President Donald Trump on Friday expressed confidence the Federal Reserve will start lowering interest rates, a day after he met with central bank Chair Jerome Powell.

The president indicated the meeting took a positive tone and believes the Fed is ready to provide the monetary policy easing he has been seeking for months.

“I think we had a very good meeting on interest rates. And [Powell] said to me … very strongly, the country is doing well,” Trump told reporters. “I got that to mean that I think he’s going to start recommending lower rates.”

Powell and his fellow policymakers have been reluctant to lower rates as they wait to see the impact Trump’s tariffs have on inflation. In fact, one argument Powell has made against cutting is that the economy is strong enough that it can withstand higher rates as officials watch how the data evolves.

Prior to Trump’s remarks, White House budget director Russell Vought kept up the heat on the Fed’s renovation project, pushing the case for a review of the central bank while pressing for lower interest rates.

Vought echoed Trump’s desire for the Fed to start easing monetary policy as a way to help the economy and specifically the housing market.

“There’s a whole host of issues with regard to the Fed, and we want to make sure that those questions get answered over time,” Vought said during the “Squawk Box” appearance. “This is not a pressure campaign on the Fed chairman.”

The tone following Thursday’s meeting was more conciliatory after months — and even years — of rancor between the Trump White House and the Powell Fed.

Both sides characterized the tour as positive, with a Fed official releasing a statement Friday saying the central bank was “honored” to welcome Trump as well as other Republican officials.

“We are grateful for the President’s encouragement to complete this important project,” the Fed spokesman said. “We remain committed to continuing to be careful stewards of these resources as we see the project through to completion.”

Pressure to continue

Still, Vought said the White House plans to follow through on what Treasury Secretary Scott Bessent has deemed the need for a review of “the entire” Federal Reserve.

In addition to the issues over the building project and interest rates, officials also have criticized the Fed for the operational deficit it is running as interest rates have held high. The Fed in the past has remitted what it has earned from its investments back to the Treasury but has been running a shortfall that totaled nearly $80 billion in 2024 as interest it pays on bank reserves has outstripped what it is realizing on investments.

“We’re going to continue to articulate our policy concerns with regard to the Fed’s management,” Vought said. “You don’t get to just be at the Fed and not have any criticism directed your way. That is not something that exists in the American political system.”

During the Thursday meeting, Trump also expressed confidence that Powell and his colleagues will see things the president’s way when it comes to rates.

“I believe that the chairman is going to do the right thing,” Trump told reporters then. “I mean, it may be a little too late, as the expression goes, but I believe he’s going to do the right thing.”

Despite the previous rancor, Trump recently has backed off previous threats of trying to fire the Fed chair, and he reiterated Thursday that he doesn’t see the need for Powell to resign.

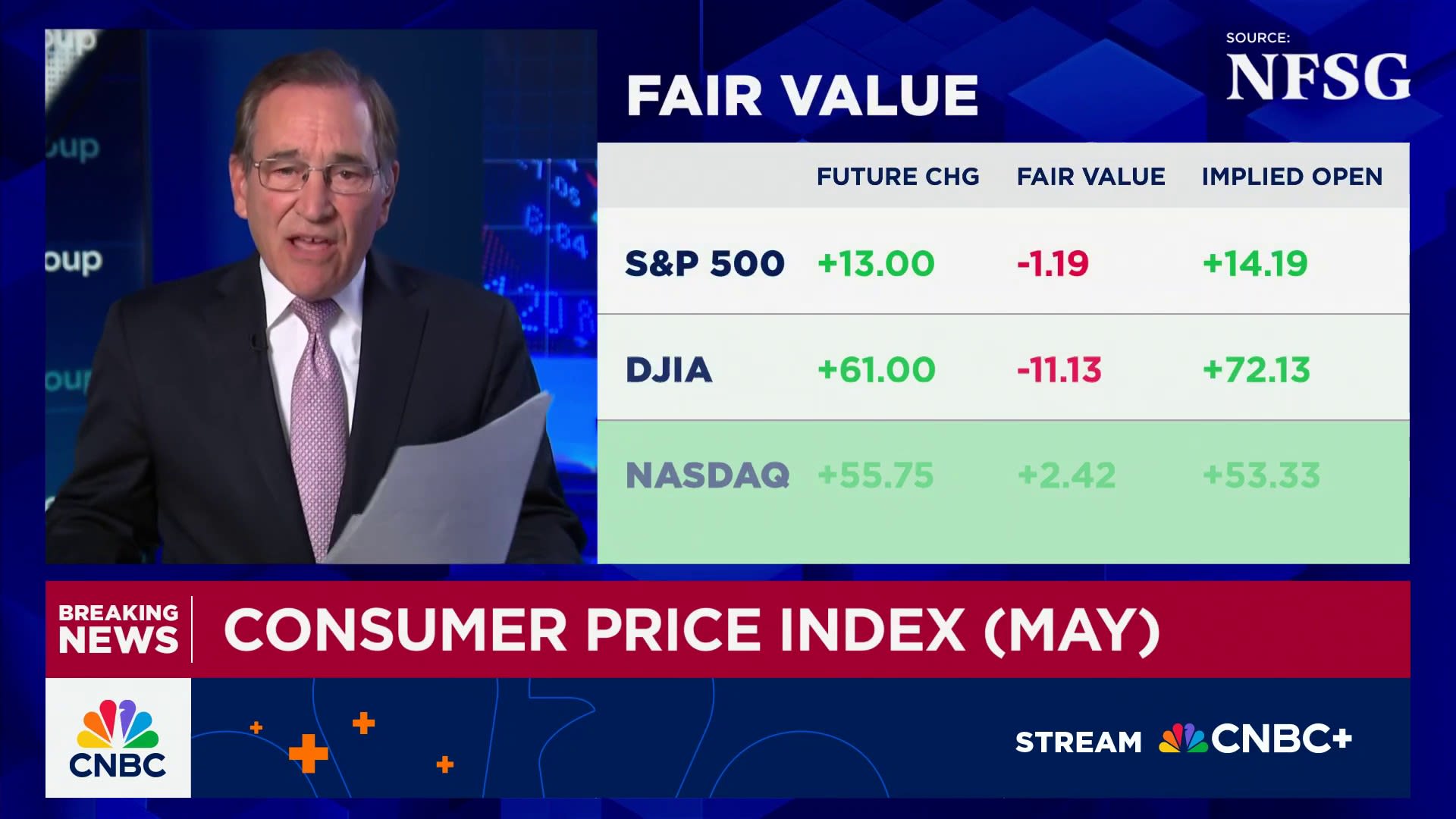

Futures markets are assigning virtually no chance for a rate cut when the Fed meets next week, with the next move not considered likely until September. Market pricing also is tilted toward the possibility of another cut before the end of the year.