Chicago Federal Reserve President Austan Goolsbee said Friday he still sees interest rate cuts in the cards though risks are rising to that outlook.

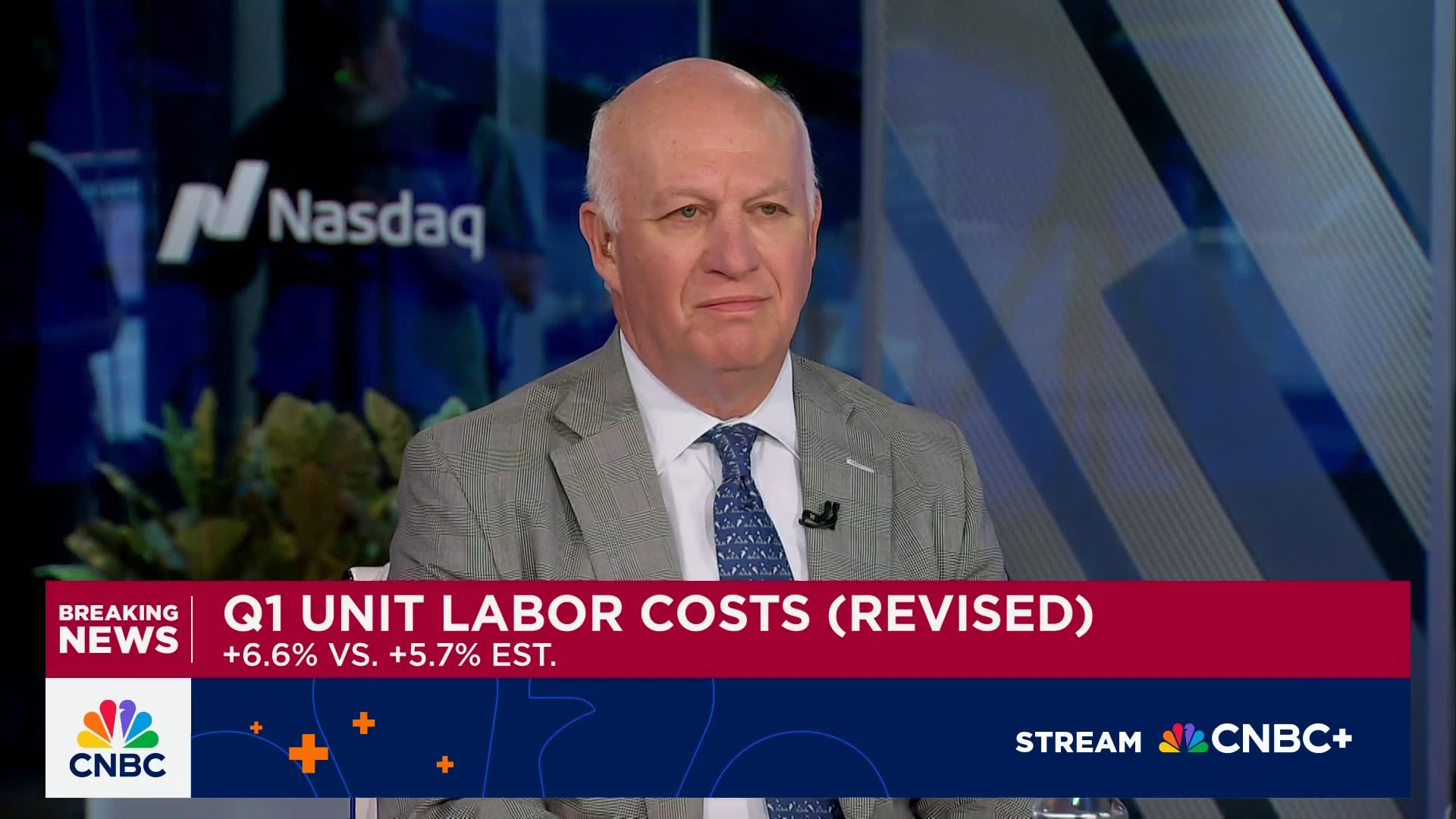

Speaking two days after he and his colleagues again voted to keep short-term rates steady, Goolsbee told CNBC that he’s been hearing more concerns from businesses in his region about the impact of tariffs and their potential to raise prices and slow growth.

“When you got a lot of uncertainty, I do think you need to wait to see some of these things get cleared up on the policy side,” the central banker said during a “Squawk Box” interview. “I’m out talking to business people and civic leaders throughout this region, and there’s been a decided turn in these conversations over the last six weeks, of anxiety, of pausing, waiting on capital projects, capex, etc., until they figure out tariffs, other fiscal policy.”

Nevertheless, Goolsbee said he still expects future rate cuts even if the Fed is taking a wait-and-see approach for now as issues play out over President Donald Trump‘s tariff plans as well as deregulation and tax cuts.

“If we can continue to make progress on inflation over the long run, I believe that rates 12 to 18 months from now will be lower than where they are today,” he said.

Speaking separately Friday morning, New York Fed President John Williams also noted the high level of uncertainty around decision-making and economic trends, particularly inflation.

“Recent data — both hard and soft — are sending mixed signals. Measures of policy uncertainty have increased sharply in recent months,” Williams said during a speech in Nassau, the Bahamas.

Both policymakers voted with the rest of the Federal Open Market Committee to hold the short-term fed funds rate in a range between 4.25%-4.5%. In its post-meeting statement, the FOMC noted that “uncertainty around the economic outlook has increased” and Chair Jerome Powell used the term “uncertainty” 10 times in his post-meeting news conference.

One question that has come up in recent days has been whether the U.S. economy is headed toward stagflation, or slow growth and rising inflation.

“Tariffs, raise prices and reduce output. So that’s a stagflationary impulse, which is different from saying this is stagflation,” Goolsbee said. “The unemployment rate is barely 4% and inflation is in the 2s. So the hard data that we start from is not the stagflation of the 1970s. It’s just the … the uncomfortable environment is when it’s moving directionally the wrong way.”

FOMC meeting participants kept their projections for two rate cuts through 2025. Markets, though, think the Fed will be more aggressive, pricing in the equivalent of three quarter percentage point reductions, according to CME Group data.