Consumers spent at a slower-than-expected pace in February, though underlying readings indicated that sales still grew at a solid pace despite worries over an economic slowdown and rising inflation.

Retail sales increased 0.2% on the month, better than the downwardly revised decline of 1.2% the prior month but below the Dow Jones estimate for a 0.6% rise, according to the advanced reading Monday from the Commerce Department. Excluding autos, the increase was 0.3%, in line with expectations.

The sales number is adjusted for seasonal factors but not for inflation. Prices rose 0.2% on the month, according to a previous Labor Department report, indicating that spending was about on pace with inflation.

The so-called control group, which strips out noncore sectors and feeds directly into gross domestic product calculations, rose a better-than-expected 1%.

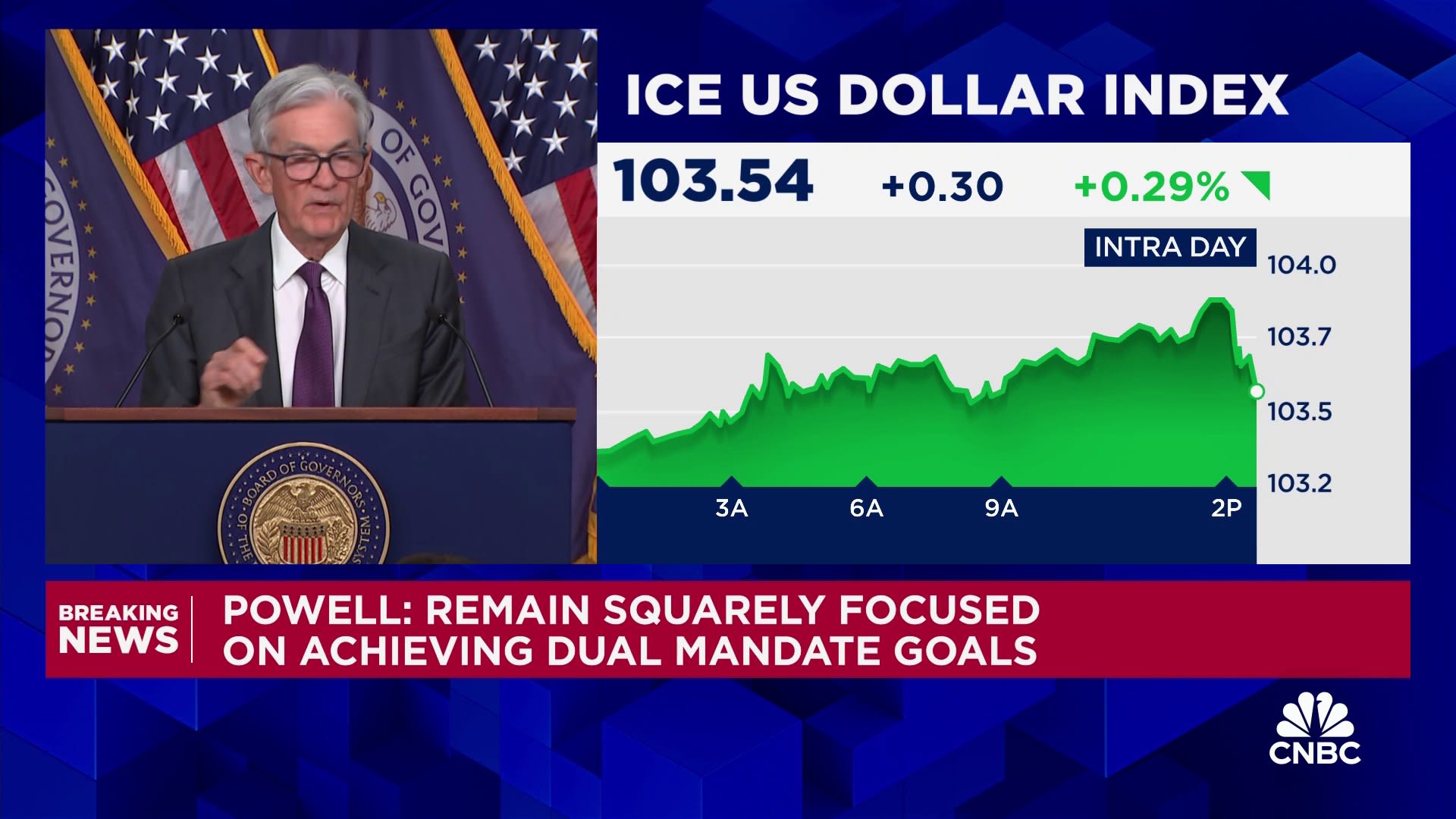

Stocks, which hit correction levels last week, were higher following the report. Longer-dated Treasury yields rose slightly.

“Not a great report, but one still in positive territory despite how pessimistic consumers are about the future,” said Robert Frick, corporate economist at Navy Federal Credit Union. “But the main factor in consumer spending is consumer income, and that’s growing at a good rate and had an impressive leap in January.”

Online spending helped boost the sales number for the month, with nonstore retailers reporting a 2.4% increase. Health and personal care showed a 1.7% gain while food and beverage outlets saw a 0.4% rise.

On the downside, bars and restaurants reported a 1.5% decrease, while gas stations were off 1% amid falling prices at the pump.

Sales overall increased 3.1% on a year-over-year basis, better than the 2.8% inflation rate as measured by the consumer price index.

One other downbeat note from the report was a steep revision for January, which originally was reported as a 0.9% decline.

The release comes amid heightened worries over economic growth, particularly as President Donald Trump engages in an aggressive tariff battle with leading U.S. trading partners. Economists worry that the tariffs will drive up inflation and slow the economy.

“Consumers and businesses are expected to pull back on spending when they’re unable to make informed decisions about the future of the economy and their place within it,” said Elizabeth Renter, senior economist at personal finance site NerdWallet. “Currently, direct economic policies and broad federal policies with indirect economic impact are in flux, making informed decisions difficult.”

Some indicators, such as the Atlanta Federal Reserve’s GDPNow tracker of economic data, are showing that growth could be negative in the first quarter, though the solid reading for control retail sales could result in an upward revision later Monday.

In other economic news Monday, the New York Fed’s measure of factory activity in the region posted an unexpectedly sharp drop for March.

The Empire State Manufacturing Survey posted a reading of -20 for the month, representing the difference between companies seeing expansion against contraction. The number indicated a drop from the 5.7 level in February and was well below the estimate for -1.8.

New orders posted a sharp slide, with the index tumbling to -14.9, down 26.3 points. Shipments also were off significantly. On inflation, indexes for prices paid and received also rose.

Correction: The new orders index tumbled to -14.9, down 26.3 points. An earlier version misstated the move.