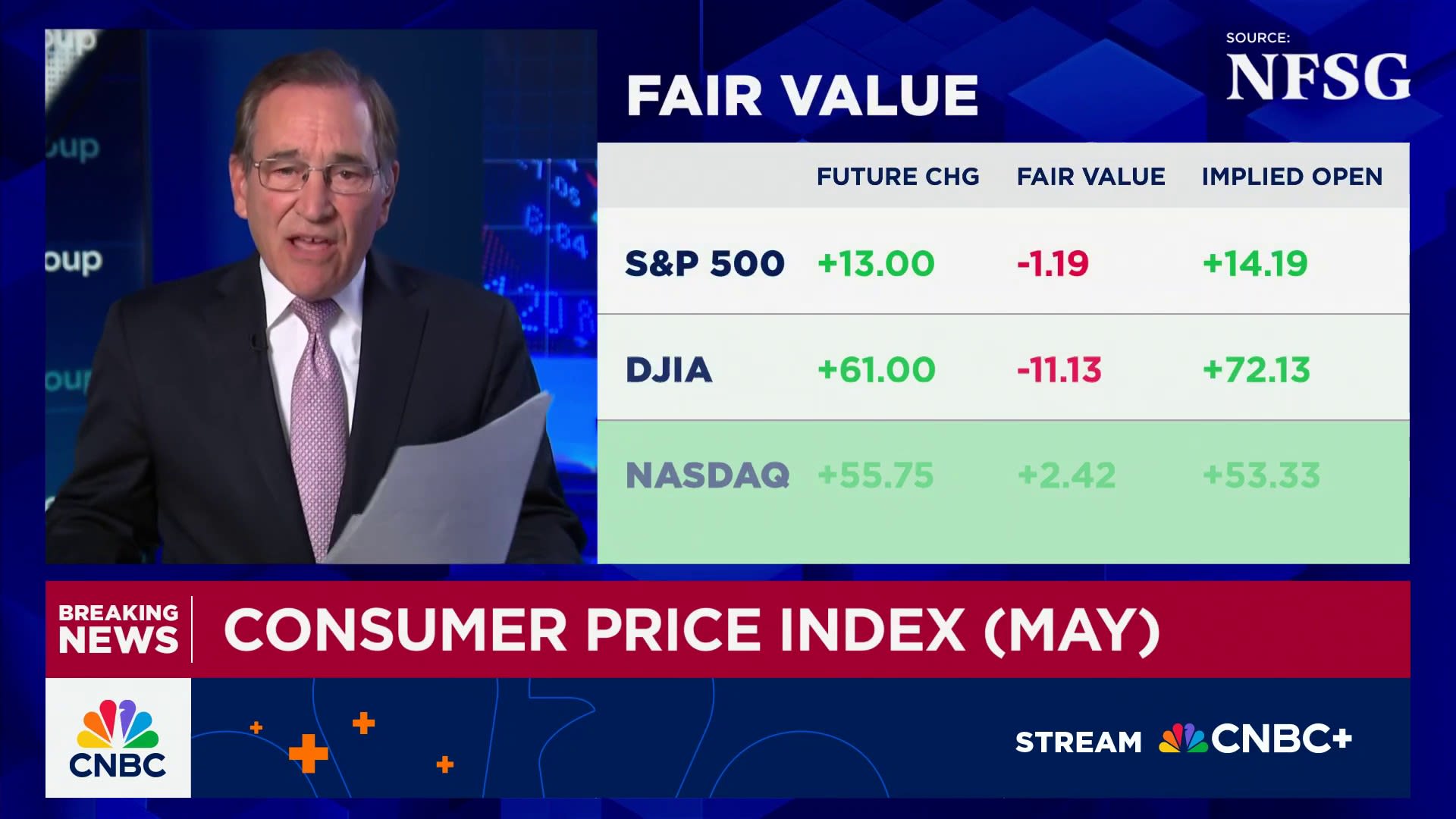

Consumer prices rose less than expected in May as President Donald Trump‘s tariffs had yet to show significant impact on inflation, the Bureau of Labor Statistics reported Wednesday.

The consumer price index, a broad-based measure of goods and services across the sprawling U.S. economy, increased 0.1% for the month, putting the annual inflation rate at 2.4%. Economists surveyed by Dow Jones had been looking for respective readings of 0.2% and 2.4%.

Excluding food and energy, the core CPI came in respectively at 0.1% and 2.8%, compared with forecasts for 0.3% and 2.9%. Federal Reserve officials consider core a better measure of long-term trends, with several expressing concerns recently over the impact that tariffs would have on inflation.

The all-items annual rate marked a 0.1 percentage point step up from April while core was the same.

Continued weakness in energy prices helped offset some of the increases, and a handful of other key items expected to show tariff-related jumps, vehicle and apparel prices in particular, actually posted declines.

Energy slipped 1% on the month, while new and used vehicle prices posted respective declines of 0.3% and 0.5%. Within energy, gasoline posted a 2.6% drop that took the year-over-year decrease to 12%.

Food increased 0.3% as did shelter, which the BLS said was the “primary factor” in the otherwise modest CPI increase. Egg prices fell 2.7% but were still up 41.5% from a year ago. Apparel posted a 0.4% drop.

Though shelter prices rose on the month, the 3.9% annual increase is the lowest rate since late 2021.

With the modest inflation moves, real average hourly earnings increased 0.3% for the month and were up 1.4% from a year ago.

“Today’s below forecast inflation print is reassuring – but only to an extent,” said Seema Shah, chief global strategist at Principal Asset Management. “Tariff-driven price increases may not feed through to the CPI data for a few more months yet, so it is far too premature to assume that the price shock will not materialize.”

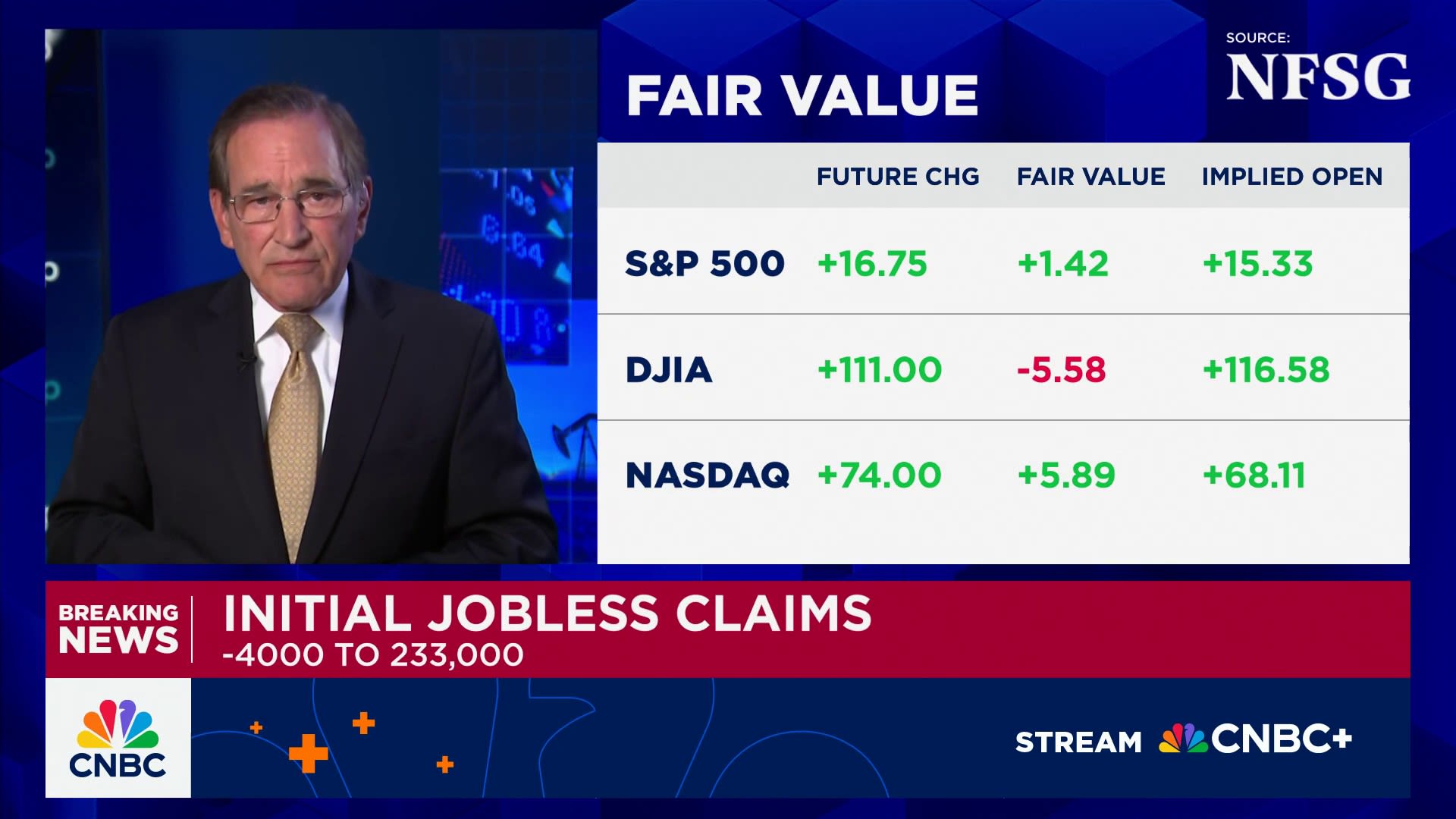

Stock market futures turned positive after the report while Treasury yields were lower.

Echoing Trump, Vice President JD Vance, in a post on X, called on the Fed to cut interest rates as inflation pressures have failed to materialize.

“The president has been saying this for a while, but it’s even more clear: the refusal by the Fed to cut rates is monetary malpractice,” Vance wrote.

Trade tensions persist

The BLS report comes with the Trump administration continuing its efforts to negotiate trade deals. In his April 2 “liberation day” announcement that rocked financial markets, Trump slapped 10% universal duties on U.S. imports and a host of other so-called reciprocal tariffs on countries he said have been using unfair trading practices.

Most recently, White House officials have met with Chinese leaders in an effort to defuse a blistering trade war between the two nations. Leaders from both countries have said they are near an agreement on rare earth materials, such as resources needed for automotive batteries, as well as technology-related items.

Other nations hit with reciprocal duties have until early July to strike a deal, according to an announcement Trump made a week after the initial move.

White House officials insist that tariffs will not cause runaway inflation, with the expectation that foreign producers would absorb much of the costs themselves. Many economists, though, believe that the broad-based nature of the duties could raise prices in a more pronounced fashion, with greater impacts likely to show up through the summer as inventories amassed ahead of the tariff implementation draw down.

The benign May inflation readings suggest “the tariffs aren’t having a large immediate impact because companies have been using existing inventories or slowly adjusting prices due to uncertain demand,” said Alexandra Wilson-Elizondo, global CIO of multi-asset solutions at Goldman Sachs Asset Management. “While we might see some price increases on goods later, service prices are expected to remain stable, suggesting any rise in inflation is likely to be temporary.”

Market pricing indicates the Fed is unlikely to consider further interest rate cuts until at least September as policymakers evaluate the impact that tariffs exert on inflation. Trump has been urging the Fed to lower rates amid the easing inflation readings and signs of a slowdown in the labor market.

Changes in data collection

Evaluating the inflation numbers has been complicated by other Trump initiatives.

In an effort to pare down the federal workforce, the administration has instituted a hiring freeze that has coincided with the BLS restricting its data collection and expanding a process called imputation, in which it uses models to fill in incomplete data. For instance, the BLS said last week that as of April it has been “reducing sample in areas across the country” and suspended collection altogether in Lincoln, Nebraska; Provo, Utah; and Buffalo, New York.

“The use of expanded imputation is likely to continue, given ongoing staffing shortages at the BLS. While it is difficult to conclude any kind of directional effect, smaller sample sizes may be liable to greater volatility,” BNP Paribas analysts said in a note.

However, the BLS said the moves to suspend collections will have “minimal impact” on overall data collection, though they could impact subindexes.

Correction: JD Vance is vice president. An earlier version misspelled his name.