminal 1 at John F. Kenne...

Ozgur Donmaz | Photodisc | Getty ImagesThe U.S. job market has been showing signs of a gradual weakening. But new federal data issued Friday sugg...

Dr. Adriana Kugler, member of the Board of Governors of the Federal Reserve, speaks to The Economic Club of New York in New York City, U.S., June...

Linde on Friday reported better-than-expected quarterly results Thursday, showcasing what the industrial gas giant does best when times get tough...

Sign at Martha's Vineyard Airport, Massachusetts Cindygoff | Istock | Getty ImagesMartha's Vineyard has long been a summer vacation destination f...

FedEx reported better-than-expected quarterly earnings and revenue Tuesday as the company announced it had achieved its $4 billion cost-cutting g...

Caution tape hangs near the steps of Federal Hall across from the New York Stock Exchange in New York.Michael Nagle | Bloomberg | Getty ImagesTho...

Palantir topped Wall Street's estimates Monday, surpassing $1 billion in quarterly revenue for the first time, and hiking its full-year guidance....

Jose Luis Pelaez Inc | Digitalvision | Getty ImagesHealth care remained a resilient sector for jobs in July even as the broader labor market show...

Warren Buffett speaks during the Berkshire Hathaway Annual Shareholders Meeting in Omaha, Nebraska, on May 3, 2025.CNBCBerkshire Hathaway on Satu...

The market may be trading around record highs, but the Verdence Capital Advisors CIO is worried trouble is lurking.Megan Horneman, who oversees $...

Starbucks shares rose more than 3% in extended trading on Tuesday, even though the coffee chain reported mixed quarterly results. Despite this, w...

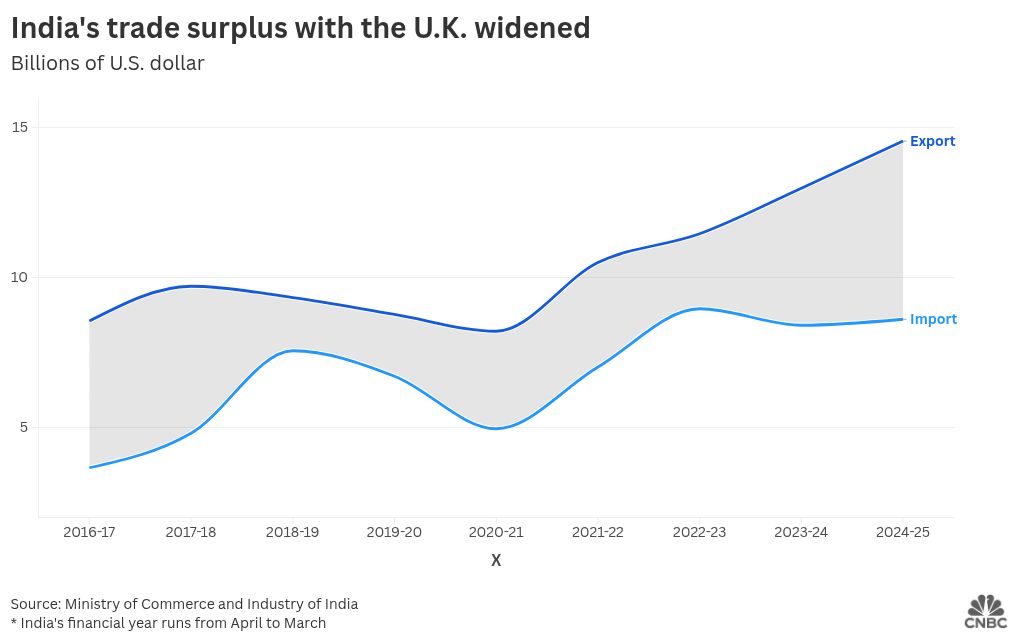

A European Union (EU) flies alongside a British Union flag, also known as a Union Jack in London.Jason Alden | Bloomberg Creative Photos | Getty ...