President Donald Trump is registering the worst economic approval numbers of his presidential career amid broad discontent over his handling of tariffs, inflation and government spending, according to the latest CNBC All-America Economic Survey.

The survey found that the boost in economic optimism that accompanied Trump’s reelection has disappeared, with more Americans now believing the economy will get worse than at any time since 2023 and with a sharp turn toward pessimism about the stock market.

The survey of 1,000 Americans across the country showed 44% approving of Trump’s handling of the presidency and 51% disapproving, slightly better than CNBC’s final reading when the president left office in 2020. On the economy, however, the survey showed Trump with 43% approval and 55% disapproval, the first time in any CNBC poll that he has been net negative on the economy while president.

Trump’s Republican base remains solidly behind him, but Democrats, at -90 net economic approval, are 30 points more negative than their average during his first term, and independents are 23 points more negative. Blue collar workers, who were key to the president’s election victory, remain positive on the Trump’s handling of the economy, but their disapproval numbers have shot up by 14 points compared to their average for his first term.

“Donald Trump was reelected specifically to improve the economy, and so far, people are not liking what they’re seeing,” said Jay Campbell, partner with Hart Associates, the Democratic pollster on the survey.

The poll was conducted April 9 through 13th and has a margin of error of +/-3.1%.

The results show that Trump has so far been able to convince only his base that his economic policies will be good for the country over time: 49% of the public believe the economy will get worse over the next year, the most pessimistic overall result since 2023. That figure includes 76% of Republicans who see the economy improving. But 83% of Democrats and 54% of independents see the economy getting worse. Among those believing the president’s policies will have a positive impact, 27% say it will take a year or longer. However, 40% of those who are negative about the president’s policies say they are hurting the economy now.

“We’re in a turbulent, kind of maelstrom of change when it comes to how people feel about what’s going to happen next,” said Micah Roberts, managing partner with Public Opinion Strategies, the Republican pollsters for the survey. “The data… suggests more than ever that it’s the negative partisan reaction that’s driving and sustaining discontent and trepidation about what comes next.”

While partisanship is the most significant part of the president’s negative showing, he loses some support among Republicans in key areas like tariffs and inflation, and has seen a notable deterioration among independents.

Tariffs look to be a substantial part of the overall public’s discontent. Americans disapprove of across-the-board tariffs by a 49 to 35 margin, and majorities believe they are bad for American workers, inflation and the overall economy. Democrats give tariffs a thumbs down by an 83-point margin and independents by 26 points. Republicans approve of the tariffs by a 59-point spread — 20 points below their 79% net approval of the president.

Large majorities of Americans see Canada, Mexico, the EU and Japan as more of an economic opportunity for the United States rather than an economic threat. In fact, all are viewed more favorably than when CNBC asked the question during Trump’s first term. The data suggest the public, including majorities of Republicans, do not embrace the antipathy the president has expressed towards those trading partners. On China, however, the public sees it as a threat by a 44% to 35% margin, substantially worse than when CNBC last asked the question in 2019.

The president’s worst numbers come on his handling of inflation, which the public disapproves of by a 37 to 60% margin, including strong net negatives from Democrats and independents. But at 58%, it’s the lowest net positive approval from Republicans for any of the issues asked about the president. 57% of the public believe we will soon be, or are currently in, a recession, up from just 40% in March 2024. The figure includes 12% who think the recession has already begun.

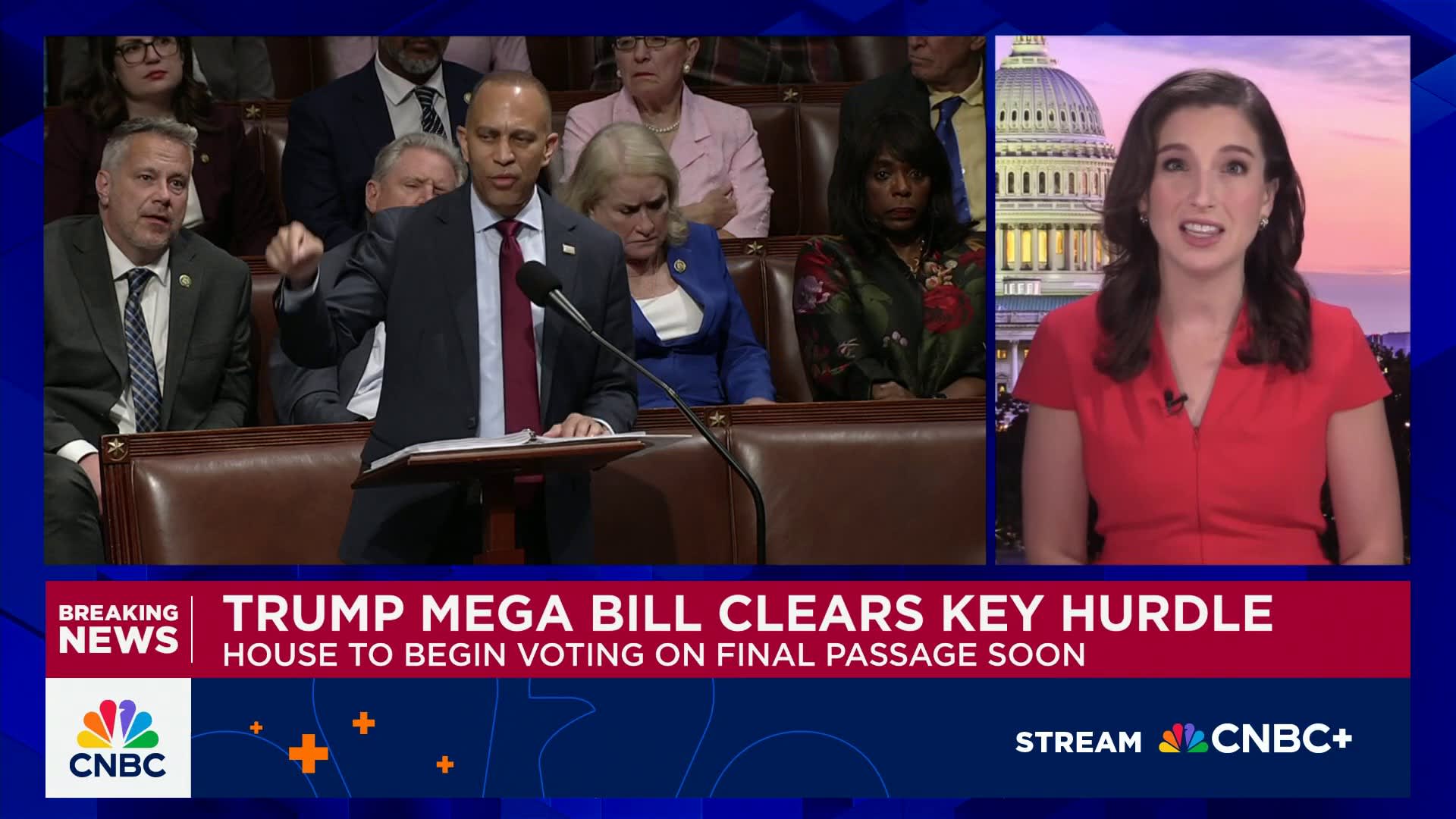

The public also disapproves of the president’s handling of federal government spending by a 45% to 51% and foreign policy by a 42% to 53% margin.

Trump’s best numbers come on immigration, where his handling of the Southern border is approved by a 53% to 41% margin, and deportation of illegal immigrants is approved 52% to 45%. The president achieved a slight majority of support from independents on deportations and 22% support from Democrats on the Southern border. While still modest, it’s the best-performing issue for Trump among Democrats.

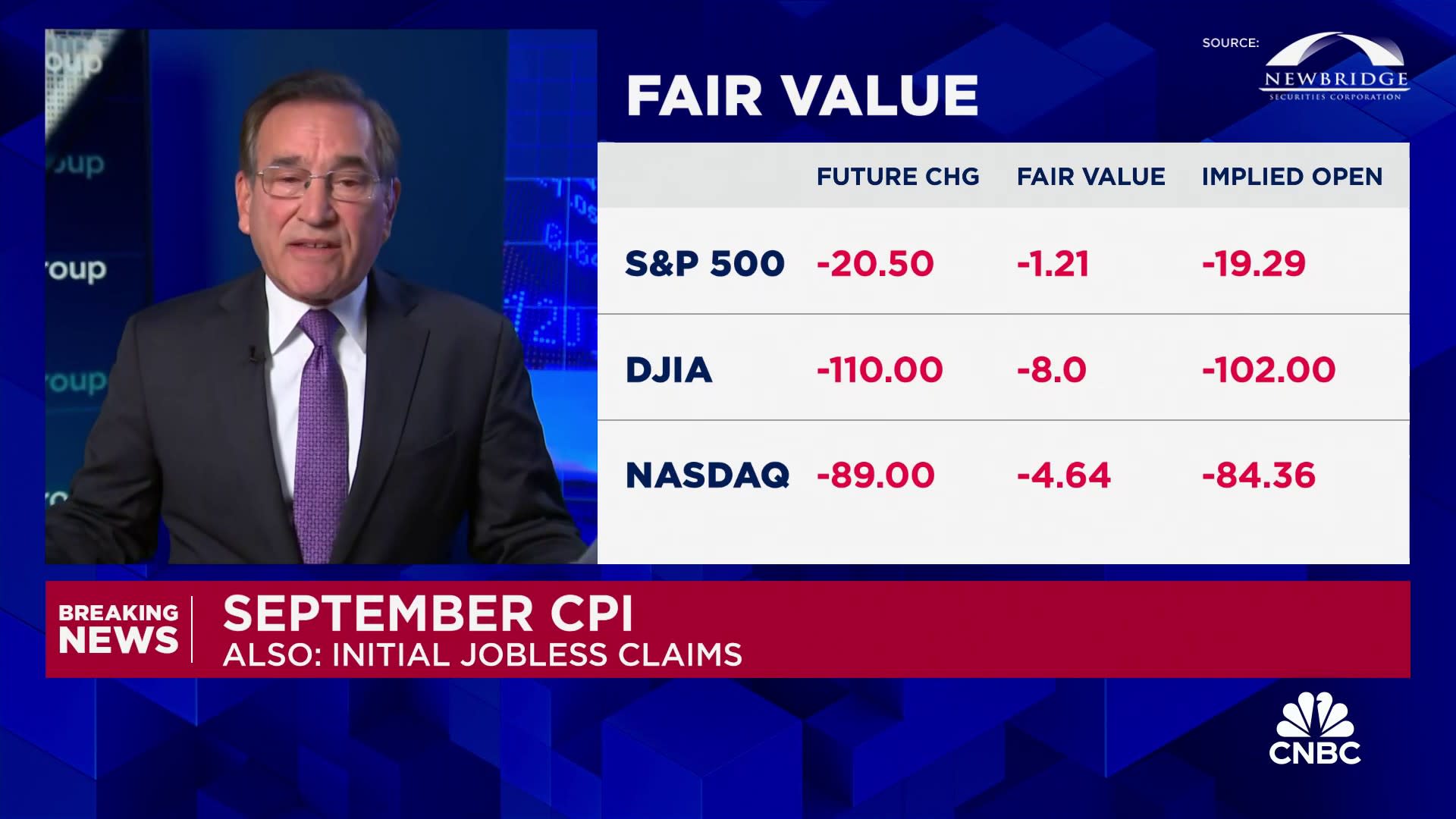

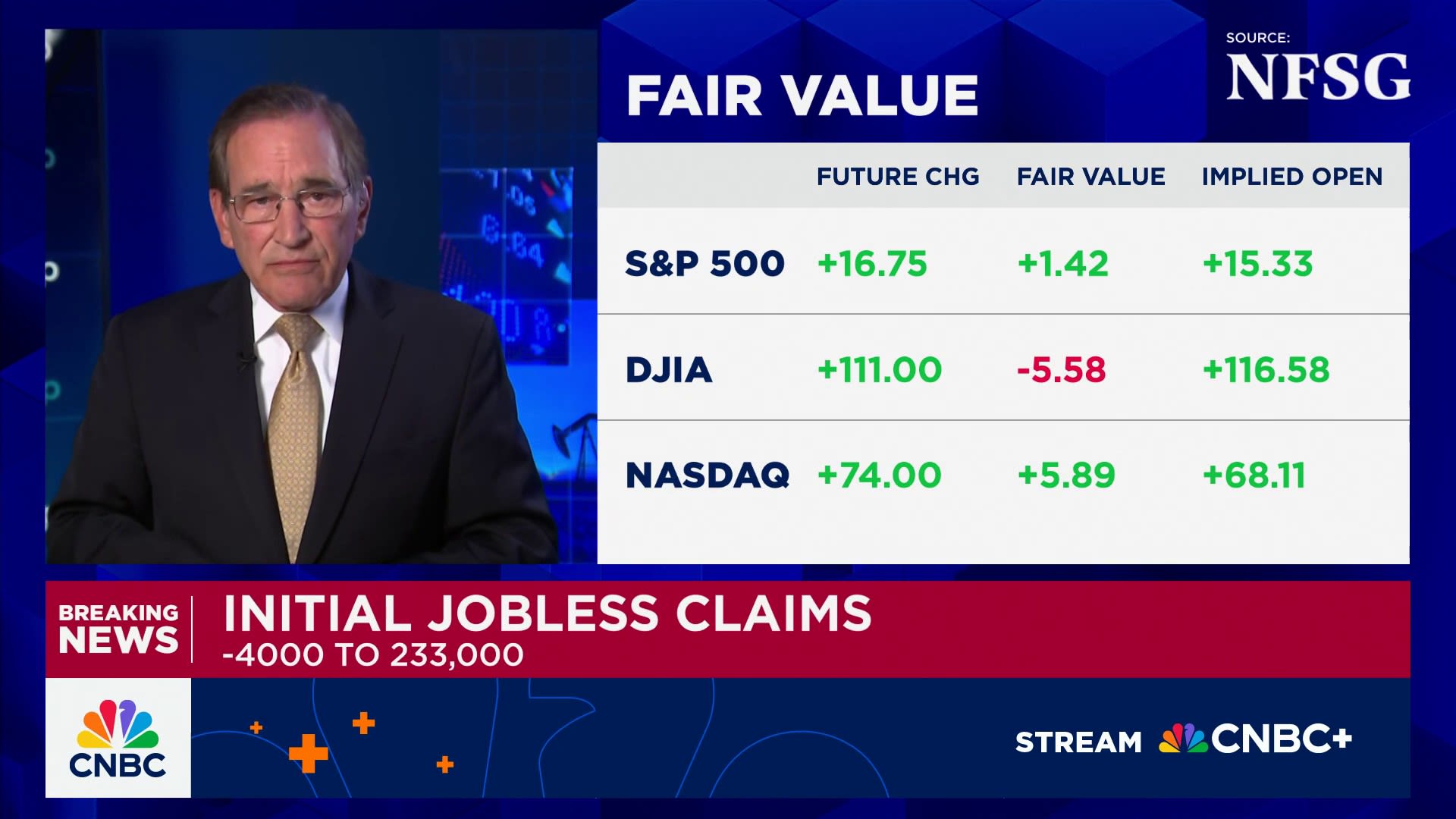

Meanwhile, Americans have turned more negative on the stock market than they’ve been in two years. Some 53% say it’s a bad time to invest, with just 38% saying it’s a good time. The numbers represent a sharp turnaround from the stock market optimism that greeted the president’s election. In fact, the December survey represented the sharpest swing toward market optimism in the survey’s 17-year history and the April survey is the sharpest turn towards pessimism.

The president’s troubles with his approval rating do not appear to be translating for now into significant potential gains for Democrats. Asked about congressional preference, 48% of the public support Democratic control and 46% support Republican control, barely changed from CNBC’s March 2022 survey.

Get Your Ticket to Pro LIVE

Join us at the New York Stock Exchange!

Uncertain markets? Gain an edge with CNBC Pro LIVE, an exclusive, inaugural event at the historic New York Stock Exchange.

In today’s dynamic financial landscape, access to expert insights is paramount. As a CNBC Pro subscriber, we invite you to join us for our first exclusive, in-person CNBC Pro LIVE event at the iconic NYSE on Thursday, June 12.

Join interactive Pro clinics led by our Pros Carter Worth, Dan Niles and Dan Ives, with a special edition of Pro Talks with Tom Lee. You’ll also get the opportunity to network with CNBC experts, talent and other Pro subscribers during an exciting cocktail hour on the legendary trading floor. Tickets are limited!