Hispanolistic | E+ | Getty Images

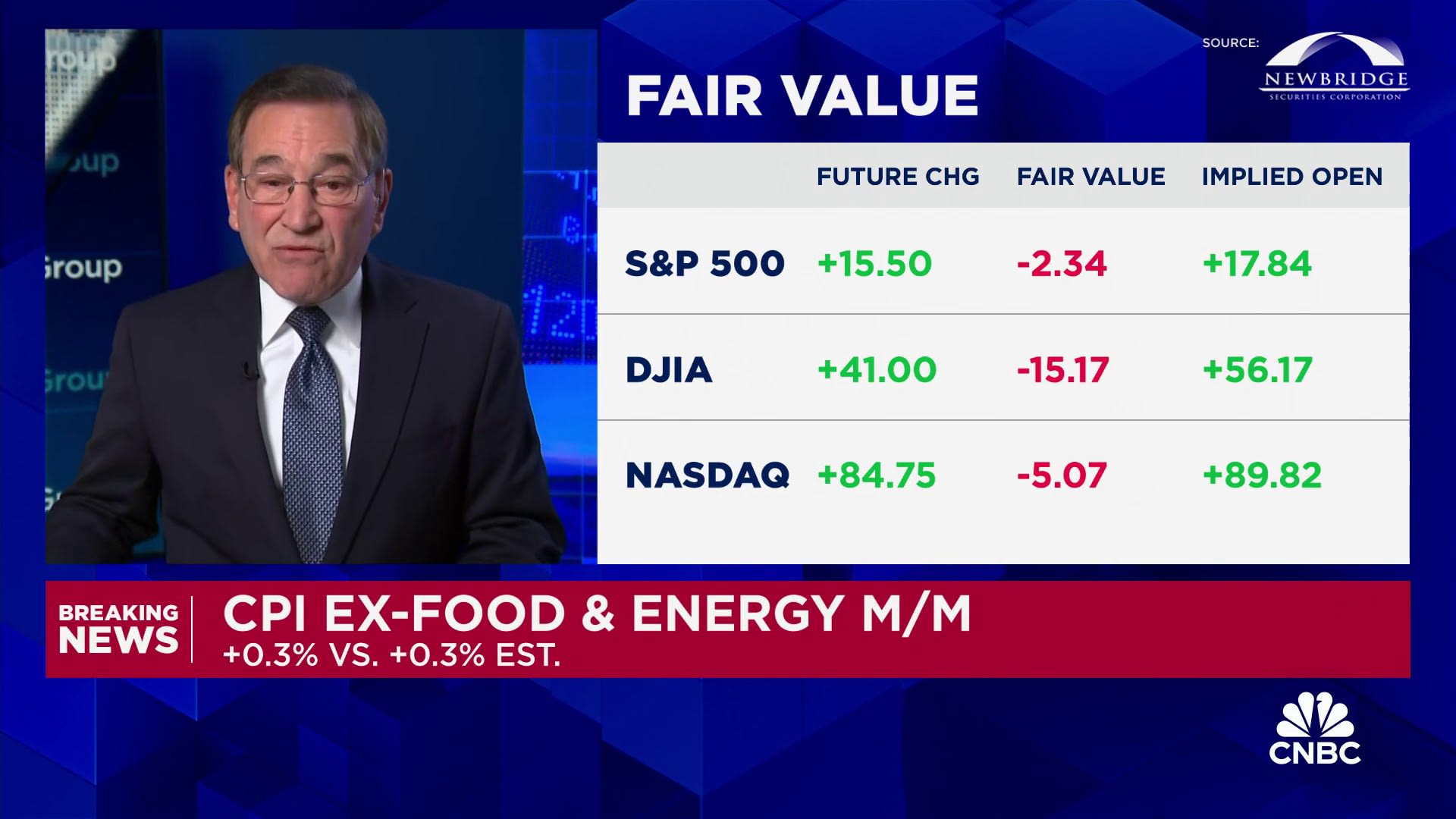

Consumers saw inflation pick up slightly

The consumer price index, a key inflation gauge, rose 2.7% last month relative to November 2023, the Bureau of Labor Statistics reported Wednesday. The annual rate was up from 2.6% in October.

“I don’t see an acceleration” of inflation, said Mark Zandi, chief economist at Moody’s. “But I think it’s persistently too strong.”

“It’s not like there’s any smoking gun saying, ‘This is the problem,'” Zandi said. “It’s kind of broad-based, a little on the high side everywhere.”

That said, there are reasons for optimism, according to economists.

Namely, consumers can take “solace” that economic trends underpinning inflation, such as moderating wage growth in the labor market, remain positive, Zandi said.

“We still think we’re on the overall path of disinflation,” despite the appearance of an inflation “revival,” said Joe Seydl, a senior markets economist at J.P. Morgan Private Bank.

A ‘bounce back’ in food prices

Inflation has pulled back significantly from its pandemic-era peak of 9.1% in June 2022.

The U.S. Federal Reserve aims for a long-term inflation target around 2%. The central bank uses a similar but different inflation gauge than the CPI, known as the personal consumption expenditures price index, or PCE.

“The bulk of this progress is behind us now and inflation may remain stubbornly sticky near current levels for a time,” Rick Rieder, head of BlackRock’s global allocation investment team, wrote in a note Wednesday.

While price pressures have broadly eased across the U.S. economy, there have been some headwinds in recent months.

Grocery inflation jumped notably, from a 0.1% monthly reading in October to 0.5% in November, for example. For context, a consistent CPI reading of about 0.2% each month would generally be in line with target inflation, economists said.

Egg prices jumped about 8% in the month alone and are up 38% over the past year, according to CPI data.

“We saw a bounce back in food prices,” Zandi said. “Part of it is avian flu: Egg prices continue to be very strong.”

Food prices are generally volatile, so one month of elevated grocery inflation data should not set off alarm bells, Zandi said. However, it will be an important category to watch as groceries “probably matter most” to the majority of households relative to pricing, he said.

Cars and housing are other trouble spots

Additionally, categories such as transportation, health care and shelter have been trouble spots, Seydl said.

Vehicle prices and airfare are big components of the transportation category. Their recent inflationary bouts are likely to be short-lived, however, Seydl said.

More from Personal Finance:

Economists have ‘really had it wrong’ about recession

Trump tariffs would likely have a cost for consumers

Why the U.S. job market is stagnant right now

New vehicle prices rose 0.6% from October to November, according to CPI data. Those for car insurance rose just 0.1% during that period, but are up 13% over the year.

In 2021, car prices spiked amid a shortage of semiconductors essential to manufacture them. That led to a severe vehicle shortage and high inflation. Later, prices fell as dealers rebuilt their inventories. Now, some price volatility is natural as the market settles back into equilibrium, Seydl said.

Car prices feed into motor vehicle insurance: When prices are elevated, insurers’ cost to replace vehicles after a car accident is also much higher. Insurers also typically need approval from regulators to raise consumer premiums, which takes time.

Airline prices, similar to those of autos, are also “finding a bottom,” Seydl said. Actual fares are roughly where they were before the Covid-19 pandemic, according to CPI data.

“We haven’t really had any airfare inflation from 2019 to today,” Seydl said. “We have just seen a lot of volatility.”

Labor costs are the primary input for health-care inflation, he said.

While wage growth has broadly eased across much of the economy — generally lessening the likelihood that businesses will raise prices to compensate for labor — the health-care sector still has a labor shortage, making price strength “pretty resilient,” Seydl said.

Prices for medical care services were up 0.4% from October to November, and 4% over the year.

As the largest CPI component, housing also continues to prop up overall inflation readings. Shelter accounted for 40% of the monthly CPI increase, according to the Bureau of Labor Statistics.

However, it has declined notably. The shelter index increased 4.7% over the last year, the smallest 12-month increase since February 2022, the Bureau of Labor Statistics said.

Inflation for rent and owners’ equivalent rent — an estimate of the rental price a homeowner could command for their property — saw their smallest one-month increases since July 2021 and April 2021, respectively.