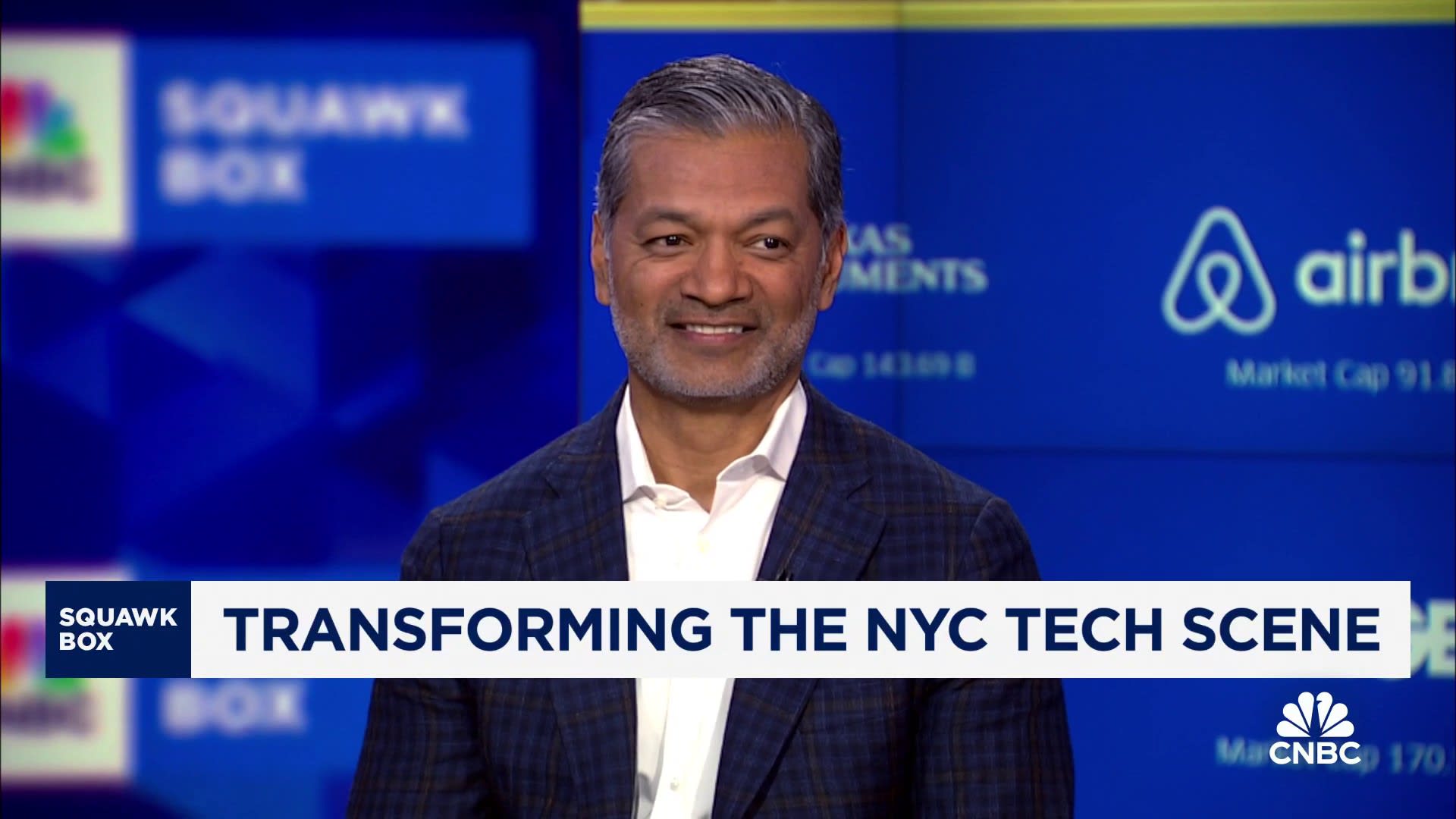

Michael Feroli, chief U.S. economist of JPMorgan Securities, listens during a Bloomberg Television interview in New York on March 6, 2018.

Christopher Goodney | Bloomberg | Getty Images

The Federal Reserve should cut interest rates by 50 basis points at its September meeting, according to JPMorgan’s Michael Feroli.

“We think there’s a good case that they should get back to neutral as soon as possible,” the firm’s chief U.S. economist told CNBC’s “Squawk on the Street” on Thursday, adding that the high point of the central bank’s neutral policy setting is around 4%, or 150 basis points below where it is currently. “We think there’s a good case for hurrying up in their pace of rate cuts.”

According to the CME FedWatch Tool, traders are pricing in a 39% chance that the Fed’s target range for the federal funds rate will be lowered by a half percentage point to 4.75% to 5% from the current 5.25% to 5.50%. A quarter-percentage-point reduction to a range of 5% to 5.25% shows odds of about 61%.

“If you wait until inflation is already back to 2%, you’ve probably waited too long,” Feroli also said. “While inflation is still a little above target, unemployment is probably getting a little above what they think is consistent with full employment. Right now, you have risks to both employment and inflation, and you can always reverse course if it turns out that one of those risks is developing.”

His comments come as August marked the weakest month for private payrolls growth since January 2021. This follows the unemployment rate inching higher to 4.3% in July, triggering a recession indicator known as the Sahm Rule.

Even still, Feroli said he does not believe the economy is “unraveling.”

“If the economy were collapsing, I think you’d have an argument for going more than 50 at the next FOMC meeting,” the economist continued.

The Fed will make its decision about where rates are headed from here on Sept. 17-18.