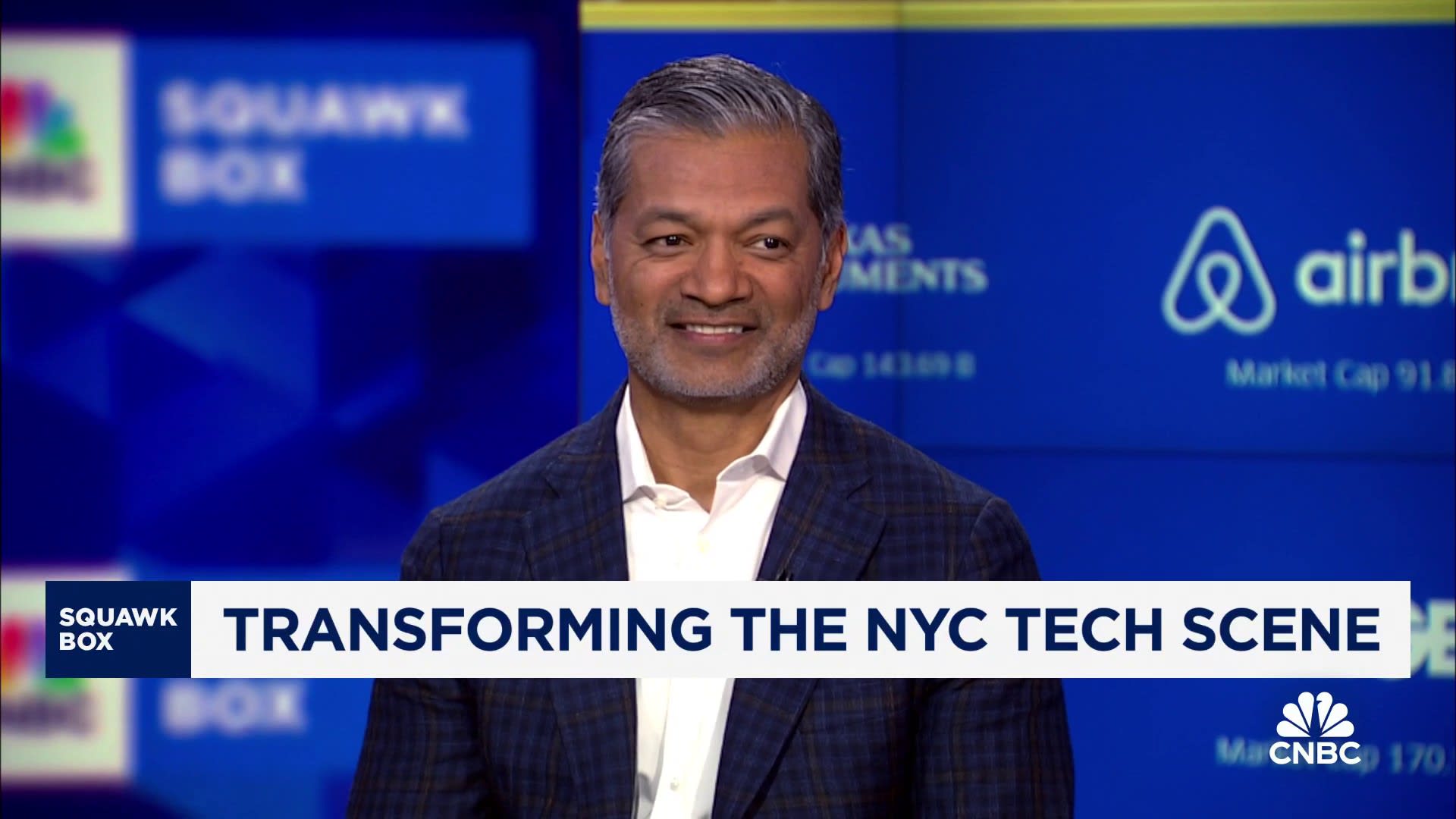

Twilio CEO Khozema Shipchandler speaks at Twilio’s Signal event in Sao Paulo on Aug. 14, 2024.

Courtesy: Twilio

Twilio shares soared 20% on Friday, their biggest gain since the early days of the Covid pandemic, after the cloud communications software vendor issued an uplifting profit forecast for the coming years.

The stock jumped to $136.23 at the close, its highest close since 2022.

Twilio revealed its new guidance at an investor event Thursday, a little over a year after the company named Khozema Shipchandler as CEO. Shipchandler, who had been Twilio’s president and before that spent 22 years at GE, replaced co-founder Jeff Lawson after a battle with activist investors.

Twilio now sees its adjusted operating margin widening to between 21% and 22% in 2027 as part of a three-year framework for guidance. That’s higher than Visible Alpha’s 19.68% consensus. Twilio’s adjusted operating margin in the most recent quarter was 16.1%.

At Thursday’s event, company executives committed to generating $3 billion in free cash flow over the next three years, compared with approximately $692 million in free cash flow for 2022, 2023 and 2024. The Visible Alpha consensus for Twilio’s 2025 through 2027 was $2.76 billion.

“If we execute well in 2025, I think we write our own story from 2026 on,” Shipchandler told CNBC ahead of the investor gathering.

Twilio, which sends text messages and emails for customers, did not issue a revenue growth target for 2027 at its Thursday event.

But Shipchandler did tell analysts at the investor event that “we’re orienting the company to deliver against double-digit growth over time.”

For 2025, the company said it expects $825 million to $850 million in free cash flow and the same amount in adjusted operating income, with 7% to 8% revenue growth year over year. The Visible Alpha consensus was $814 million in adjusted operating income and about $808 million in free cash flow. The 2025 revenue forecast was in line with LSEG consensus.

Twilio went public in 2016 as a high-growth software company taking advantage of the transition to the cloud. It was one of the big early beneficiaries of the Covid remote work boom as more companies relied on mobile communications to keep in touch with employees and clients. The stock surged more than 240% in 2020.

But in 2022, the stock lost more than 80% of its value as investor focus shifted to profit over growth to reckon with rising interest rates and soaring inflation. Twilio cut 17% of its workforce in early 2023, and activist investors Anson Funds and Legion Partners Asset Management agitated for a sale of Twilio or one of its business units, CNBC reported.

Since activist firm Sachem Head Capital Management won a Twilio board seat in April, the company’s stock has about doubled as revenue growth has accelerated and losses have narrowed.

By expanding into new areas, such as conversational artificial intelligence, Twilio says it can sell into a $158 billion total addressable market by 2028, compared with $119 billion when only focusing on the communications and customer data platform categories.

Twilio’s preliminary results for the fourth quarter show 11% revenue growth, with adjusted operating income that exceeds the top end of the $185 million to $195 million range that the company issued in October. Analysts surveyed by LSEG had expected 7.9% revenue growth and, according to Visible Alpha, the adjusted operating income consensus was about $190 million.

Baird analysts William Power and Yanni Samoilis upgraded their stock to the equivalent of buy from the equivalent of hold in a Friday note to clients, raising their price target to $160 from $115. The analysts said they “expect a potential beat-and-raise cadence to continue to push shares higher, particularly with the strengthening profitability, cash flow, and capital returns.”

WATCH: Twilio CEO says its time to supercharge innovation cycle