Prices that consumers pay for a variety of goods and services rose again in December but closed out 2024 with some mildly better news on inflation, particularly on housing.

The consumer price index increased a seasonally adjusted 0.4% on the month, putting the 12-month inflation rate at 2.9%, the Bureau of Labor Statistics reported Wednesday. Economists surveyed by Dow Jones had been looking for respective readings of 0.3% and 2.9%.

However, excluding food and energy, the core CPI annual rate was 3.2%, a notch down from the month before and slightly better than the 3.3% forecast. The core measure rose 0.2% on a monthly basis, also 0.1 percentage point less than expected.

Much of the move higher in the CPI came from a 2.6% gain in energy prices for the month, pushed higher by a 4.4% surge in gasoline. That was responsible for about 40% of the index’s gain, according to the BLS. Food prices also rose, up 0.3% for the month.

On an annual basis, food climbed 2.5% in 2024 while energy nudged down by 0.5%.

Shelter prices, which comprise about one-third of the CPI weighting, rose by 0.3% but were up 4.6% from a year ago, the smallest one-year gain since January 2022. Services prices excluding rents rose 4% from a year ago, the slowest since February 2024.

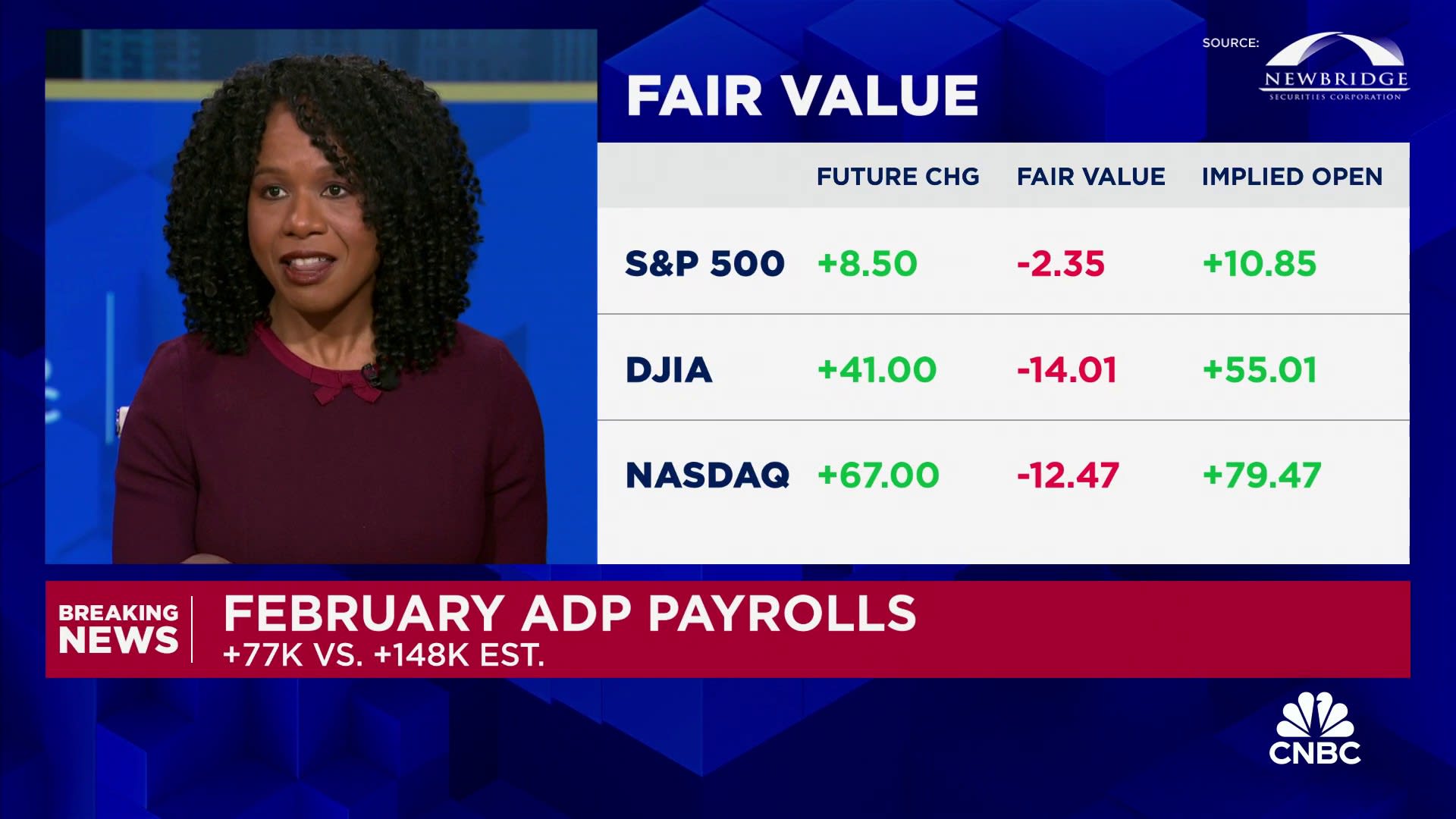

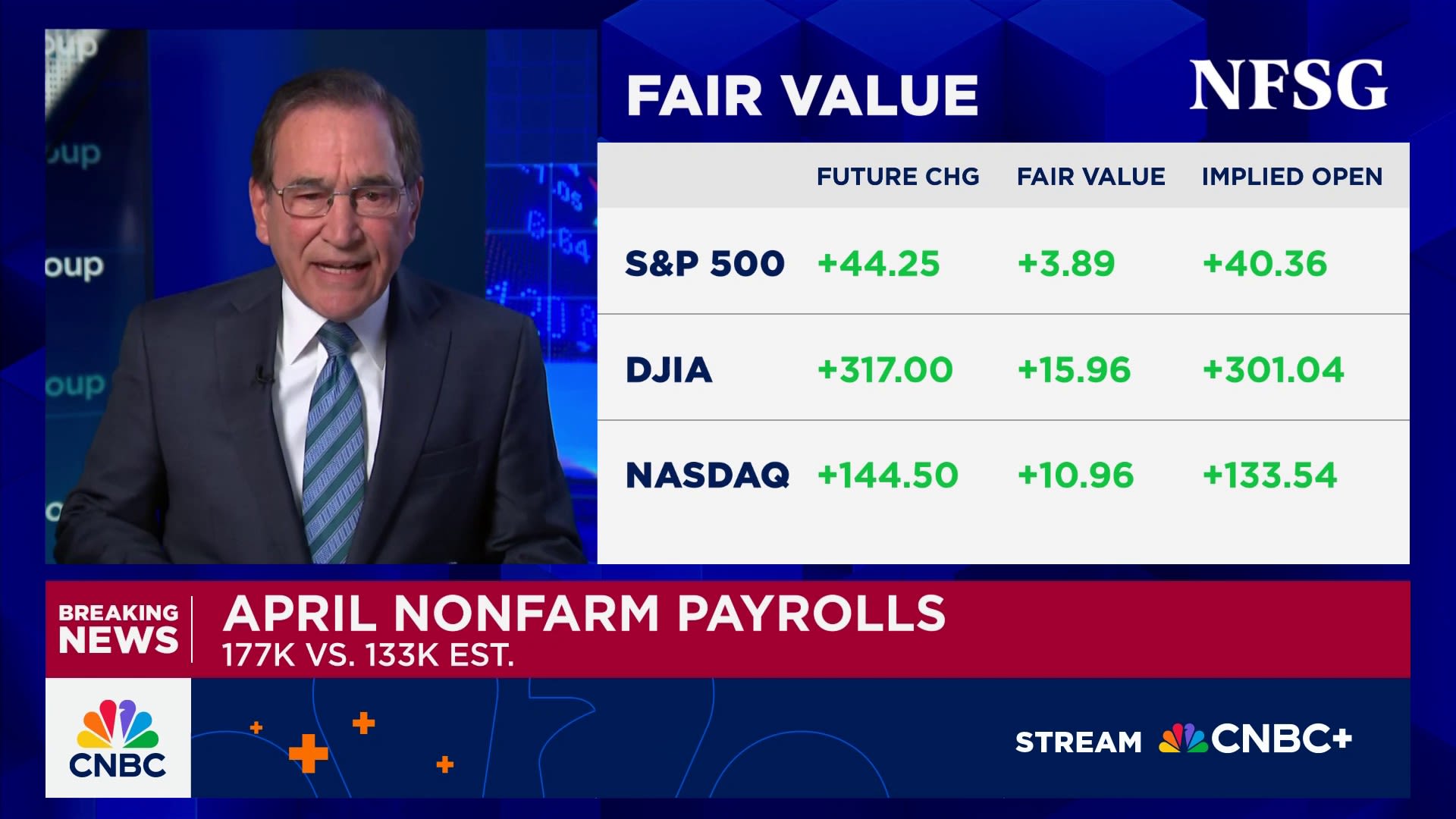

Stock market futures surged following the release while Treasury yields tumbled.

Though the numbers compared favorably to forecasts, they still show that the Federal Reserve has work to do to reach its 2% inflation target. Headline inflation moved down from its 3.3% rate in 2023, while core was 3.9% a year ago.

“Today’s CPI may help the Fed feel a little more dovish. It won’t change expectations for a pause later this month, but it should curb some of the talk about the Fed potentially raising rates,” said Ellen Zentner, chief economic strategist at Morgan Stanley Wealth Management. “And judging by the market’s initial response, investors appeared to feel a sense of relief after a few months of stickier inflation readings.”

The inflation readings this week – the BLS released its produce price index Tuesday – are expected to keep the Fed on hold when it convenes its policy meeting later this month.

While the market cheered the CPI release, the news was less positive for workers: Inflation-adjusted hourly earnings for the month fell by 0.2%, putting the year-over-year gain at just 1%, the BLS said in a separate release.

Details in the inflation report otherwise were mixed.

Used car and truck prices jumped 1.2% while new vehicle prices also moved higher by 0.5%. Transportation services surged 0.5% and were up 7.3% year over year, while egg prices jumped 3.2%, taking the annual gain to 36.8%. Auto insurance rose 0.4% and was up 11.3% annually.

“The inflation rate is currently grappling with a ‘last mile’ problem, where progress in reducing price pressures has slowed,” said Sung Won Sohn, a professor at Loyola Marymount University and chief economist at SS Economics. “Key drivers of inflation, including gas, food, vehicles, and shelter, remain persistent challenges. However, there are signs of hope that long-term inflationary pressures may continue to ease, aided by moderating trends in critical sectors such as shelter and labor costs.”

The report comes with markets skittish over the state of inflation and the Fed’s potential response. Tariffs and mass deportations that President-elect Donald Trump has promised have increased concerns over inflation.

Job growth in December was much stronger than economists had expected, with the gain of 256,000 further raising concerns that the Fed could stay on hold for an extended period and even contemplate interest rate increases should inflation prove stickier than expected.

The December CPI report, coupled with a relatively soft reading Tuesday on wholesale prices, shows that while inflation is not cooling dramatically, it also isn’t indicating signs of reaccelerating.

A separate report Wednesday from the New York Fed showed manufacturing activity softening but prices paid and received rising substantially.

Futures pricing continued to imply a near certainty that the Fed would stay on hold at its Jan. 28-29 meeting but tilted to nearly 50-50 chance of two rate cuts through the year, assuming quarter percentage point increments, according to CME Group figures. Markets expect the next cut likely will happen in May or June.

The Fed uses the Commerce Department’s personal consumption expenditures price index as its primary forecasting measure for inflation. However, the CPI and PPI measures figure into that calculation.

The two readings likely mean that the core PCE will rise just 0.2% in December, keeping the annual rate at 2.8%, according to Samuel Tombs, chief U.S. economist at Pantheon Macroeconomics.