Inflation eased slightly in January as worries accelerated over President Donald Trump‘s tariff plans, according to a Commerce Department report Friday.

The personal consumption expenditures price index, the Federal Reserve’s preferred inflation measure, increased 0.3% for the month and showed a 2.5% annual rate.

Excluding food and energy, the core PCE also rose 0.3% for the month and was at 2.6% annually. Fed officials more closely follow the core measure as a better indicator of longer-term trends. The 12-month core measure showed a step down from the upwardly revised 2.9% level in December. Headline inflation eased by 0.1 percentage point.

The numbers all were in line with Dow Jones consensus estimates and likely keep Fed Chair Jerome Powell and his colleagues on hold for the time being regarding interest rates.

The inflation report was “good, but we’re not done,” said Jose Rasco, chief investment officer for the Americas at HSBC Global Private Banking and Wealth Management. “So that prudent patient Powell, as I call him, is going to remain in play, and I think he’s going to wait.”

Elsewhere in the report, income and spending numbers showed some surprises.

Personal income posted a much sharper increase than expected, up 0.9% on the month against expectations for a 0.4% increase. However, the higher incomes did not translate into spending, which decreased 0.2%, versus the forecast for a 0.1% gain.

The personal savings rate also spiked higher, rising to 4.6%.

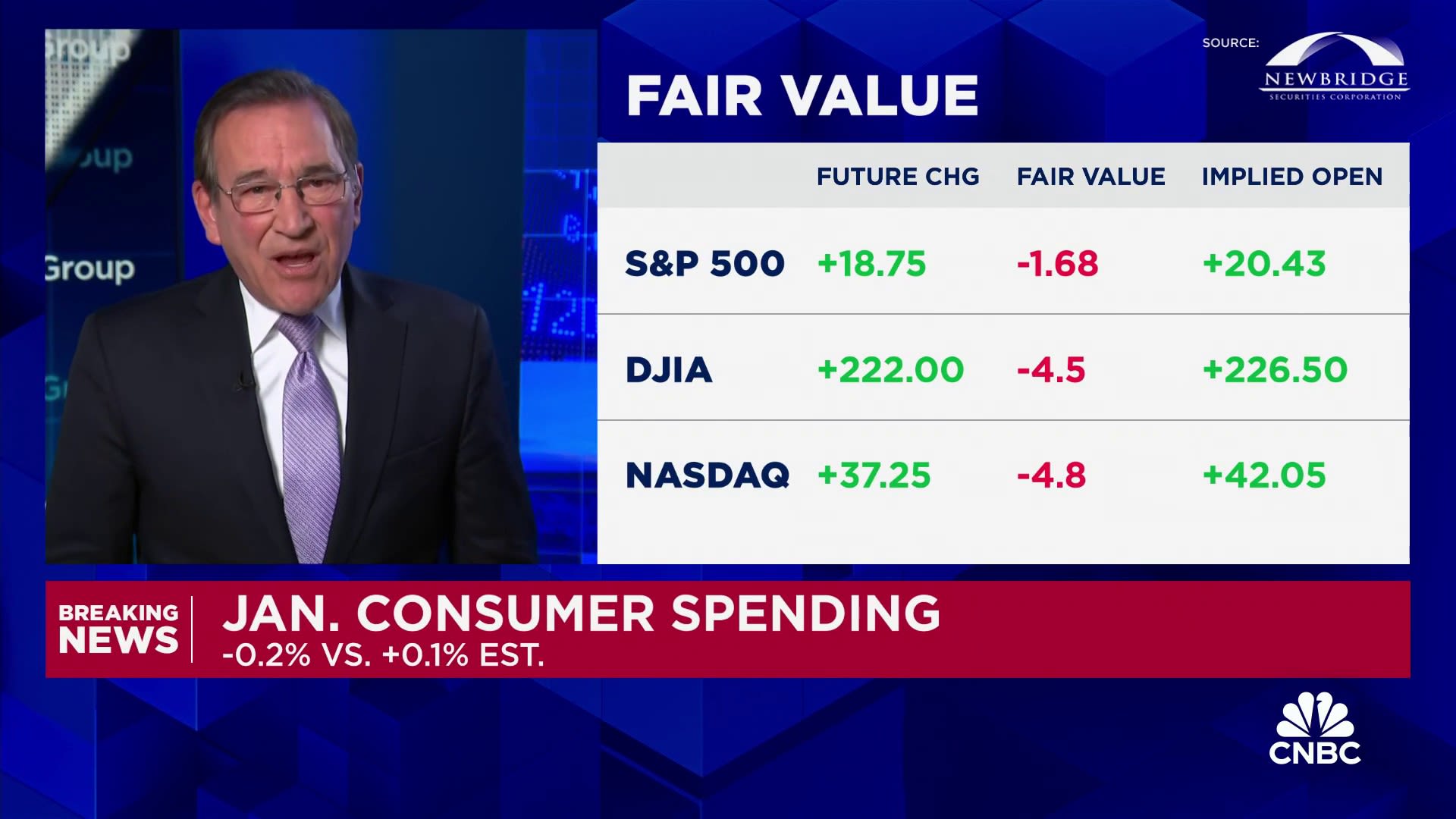

Stock market futures pointed higher following the report while Treasury yields were mostly lower.

The report comes as Fed policymakers weigh their next move for interest rates. In recent weeks, officials mostly have expressed hopes that inflation will continue to gravitate lower. However, they have indicated they want more evidence that inflation is headed sustainably back to their 2% goal before they will lower interest rates further.

Goods prices rose 0.5% on the month, pushed by a 0.9% increase in motor vehicles and parts as well as a 2% jump in gasoline. Services increased just 0.2% and housing rose 0.3%.

Following the report, futures traders slightly raised the odds of a June quarter percentage point rate cut, with the market-implied probability now just above 70%, according to the CME Group’s FedWatch gauge. Markets expect two cuts by the end of the year, though the odds for a third reduction have risen in recent days.

Though the public more closely follows the consumer price index, released earlier in the month by the Bureau of Labor Statistics, the Fed prefers the PCE measure because it is broader based, adjusts for changes in consumer behavior and places considerably less emphasis on housing costs.

The CPI for January showed an all-items inflation rate of 3% and 3.3% at the core.