Traders work on the floor of the New York Stock Exchange (NYSE) at the opening bell on May 27, 2025, in New York City.

Timothy A. Clary | Afp | Getty Images

Investors are getting nervous the U.S. government might struggle to pay its debt — and they are snapping up insurance in case it defaults.

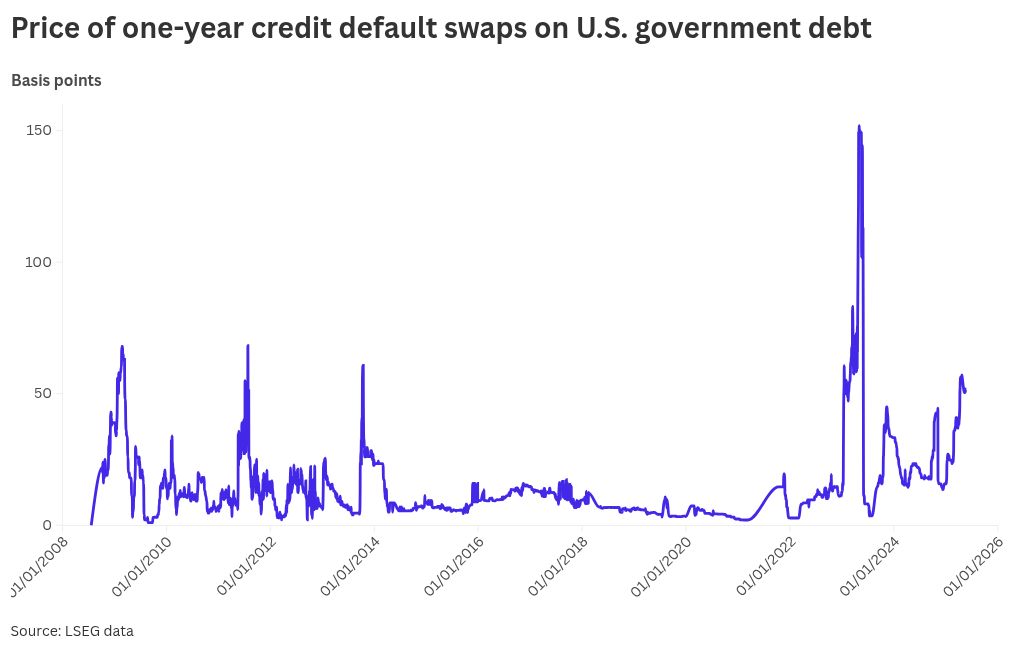

The cost of insuring exposure to U.S. government debt has been rising steadily and is hovering near its highest level in two years, according to LSEG data.

Spreads or premiums on U.S. 1-year credit default swaps were up at 52 basis points as of Wednesday from 16 basis points at the start of this year, LSEG data showed.

Credit default swaps are like insurance for investors. Buyers pay a fee to protect themselves in case the borrower — in this case the U.S. government — can’t repay their debt. When the cost of insuring the U.S. debt goes up, it’s a sign that investors are getting nervous.

Spreads on the CDS with 5-year tenor were at nearly 50 basis points compared with about 30 basis points at the start of the year. In a CDS contract, the buyer pays a recurring premium known as the spread to the seller. If a borrower, in this case, the U.S. government defaults on its debt, the seller must compensate the buyer.

CDS prices reflect how risky a borrower seems and are used to guard against signs of financial trouble, not just a full-blown default, said Rong Ren Goh, portfolio manager in Eastspring Investments’ fixed income team.

The recent surge in demand for CDS contracts is a “hedge against political risk, not insolvency,” said Goh, underscoring the broader anxiety about U.S. fiscal policy and “political dysfunction,” rather than a market view that the government is verging on failing to meet its obligation.

Investors are pricing in the increased concerns around the unresolved debt ceiling, several industry watchers said.

“The credit default swaps have become popular again as the debt ceiling remains unresolved,” said Freddy Wong, head of Asia Pacific at Invesco fixed income, pointing out that the U.S. Treasury has reached the statutory debt limit in January 2025.

The Congressional Budget Office said in a March notice that the Treasury had already reached the current debt limit of $36.1 trillion and had no room to borrow, “other than to replace maturing debt.”

Treasury Secretary Scott Bessent said earlier this month that his department was tallying the federal tax receipts collected around April 15 filing deadline to come up with a more precise forecast for the so-called “X-date,” referring to when the U.S. government will exhaust its borrowing capacity.

Data from Morningstar shows that spikes in CDS spreads on U.S. government debt have typically aligned with periods of heightened worries around U.S. government’s debt limit, particularly in 2011, 2013 and in 2023.

Wong pointed out that there are still several months before the U.S. reaches the X-date.

The U.S. House of Representatives has passed a major tax cut package which could reportedly seethe debt ceiling raised by $4 trillion, pending approval from the Senate.

In a May 9 letter, Bessent urged congressional leaders to extend the debt ceiling by July, before Congress leaves for its annual August recess, in order to avert economic calamity, but warned “significant uncertainty” in the exact date.

“There is still enough time for the Senate to pass its version of the bill by late July to avoid a technical default in U.S. Treasury,” added Wong.

During the debt ceiling crisis in 2023, the U.S. Congress passed a bill suspending the debt ceiling just days before the U.S. government entered into a technical default.

In the past, the U.S. has come dangerously close to a default but in each case, Congress acted last minute to raise or suspend the ceiling.

Fiscal reckoning

The surge in CDS prices is likely a “short-lived” reaction while investors wait for a new budget deal to raise the debt limit. It is unlikely a sign of an impending financial crisis, according to industry watchers.

During the 2008 financial meltdown, institutions and investors actively traded CDS linked to mortgage-backed securities, many of which were filled with high-risk subprime loans. When mortgage defaults soared, these securities plummeted in value, resulting in enormous CDS payout obligations.

However, the implications for soaring demand for sovereign CDS are very different compared to demand for corporate CDS which was the case in 2008, where investors were making an actual call about growing default risk at corporations, said Spencer Hakimian, founder of Tolou Capital Management.

“Traders seem to believe that CDS provides a speculative instrument for betting on a government debt crisis, which I view as extremely unlikely,” said Ed Yardeni, president of Yardeni Research, who added that the the U.S. will “always prioritize” paying interest on its debt.

“The U.S. government won’t default on its debt. The fear that it might do so is not justified,” he told CNBC.

Moody’s earlier this month downgraded the U.S. sovereign credit rating to Aa1 from Aaa, citing the government’s deteriorating fiscal health.

Should the Senate pass the bill in time, the massive ceiling increase will push up the Treasury supply, putting the U.S. fiscal deficit condition back in the spotlight, Wong warned.