Bitcoin’s milestone week comes as new crypto exchange-traded funds are hitting the market.

Investor and best-selling personal finance author Ric Edelman thinks the rollout gives investors more access to upside.

He finds buffer ETFs and yield ETFs particularly exciting.

“You can now invest in bitcoin ETFs that protect you against the downside volatility while preserving your ability to enjoy the upside profits,” Edelman told CNBC’s “ETF Edge” this week.” You can generate massive amounts of yield, much more than you can in the stock market.”

Edelman is the founder of the Digital Assets Council of Financial Professionals, which educates financial advisors on cryptocurrencies. He is also in Barron’s Financial Advisor Hall of Fame.

“Crypto is meant to be a long-term hold, just like the stock market,” said Edelman. “It’s meant to diversify the portfolio.”

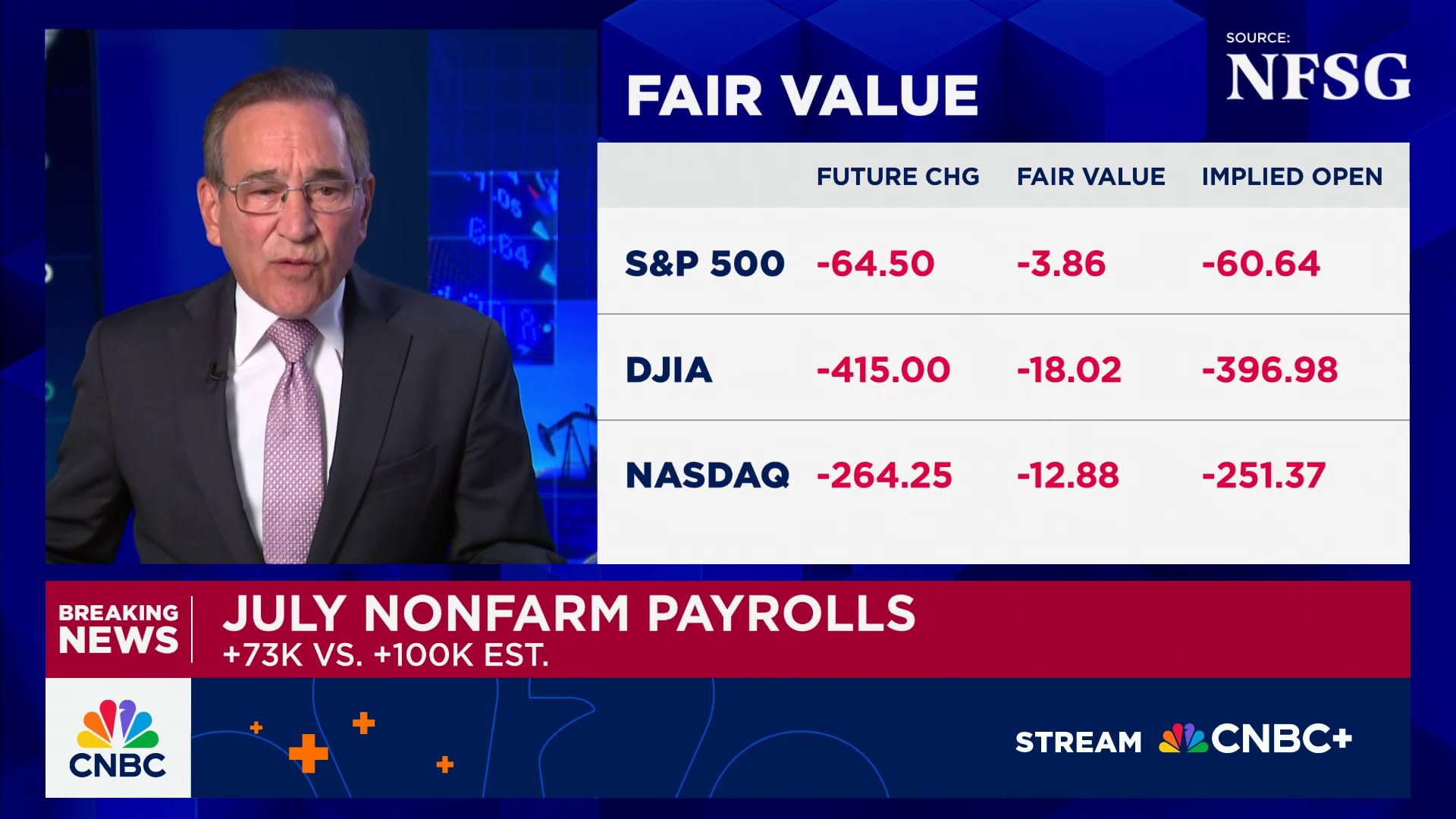

His thoughts came as a bitcoin rally got underway. The cryptocurrency crossed $100,000 on Thursday for the first time since February. As of Friday’s close on Wall Street, bitcoin gained 6% this week. It is now up almost 10% so far this month.

However, Edelman sees problems when it comes to leverage and inverse bitcoin ETFs. He warned that not all crypto ETFs are appropriate for retail investors, suggesting most don’t understand how they work.

‘Same thing as buying a lottery ticket’

“These leveraged ETFs often have an assumption you’re going to hold the fund for a single day, a daily reset,” he said. “That’s literally the same thing as buying a lottery ticket. This isn’t investing.”

During the same interview, “ETF Edge” host Bob Pisani referenced 2x Bitcoin Strategy ETF (BITX) as an example of a leveraged bitcoin product that includes daily fees and resets.

The fund is beating bitcoin this week, jumping more than 12%. So far this month, the ETF is up 19%. But the BITX is underperforming bitcoin this year. It is up about 1.5%, while bitcoin is up roughly 10%.

Volatility Shares is the ETF provider behind BITX.

The company writes on its website: “The Fund is not suitable for all investors … An investor in the Fund could potentially lose the full value of their investment within a single day.”