Inflation edged higher in July, according to a measure favored by the Federal Reserve as the central bank prepares to enact its first interest rate reduction in more than four years.

The Commerce Department reported Friday that the personal consumption expenditures price index rose 0.2% on the month and was up 2.5% from the same period a year ago, exactly in line with the Dow Jones consensus estimates.

Excluding volatile food and energy prices, core PCE also increased 0.2% for the month but was up 2.6% from a year ago. The 12-month figure was slightly softer than the 2.7% estimate.

Fed officials tend to focus more on the core reading as a better gauge of long-run trends. Both core and headline inflation on a 12-month basis were the same as in June.

Core prices less housing, another key metric for the Fed, increased just 0.1% on the month. As other inflation components ease, shelter has proven to be stubborn, again rising 0.4% in July, according to Friday’s report.

Elsewhere in the report, the department’s Bureau of Economic Analysis said personal income increased 0.3%, slightly higher than the 0.2% estimate, while consumer spending rose 0.5%, in line with the forecast. Spending continued at a solid clip even though the personal savings rate fell to 2.9%, the lowest since June 2022.

From a component standpoint, inflation changed little over the past month. The BEA said that goods prices fell by less than 0.1% though services increased 0.2%.

On a 12-month basis, goods also were off by less than 0.1%, while services jumped 3.7%. Food prices were up 1.4% and energy accelerated 1.9%.

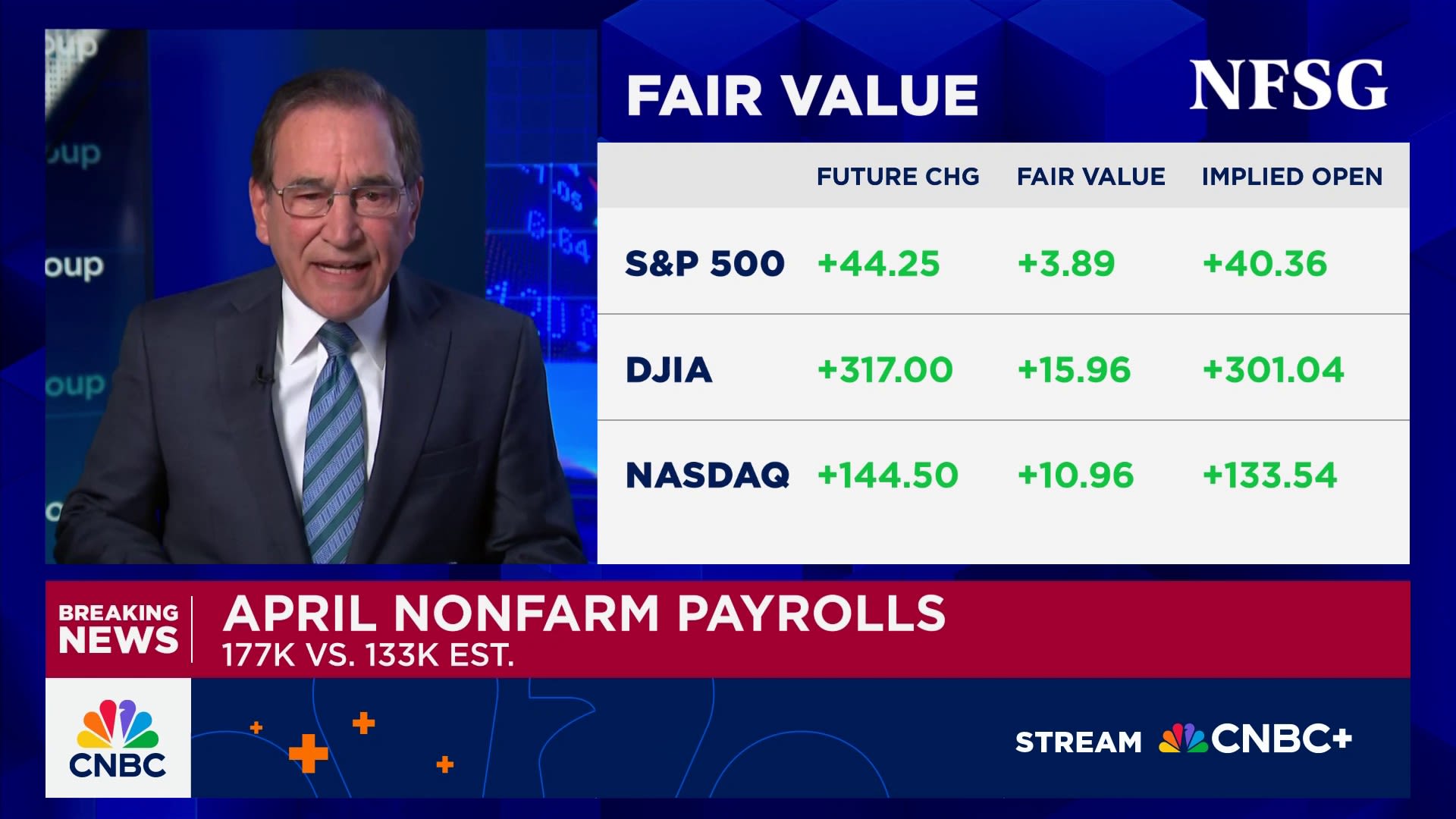

Markets reacted little to the news, with equity futures pointing to a slightly higher open on Wall Street and Treasury yields higher as well.

The data “points to the re-establishment of price stability across the American economy,” wrote Joseph Brusuelas, chief economist at RSM.

“The American economy is poised to grow at or above the long-term 1.8% rate as the Fed begins its rate-cutting campaign, which should put a floor under growth and hiring,” he added. “This data supports risk taking by the commercial sector as rates come down and by investors, who are now looking at a sustained increase in the economic expansion.”

The report comes with the markets pricing in a 100% chance of a rate cut in September, with the only uncertainty being whether the Fed will take the incremental step of lowering benchmark rates by a quarter percentage point or being more aggressive and moving a half-point lower.

Following Friday’s release, market pricing tilted a bit more towards a quarter-point, or 25 basis point, reduction, lowering the probability for a 50 basis point move to 30.5%, according to the CME Group’s FedWatch gauge.

In recent days, policymakers such as Chair Jerome Powell have expressed confidence that inflation is progressing back to the Fed’s 2% goal.

The Fed is expected now to switch from a nearly complete focus on bringing down inflation to at least an equal concentration on supporting the labor market. Though the unemployment rate is still low at 4.3%, it has been trending higher over the past year, and surveys suggest a slowdown in hiring and a perception among workers that jobs are getting tougher to come by.

Attention now will be turned to the nonfarm payrolls report for August, due in a week, that is expected to show an increase of about 175,000, according to FactSet.