Apple stock should get better, but not quite yet. The news Evercore ISI added Apple to its tactical outperform list on Friday — one session after the stock had its worst performance since early August on reports showing iPhone softness in China. The analysts, however, argued that shares are well positioned with lower expectations going into Apple’s fiscal 2025 first quarter, released on Jan. 30 after the closing bell. The three-month period ended in December covers the holiday shopping season. Evercore expects an in-line print, “with continued emerging market growth and strength from Services and Wearables (new AirPods and Watch).” Looking ahead to the March quarter, the analysts said they “continue to expect a stronger-for-longer iPhone cycle that could drive growth ahead of seasonality.” To be sure, Evercore did flag China as a “key wildcard” for the upcoming fiscal Q1 earnings release. Investors have been worried about muted demand and increased competition in Apple’s second-largest market, which accounted for 15% of overall sales during its fiscal 2024 fourth quarter , the three-month stretch that ended in September. That concern was reflected in Thursday’s roughly 4% decline in Apple shares after a research report from analysts at Canalys suggested Apple had fallen to third place in smartphones sold in China last year — behind homegrown electronics makers Huawei and Vivo. Evercore recognized these concerns in its note to clients but said that demand for the devices in aggregate should remain stable. The Evercore analysts reasoned that Apple’s push to expand its presence in emerging economies like India would pick up the China slack. Apple shares recovered nearly 1% on Friday. Big picture The new research from Evercore and Canalys follows a poor start to 2025 for Apple. While closing at a record high of $259 each on Dec. 26, the tech stock has been on a slide since the new year. Thursday’s sharp decline, the worst single-day performance in more than five months, pushed shares further into correction territory, which was reached with Tuesday’s close. Even with Friday’s bounce, the mega-cap stock remained in a correction, defined by a 10% drop or more from its recent highs. In 2025, Apple shares have lost more than 8% following last year’s 30% advance. The slide in Apple stock during the final days of 2024 and into 2025 mirrors a similar pattern seen at the end of 2023 into 2024. Like the beginning of last year, when the Club sold some Apple shares , we also closed out 2024 with a trim on Dec. 26, the day of the stock’s record close. Neither of those small sales changed our “own it, don’t trade it” designation on Apple. Instead, these moves were in recognition that our position got too large in relation to the rest of the portfolio. After all, we didn’t want to be greedy when sitting on such huge profits. AAPL 5Y mountain Apple (AAPL) 5 years Only time will tell whether or not Apple will rebound quickly in 2025 or continue lower for longer as it did last year. We do, however, anticipate a rally at some point. In 2024, the stock didn’t bottom until late April in the mid-$160s before kicking into high gear for the rest of the year. China was also a big concern early last year. But Apple critics were silenced with a strong fiscal 2024 second-quarter earnings report in May. About a month later, the company unveiled its highly-anticipated generative artificial intelligence system, dubbed Apple Intelligence , which turbocharged another rally that lasted until its most recent record close on Dec. 26. Apple Intelligence, which works with the latest iPhone 16 models and the iPhone 15 Pro and Pro Max, has been going out to users in operating system software updates. Since the first AI features were not available until after September’s iPhone 16 launch, there’s been a debate about whether a more gradual rollout helps elongate the upgrade cycle, which is what the Club believes. Bottom line Despite Evercore’s short-term buy call, Jim is advising against purchasing Apple stock ahead of the earnings release. “It’s got a China wildcard that I don’t like,” he said Friday. “Maybe that can be resolved.” Jim agreed with Evercore’s projections for a “stronger-for-longer iPhone cycle,” and that there’s more upside to come in Apple’s Services business. But shares are lagging for now because of the huge run Apple had at the end of last year. “We had this big spike that we shouldn’t have had,” he said. Candidly, the Club expects a messy December quarter for Apple. As Jeff Marks, the director of portfolio analysis for the Investing Club, put it Thursday: “The long knives are out for Apple, and estimates may need to come down slightly ahead of the iPhone maker’s Jan. 30 earnings report.” (Jim Cramer’s Charitable Trust is long AAPL. See here for a full list of the stocks.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.

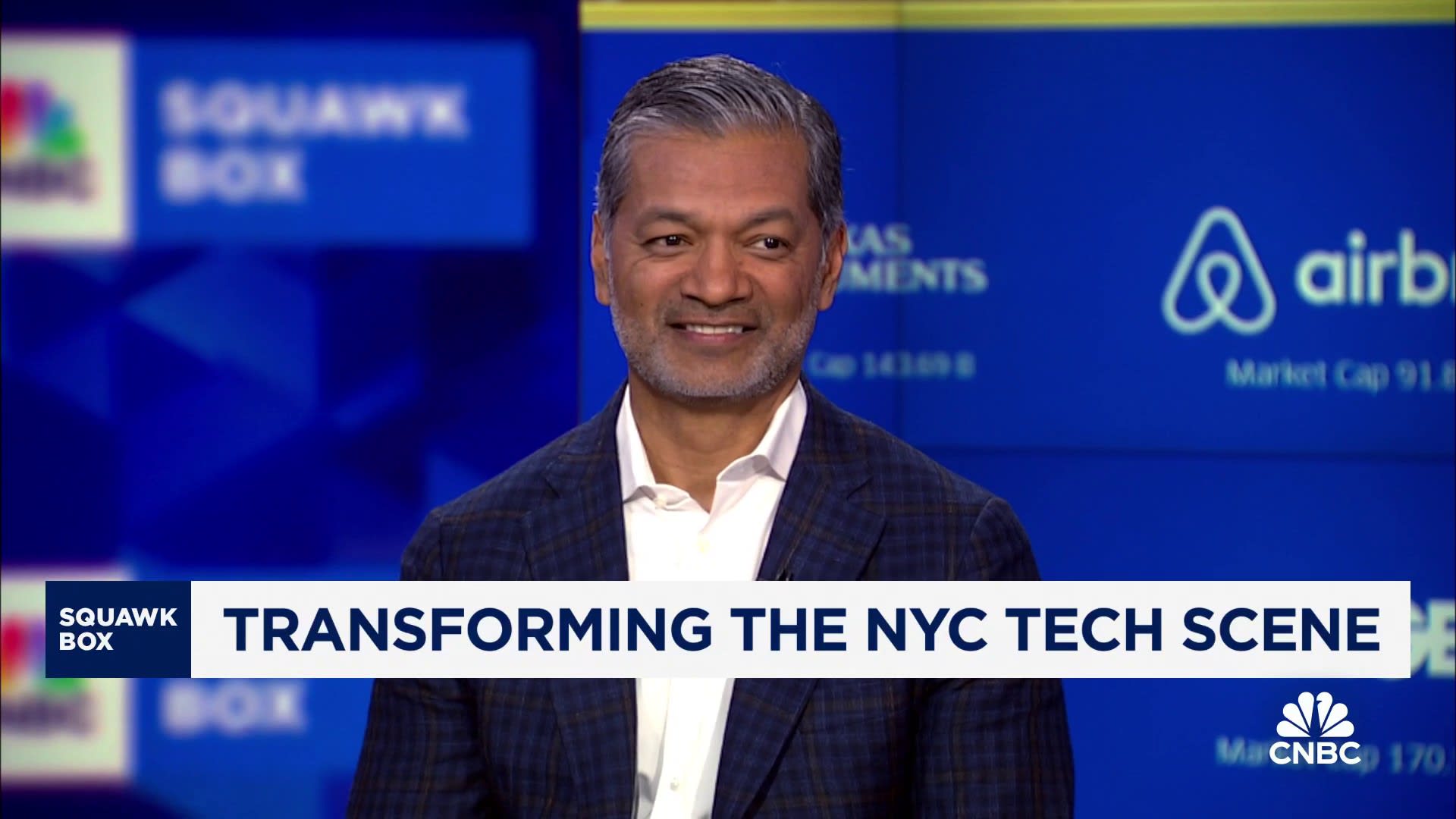

Apple CEO Tim Cook gives an interview at the Fifth Avenue Apple Store on new products launch day on September 20, 2024 in New York City.

Michael M. Santiago | Getty Images News | Getty Images

Apple stock should get better, but not quite yet.