Goldman Sachs has cut its probability forecast for a U.S. recession to 20% shortly after raising it, as fresh labor market data sparked a reassessment of market views on the economy.

Economists at Goldman earlier this month raised their 12-month U.S. recession probability from 15% to 25% after the U.S. July jobs report of Aug. 2 showed nonfarm payrolls grew by a less-than-expected 114,000. That was down from the downwardly revised 179,000 of June and below the Dow Jones estimate of 185,000.

The report triggered widespread concerns about the world’s largest economy, and contributed to the sharp — but ultimately brief — stock market sell-off at the start of the month.

It also triggered the “Sahm Rule,” a historical indicator showing that the initial phase of a recession has begun when the three-month moving average of the U.S. unemployment rate is at least half a percentage point higher than the 12-month low.

Goldman initially cited this as a reason for hiking the probability of an economic downturn — but changed tack on Saturday, when it wrote in a note that it saw the odds down to 20% because data released since Aug. 2 showed “no sign of a recession.”

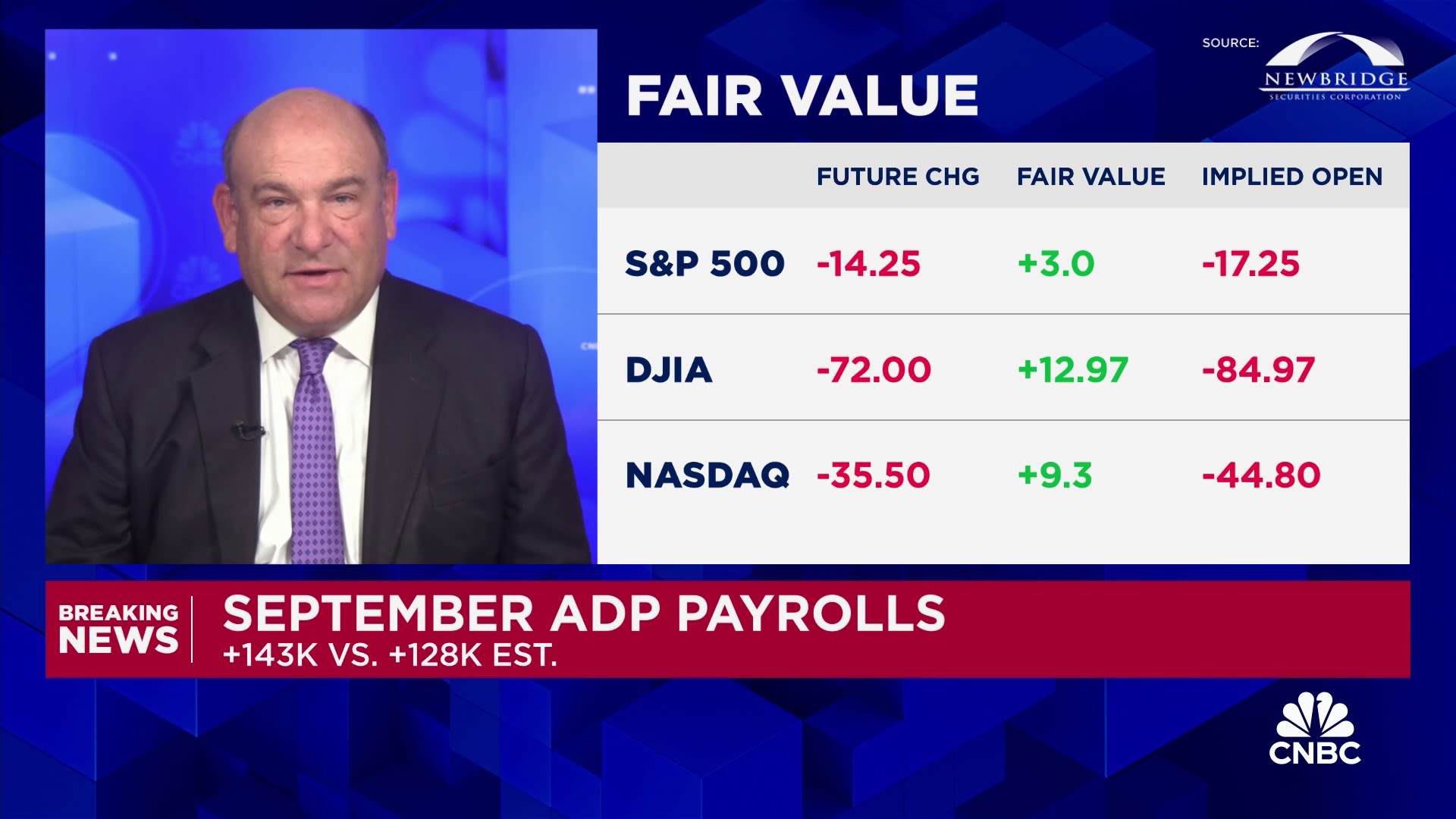

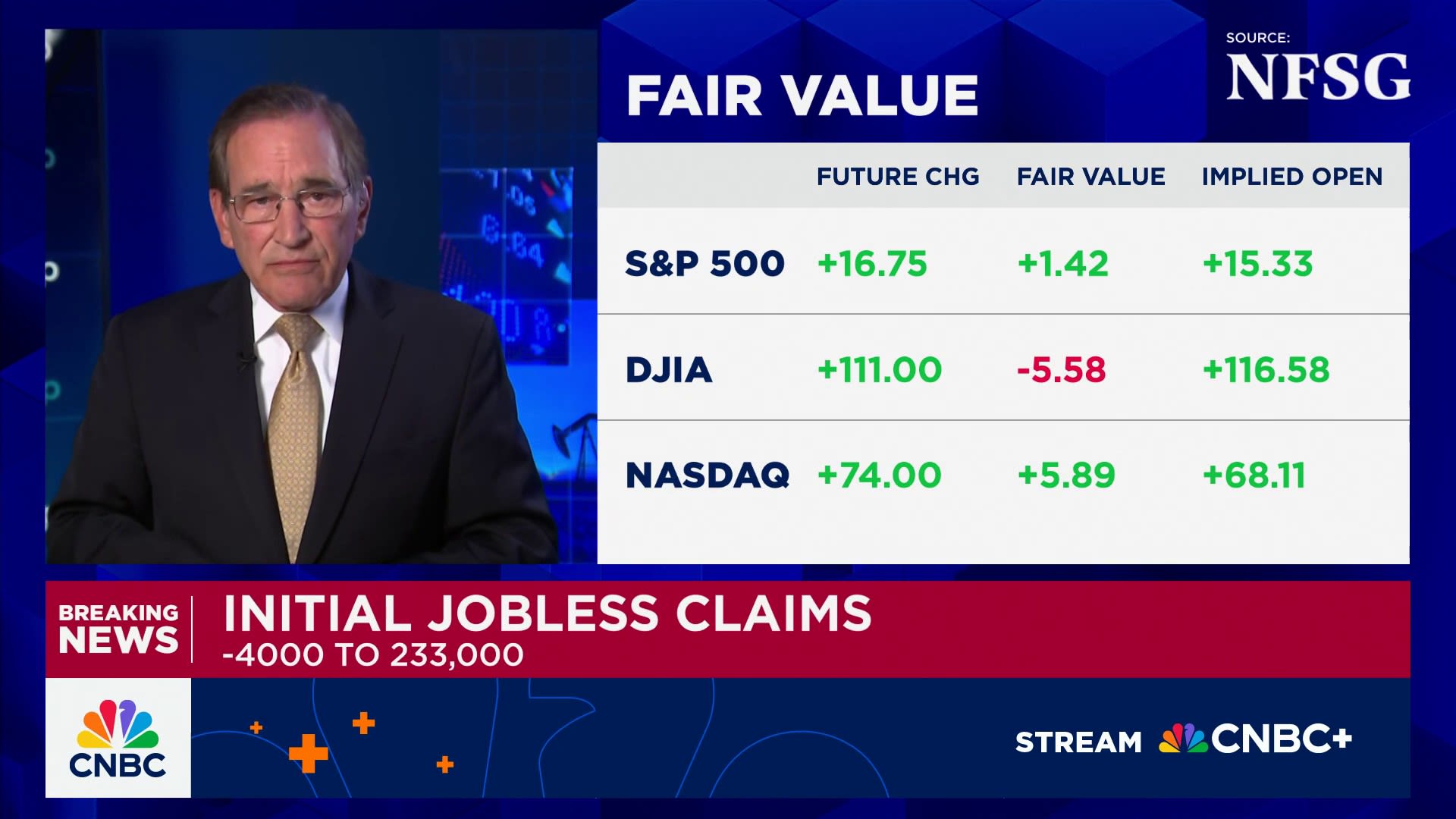

That included retail sales for July — which rose by 1%, versus an estimate of 0.3% — and weekly unemployment benefit claims, which were lower than expected.

The figures prompted a change in mood which was reflected in a rally in global stocks late last week.

“Continued expansion would make the US look more similar to other G10 economies, where the Sahm rule has held less than 70% of the time,” Goldman economists said Saturday, noting that several smaller economies, including Canada, had seen sizeable unemployment rate increases in the current cycle without entering a recession.

Claudia Sahm, chief economist at New Century Advisors and inventor of the rule, told CNBC that she did not believe the U.S. was currently in a recession, but that further weakening in the labor market could push it into one.

A healthy jobs report on Sept. 6 would “probably” spur Goldman to cut its recession probability back to 15%, where it had been for nearly a year before August, the bank’s economists said.

Unless another downside surprise in the jobs report takes place, Goldman will become more confident in its forecast for a 25 basis point rate cut at the Federal Reserve’s September meeting, rather than a steeper 50 basis point trim, they added.

Markets have fully priced in a Fed rate cut in September, but have slashed the odds of a 50 basis point reduction to just 28.5%, according to CME’s FedWatch tool.

Rashmi Garg, senior portfolio manager at Al Dhabi Capital, told CNBC’s “Capital Connection” on Monday she expected a cut of 25 basis points “unless we see a sizeable deterioration in the labor market in the Sept. 6 jobs report.”

— CNBC’s Sam Meredith contributed to this story.