Inflation edged higher in October as the Federal Reserve is looking for clues on how much it should lower interest rates, the Commerce Department reported Wednesday.

The personal consumption expenditures price index, a broad measure the Fed prefers as its inflation gauge, increased 0.2% on the month and showed a 12-month inflation rate of 2.3%. Both were in line with the Dow Jones consensus forecast, though the annual rate was higher than the 2.1% level in September.

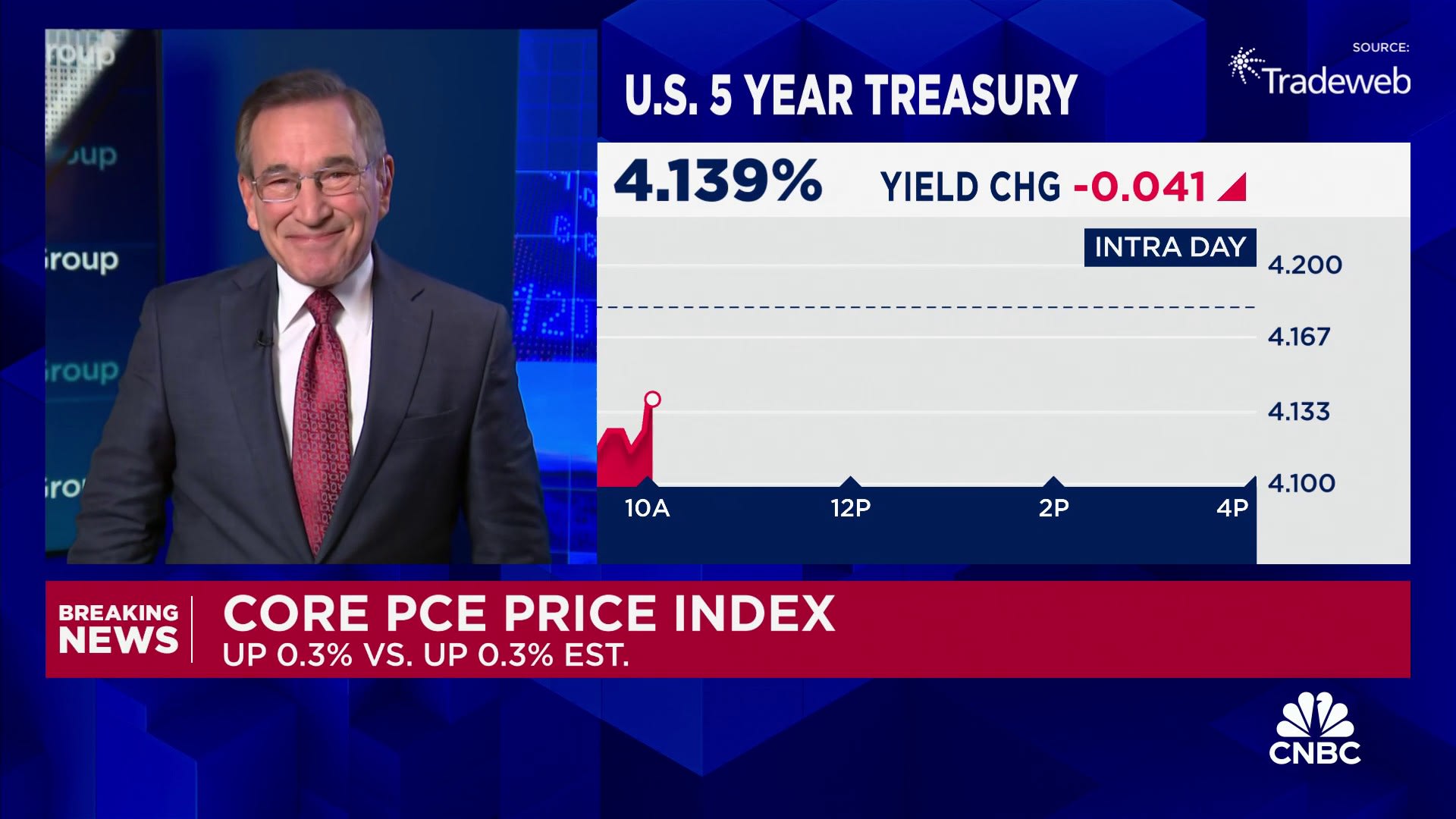

Excluding food and energy, core inflation showed even stronger readings, with the increase at 0.3% on a monthly basis and an annual reading of 2.8%. Both also met expectations. The annual rate was 0.1 percentage point above the prior month.

Services prices generated most of the inflation for the month, rising 0.4%, while goods fell 0.1%. Food prices were little changed, while energy was off 0.1%.

Fed policymakers target inflation at a 2% annual rate. PCE inflation has been above that level since March 2021 and peaked around 7.2% in June 2022, prompting the Fed to go an on aggressive rate-hiking campaign.

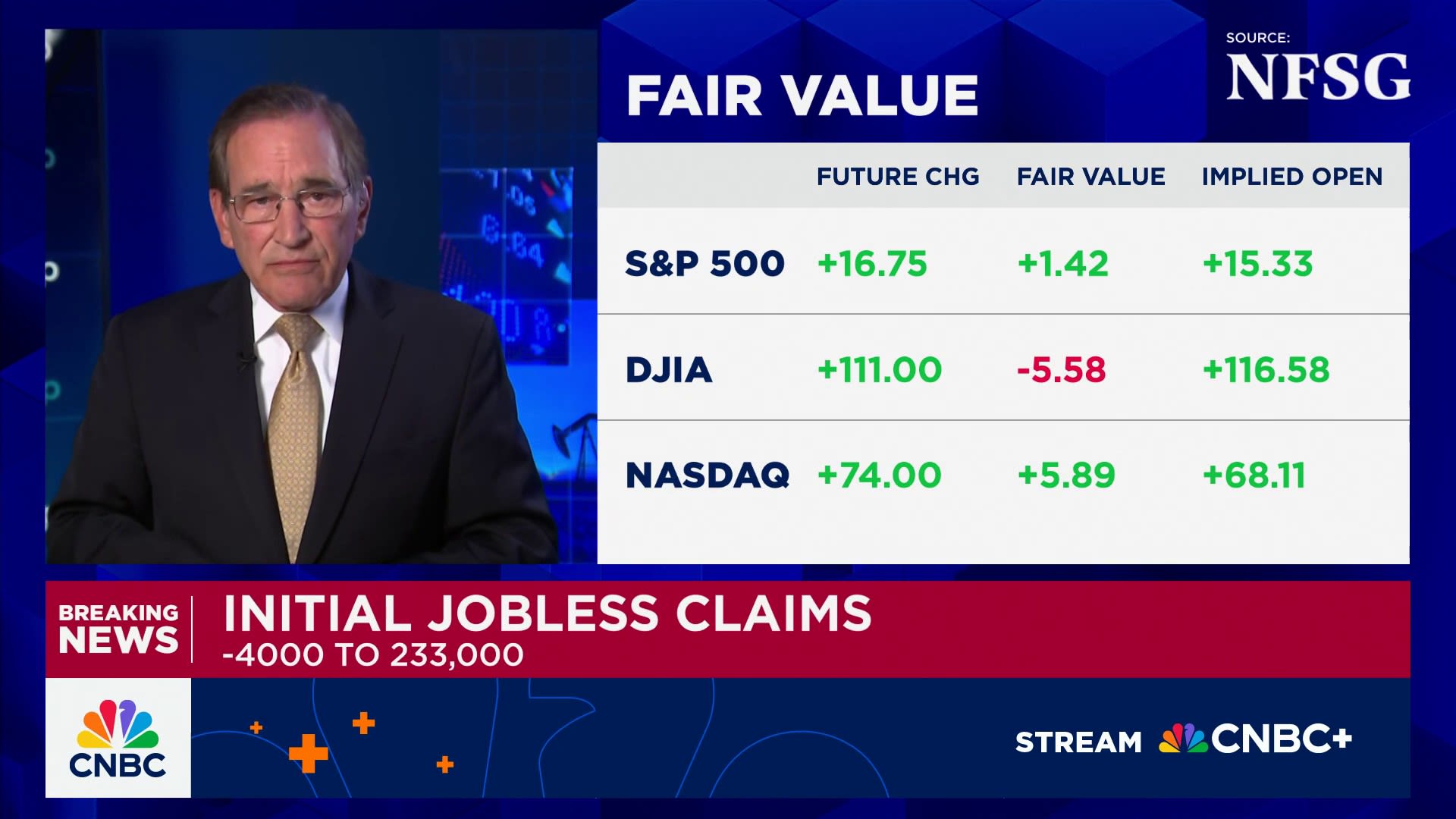

Stocks were mixed following the release, with the Dow Jones Industrial Average up about 100 points, though the S&P 500 and Nasdaq Composite were both negative. Treasury yields fell.

Despite the rise in headline inflation, traders increased their bets that the Fed would approve another rate cut in December. Odds of a quarter-percentage-point reduction in the central bank’s key borrowing rate were at 66% Wednesday morning, according to the CME Group’s FedWatch measure.

While the inflation rate has dropped significantly since the Fed started tightening, it remains a nettlesome problem for households and figured prominently into the presidential race. Despite its deceleration over the past two years, the cumulative effects of inflation have hit consumers hard, particularly on the lower end of the wage scale.

Consumer spending was still solid in October, though it tailed off a bit from September. Current-dollar expenditures rose 0.4% on the month, as forecast, while personal income jumped 0.6%, well above the 0.3% estimate, the report showed.

The personal saving rate slipped to 4.4%, tied for its lowest since January 2023.

On the inflation side, housing-related costs have continued to boost the numbers, despite expectations that the pace would cool as rents eased. Housing prices rose 0.4% in October.

The Fed follows a broad dashboard of indicators to gauge inflation but uses the PCE figure specifically for its forecasting and as its main policy tool. The data is considered broader than the Labor Department’s consumer price index and adjusts for behavior in consumer spending such as replacing more expensive items for less costly ones.

Officials tend to consider core inflation as a better long-term gauge but use both numbers in considering policy moves.

The release follows consecutive rate cuts by the Fed in September and November totaling three quarters of a percentage point. Though the November reduction happened after the month the report covers, markets had been widely anticipating the move.

Fed officials at their November meeting indicated confidence that inflation was moving toward the 2% target, though members advocated a gradual reduction in interest rates as they acknowledged uncertainty over how much cuts will be needed.