Consumer sentiment grew even worse than expected in April as the expected inflation level hit its highest since 1981, a closely watched University of Michigan survey

The survey’s mid-month reading on consumer sentiment fell to 50.8, down from 57.0 in March and below the Dow Jones consensus estimate for 54.6. The move represented a 10.9% monthly change and was 34.2% lower than a year ago. It was lowest reading since June 2022 and the second lowest in the survey’s history going back to 1952.

As sentiment moved lower, inflation worries surged.

Respondents’ expectation for inflation a year from now leaped to 6.7%, the highest level since November 1981 and up from 5% in March. At the five-year horizon, the expectation climbed to 4.4%, a 0.3 percentage point increase from March and the highest since June 1991.

Other measures in the survey also showed deterioration.

The current economic conditions index fell to 56.5, an 11.4% drop from March, while the expectations measure slipped to 47.2, a 10.3% fall and its lowest since May 1980. On an annual basis, the two measures dropped 28.5% and 37.9%, respectively.

Stocks turned negative following the report and Treasury yields added to gains.

“Consumers have spiraled from anxious to petrified,” wrote Samuel Tombs, chief U.S. economist at Pantheon Macroeconomics.

Sentiment declines came across all demographics, including age, income and political affiliation, according to Joanne Hsu, the survey’s director.

“Consumers report multiple warning signs that raise the risk of recession: expectations for business conditions, personal finances, incomes, inflation, and labor markets all continued to deteriorate this month,” Hsu said.

In addition to the other readings, the survey showed unemployment fears rising to their highest since 2009.

The survey comes amid concerns that President Donald Trump‘s tariffs will raise inflation and slow growth, with some prominent Wall Street executives and economists expecting the U.S. could teeter on recession over the next year.

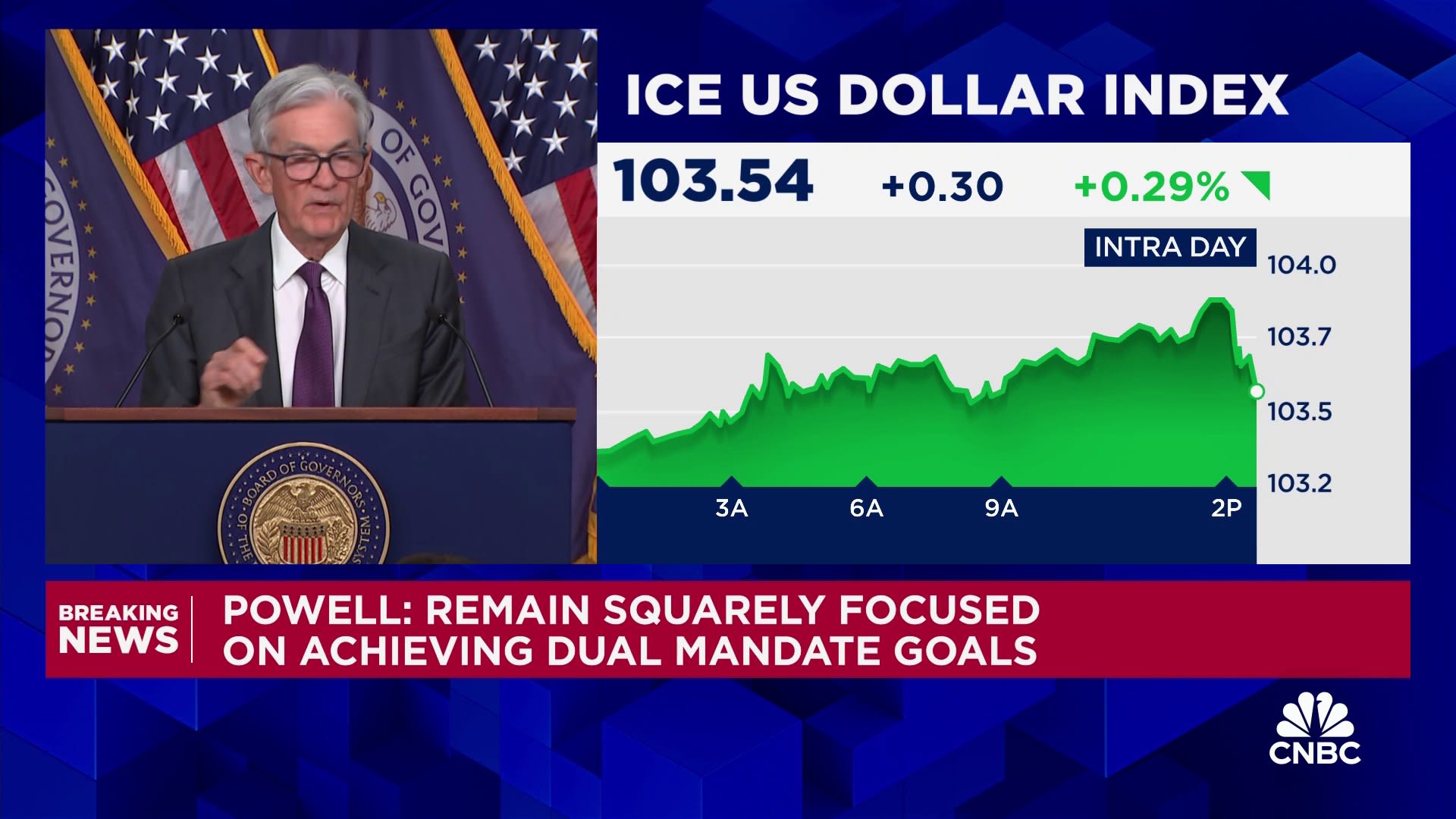

To be sure, the survey’s readings are generally counter to market-based expectations, which indicate little worry of inflation ahead. However, Federal Reserve officials in recent days say they fear that consumer expectations can quickly become reality if behavior changes. Consumer and producer inflation readings this week showed price pressures easing in March.

Also, the University of Michigan survey included responses between March 25 and April 8, the end period coming the day before Trump announced a 90-day stay on aggressive tariffs against dozens of U.S. trading partners.

Get Your Ticket to Pro LIVE

Join us at the New York Stock Exchange!

Uncertain markets? Gain an edge with CNBC Pro LIVE, an exclusive, inaugural event at the historic New York Stock Exchange.

In today’s dynamic financial landscape, access to expert insights is paramount. As a CNBC Pro subscriber, we invite you to join us for our first exclusive, in-person CNBC Pro LIVE event at the iconic NYSE on Thursday, June 12.

Join interactive Pro clinics led by our Pros Carter Worth, Dan Niles and Dan Ives, with a special edition of Pro Talks with Tom Lee. You’ll also get the opportunity to network with CNBC experts, talent and other Pro subscribers during an exciting cocktail hour on the legendary trading floor. Tickets are limited!