Shoppers browse the frozen food cases at WinCo.

Joe Jaszewski | Idaho Statesman | Tribune News Service | Getty Images

Despite widespread fears to the contrary, President Donald Trump‘s tariffs have yet to show up in any of the traditional data points measuring inflation.

In fact, separate readings this week on consumer and producer prices were downright benign, as indexes from the Bureau of Labor Statistics showed that prices rose just 0.1% in May.

The inflation scare is over, then, right?

To the contrary, the months ahead are still expected to show price increases driven by Trump’s desire to ensure the U.S. gets a fair shake with its global trading partners. So far, though, the duties have not driven prices up, save for a few areas that are particularly sensitive to higher import costs.

At least three factors have conspired so far to keep inflation in check:

- Companies hoarding imported goods ahead of the April 2 tariff announcement.

- The time it takes for the charges to make their way into the real economy.

- The lack of pricing power companies face as consumers tighten belts.

“We believe the limited impact from tariffs in May is a reflection of pre-tariff stockpiling, as well as a lagged pass-through of tariffs into import prices,” Aichi Amemiya, senior economist at Nomura, said in a note. “We maintain our view that the impact of tariffs will likely materialize in the coming months.”

This week’s data showed isolated evidence of tariff pressures.

Canned fruits and vegetables, which are often imported, saw prices rise 1.9% for the month. Roasted coffee was up 1.2% and tobacco increased 0.8%. Durable goods, or long-lasting items such as major appliances (up 4.3%) and computers and related items (1.1%), also saw increases.

“This gain in appliance prices mirrors what happened during the 2018-20 round of import taxes, when the cost of imported washing machines surged,” Joseph Brusuelas, chief economist at RSM, said in his daily market note.

One of the biggest tests, though, on whether the price increases will prove durable, as many economists fear, or as temporary, the prism through which they’re typically viewed, could largely depend on consumers, who drive nearly 70% of all economic activity.

The Federal Reserve’s periodic report on economic activity issued earlier this month indicated a likelihood of price increases ahead, while noting that some companies were hesitant to pass through higher costs.

“We have been of the position for a long time that tariffs would not be inflationary and they were more likely to cause economic weakness and ultimately deflation,” said Luke Tilley, chief economist at Wilmington Trust. “There’s a lot of consumer weakness.”

Indeed, that’s largely what happened during the damaging Smoot-Hawley tariffs in 1930, which many economists believe helped trigger the Great Depression.

Tilley said he sees signs that consumers already are cutting back on vacations and recreation, a possible indication that companies may not have as much pricing power as they did when inflation started to surge in 2021.

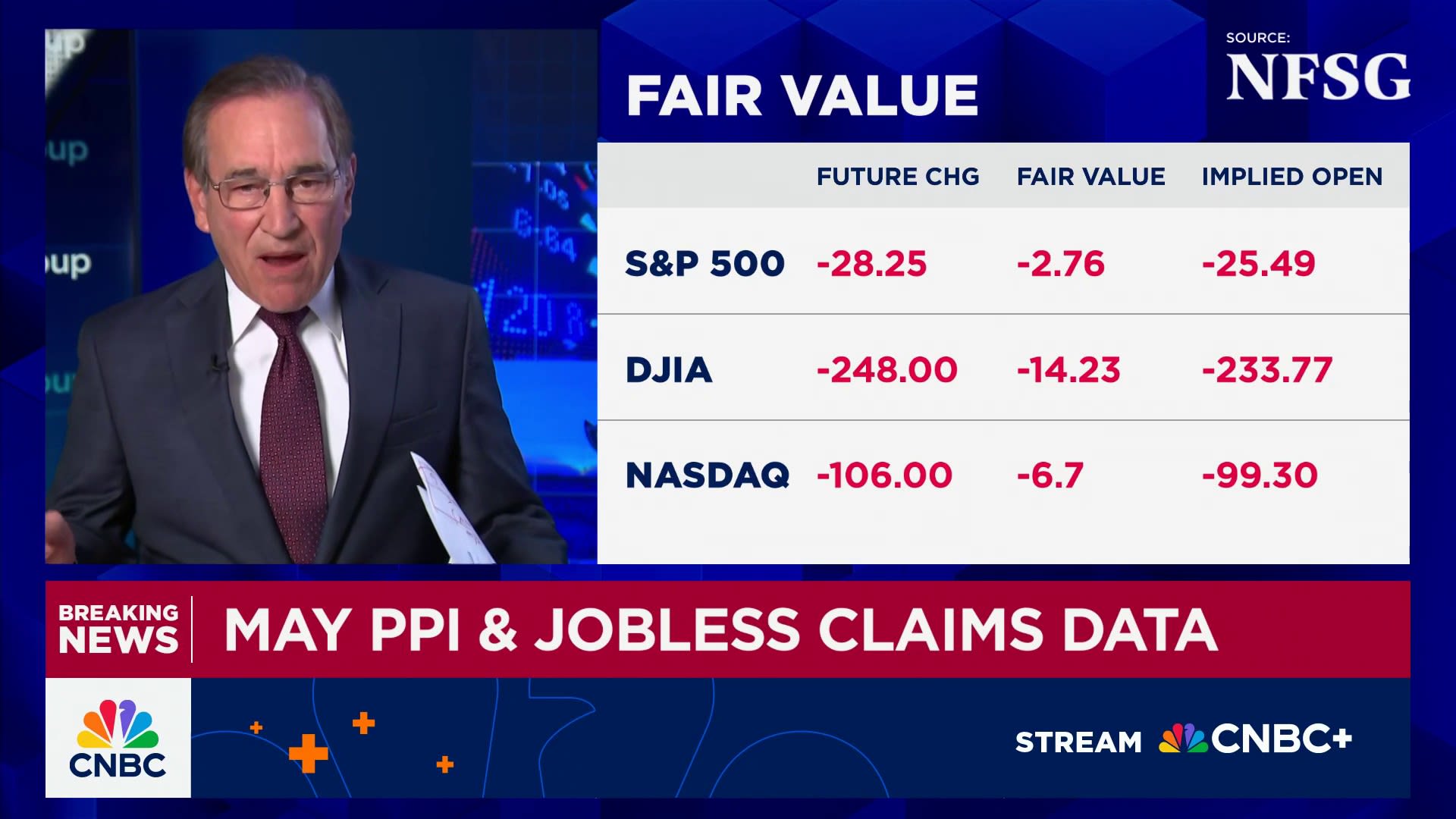

Fed officials, though, remain on the sidelines as they wait over the summer to see how tariffs do impact prices. Markets largely expect the Fed to wait until September to resume lowering interest rates, even though inflation is waning and the employment picture is showing signs of cracks.

“This time around, if inflation proves to be transitory, then the Federal Reserve may cut its policy rate later this year,” Brusuelas said. “But if consumers push their own inflation expectations higher because of short-term dislocations in the price of food at home or other goods, then it’s going to be some time before the Fed cuts rates.”