Chicago Federal Reserve President Austan Goolsbee said Friday that President Donald Trump’s latest tariff threats have complicated policy and likely put off changes to interest rates.

In a CNBC interview, the central bank official indicated that while he still sees the direction of rates being lower, the Fed likely will be on hold as it evaluates the ever-changing trade policy and how it affects inflation and employment.

“Everything’s always on the table. But I feel like the bar for me is a little higher for action in any direction while we’re waiting to get some clarity,” Goolsbee said on “Squawk Box” when asked about Trump’s new actions Friday morning. “Over the longer run, if they’re putting in place tariffs that have a stagflationary impact … then that’s the central bank’s worst situation.”

“So I think we’ll have to see how big the impacts on prices are,” he added. “I know people hate inflation.”

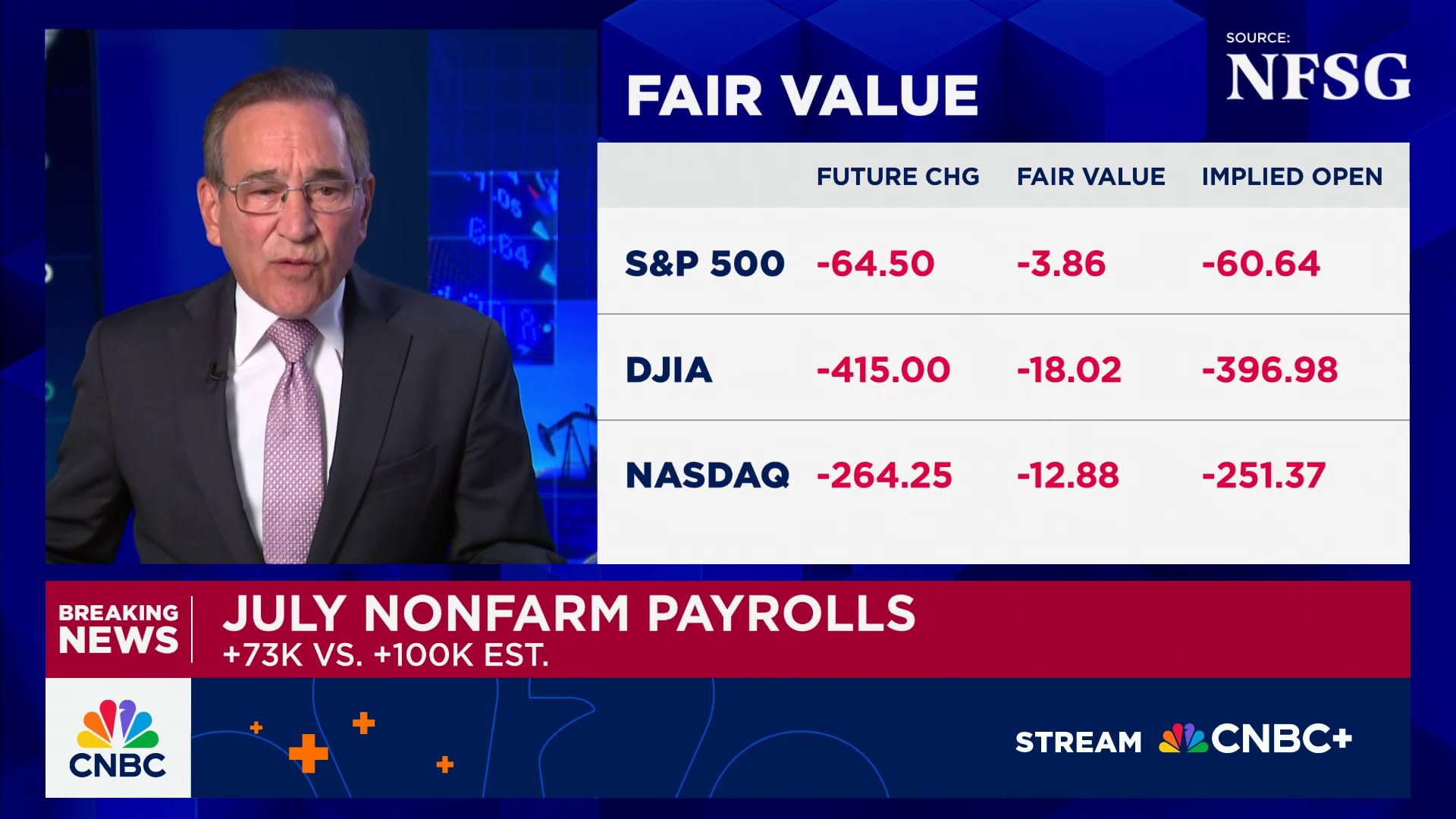

Goolsbee spoke as Trump jolted markets again

While the impact of a costlier iPhone likely wouldn’t mean much from a larger economic perspective, the saber-rattling underscores the volatility of trade policy and provides another flash point for a market already unnerved by worries about fiscal policy that have sent bond yields sharply higher.

Central bankers are generally careful not to wade into issues of fiscal and trade policy, but are left to analyze their repercussions.

Goolsbee said he is still optimistic that the longer-run trajectory is toward solid economic growth before Trump’s April 2 tariff announcement that rattled markets.

“I’m still underneath hopeful that we can get back to that environment, and 10 to 16 months from now, rates could be a fair bit below where they are today,” he said.

Goolsbee is a voting member this year on the rate-setting Federal Open Market Committee, which next meets June 17-18. At the meeting, officials will get a chance to update their economic and interest rate projections. The last update, in March, saw the committee indicating two rate cuts this year.

Markets expect the Fed will cut twice this year, with the next move not happening until September. Goolsbee did not commit to a course of action from here amid the uncertainty.

“I don’t like even mildly tying our hands at the next meeting, much less over six, eight, 10 meetings from now,” he said. “That said, as we went into April 2, I believe that we’re at pretty stable full employment, that inflation was on a path back to 2% and if we could do those, I thought that over the next 12 to 18 months, rates could come down a fair amount.”

The Fed’s benchmark overnight borrowing rate is targeted between 4.25% and 4.50%, where it has been since December. The actual rate most recently traded at 4.33%.