Three years ago, JPMorgan Chase became the first bank with a branch in all 48 contiguous states. Now, the firm is expanding, with the aim of reaching more Americans in smaller cities and towns.

JPMorgan recently announced a new goal within its multibillion-dollar branch expansion plan that ensures coverage is within an “accessible drive time” for half the population in the lower 48 states. That requires new locations in areas that are less densely populated — a focus for Chairman and CEO Jamie Dimon as he embarks on his 14th annual bus tour Monday.

Dimon’s first stop is in Iowa, where the bank plans to open 25 more branches by 2030.

“From promoting community development to helping small businesses and teaching financial management skills and tools, we strive to extend the full force of the firm to all of the communities we serve,” Dimon said in a statement.

He will also travel to Minnesota, Nebraska, Missouri, Kansas and Arkansas this week. Across those six states, the bank has plans to open more than 125 new branches, according to Jennifer Roberts, CEO of Chase Consumer Banking.

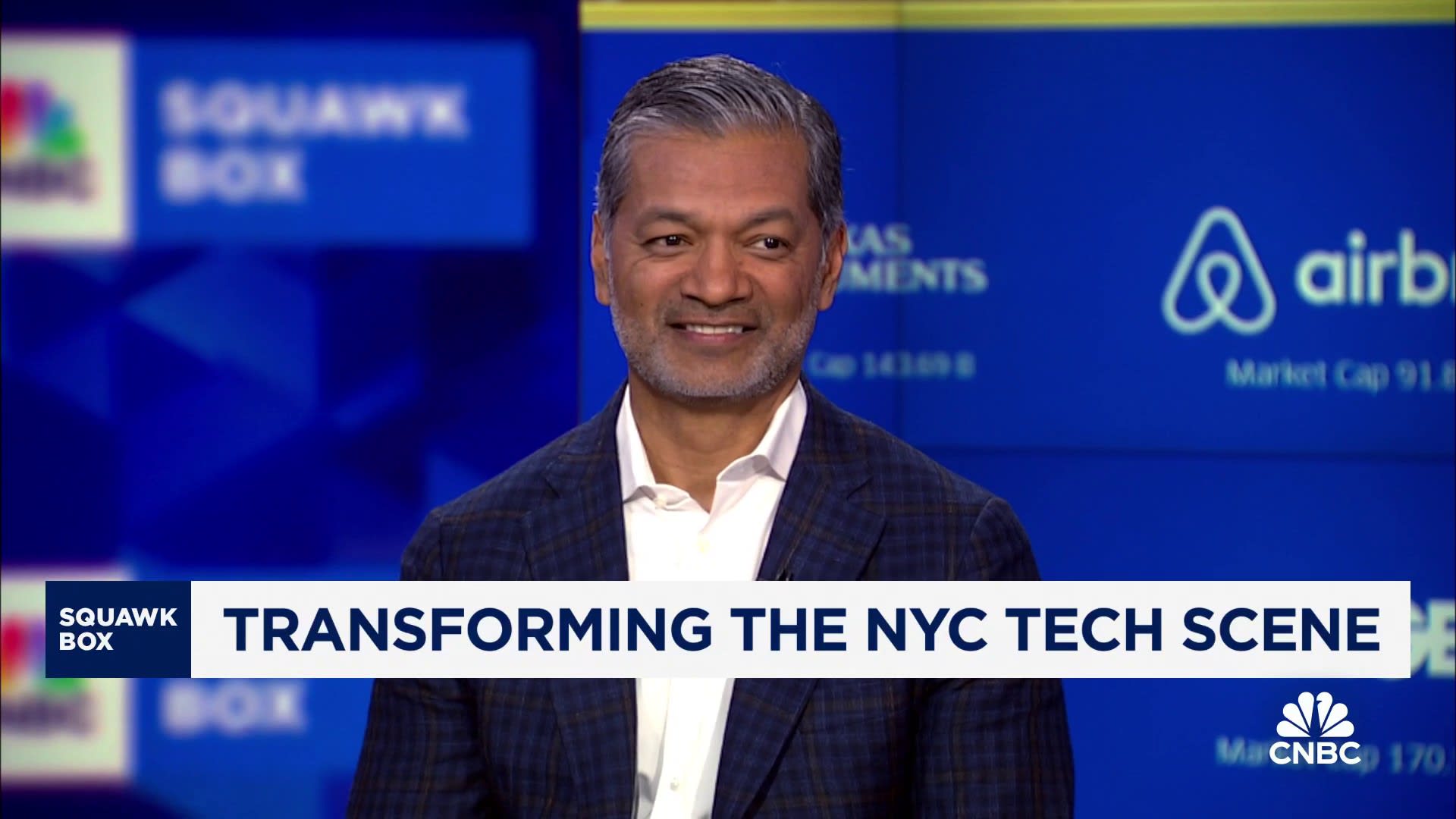

“We’re still at very low single-digit branch share, and we know that in order for us to really optimize our investment in these communities, we need to be at a higher branch share,” Roberts said in an interview with CNBC. Roberts is traveling alongside Dimon across the Midwest for the bus tour.

Roberts said the goal is to reach “optimal branch share,” which in some newer markets amounts to “more than double” current levels.

At the bank’s investor day in May, Roberts said that the firm was targeting 15% deposit share and that extending the reach of bank branches is a key part of that strategy. She said 80 of the firm’s 220 basis points of deposit-share gain between 2019 and 2023 were from branches less than a decade old. In other words, almost 40% of those deposit share gains can be linked to investments in new physical branches.

In expanding its brick-and-mortar footprint, JPMorgan is bucking the broader banking industry trend of shuttering branches. Higher-for-longer interest rates have created industrywide headwinds due to funding costs, and banks have opted to reduce their branch footprint to offset some of the macro pressures.

In the first quarter, the U.S. banking industry recorded 229 net branch closings, compared with just 59 in the previous quarter, according to S&P Global Market Intelligence data. Wells Fargo and Bank of America closed the highest net number of branches, while JPMorgan was the most active net opener.

According to FDIC research collated by KBW, growth in bank branches peaked right before the financial crisis, in 2007. KBW said this was due, in part, to banks assessing their own efficiencies and shuttering underperforming locations, as well as technological advances that allowed for online banking and remote deposit capture. This secular reckoning was exacerbated during the pandemic, when banks reported little change to operating capacity even when physical branches were closed temporarily, the report said.

But JPMorgan, the nation’s largest lender, raked in a record $50 billion in profit in 2023 – the most ever for a U.S. bank. As a result, the firm is in a unique position to spend on brick-and-mortar, while others are opting to be more prudent.

When it comes to prioritizing locations for new branches, Roberts said it’s a “balance of art and science.” She said the bank looks at factors such as population growth, the number of small businesses in the community, whether there is a new corporate headquarters, a new suburb being built, or new roadways.

And even in smaller cities, foot traffic is a critical ingredient.

“I always joke and say, if there’s a Chick-fil-A there, we want to be there, too,” Roberts said. “Because Chick-fil-A’s, no matter where they go, are always successful and busy.”