France’s newly-installed government on Thursday presented a draft budget containing 60 billion euros ($65.6 billion) in tax hikes and spending cuts, as analysts warned the package may not be enough to stave off ratings downgrades for the economy.

The 2025 budget features a greater focus on tax-raising measures than some were expecting. Analysts also flagged “politically complicated” proposals such as a delay to an inflation adjustment for pensions, and cuts to local government, the civil service and the healthcare system.

Other key elements include temporary additional taxes on large shipping firms and corporations with revenue of more than a billion euros a year, impacting around 440 companies; an income tax surcharge on households with incomes over 500,000 euros; the reintroduction of a levy on electricity consumption; and an increase in taxes and charges on airline tickets and cars with high emissions.

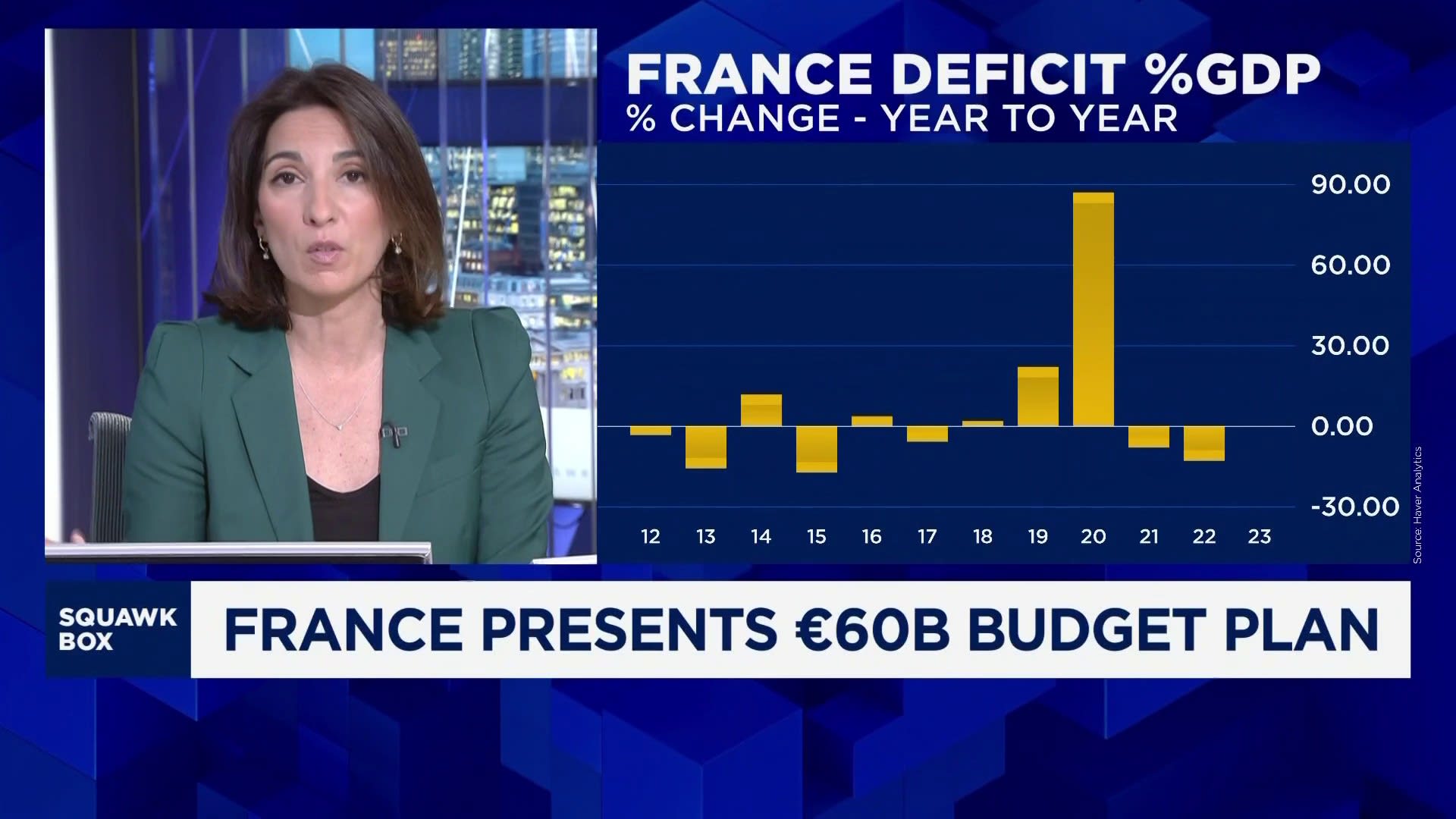

One of the budget’s core aims is to reduce France’s projected 6.1% deficit for 2024 to 5% of gross domestic product next year — an effort to comply with European Union rules which state a member nation’s budget deficit should not exceed 3% of GDP.

The government set a new target of meeting this rule by 2029, an extension of its previous goal of 2027. It also warned the deficit could swell to 7% next year without action.

Political challenge

The task of finding 60 billion euros in a year left the government with few options, meaning it had to turn to those which are “politically complicated,” Hadrien Camatte, senior economist for France, Belgium and the euro zone at Natixis, told CNBC’s “Squawk Box Europe” on Friday.

The fragile French government led by Prime Minister Michel Barnier has already faced one vote of no confidence this week, which it survived.

The government was formed last month after fraught negotiations in the wake of the July parliamentary election, which handed the most seats to the left-wing New Popular Front — itself a relatively divided alliance — but failed to deliver any party or coalition a majority.

In acknowledgement of this, Barnier characterized the draft budget as a starting point to be debated by lawmakers and said he was open to changes that maintain its fiscal integrity.

“There will be changes and there will be heated debate regarding pensions and social security contributions,” Camatte said, with debate over the budget set to kick off on Oct. 21 and votes on various portions of it from Oct. 29.

“The problem is when you have to find 60 billion, we have never found 60 billion in one year, it would be unprecedented, and that’s why it’s not very credible to find so huge an amount, especially with only a very fragile relative majority.”

Tax focus

The policy mix underpinning the 2025 budget is “less skewed towards spending cuts and more geared towards tax increases than we anticipated,” analysts at Goldman Sachs said in a note Friday.

“The magnitude of the proposed consolidation and the corresponding reliance on tax increases leave us less confident in the ability of the government to meet its 2025 deficit target of 5.0%. Our previous research has found that abrupt adjustments and tax-based consolidations tend to have a lower chance of succeeding in improving the fiscal position sustainably,” they wrote, noting their own deficit forecast was 5.2%.

However, they also flagged the potential for some near-term political stability given the government’s survival of the Oct. 8 no confidence vote.

French Minister for the Economy, Finance and Industry Antoine Armand arrives at the Elysee presidential palace to attend the weekly cabinet meeting, during which France’s 2025 budget was presented, on October 10, 2024 in Paris.

Ludovic Marin | Afp | Getty Images

This means their base case is currently for the government to pass the budget bill by the end of the year, they said, but with greater uncertainty beyond that point.

“When you need fresh money very quickly, you don’t have any other option than increasing taxes. The problem is that tax is already very elevated in France,” Natixis’ Camatte told CNBC, noting the country has the second-highest wage taxation rate in Europe.

Despite an emphasis on tax hikes, the bill’s split should see government spending cut by 40 billion euros while revenues rise by 20 billion euros, according to Erik-Jan van Harn, senior macro strategist at Rabobank.

However, he added: “Barnier’s ambitious plans are fraught with implementation risks. His government commits until 2029 but isn’t very likely to survive until then.”

Ratings risk

Questions remain over what the 2025 budget will mean for France’s economic growth, and whether the country can avoid further credit downgrades on its sovereign debt, after cuts by agencies S&P and Fitch over the last two years.

The government has spread its measures to try to avoid harming economic growth, Evelyn Herrmann, Europe economist at Bank of America Global Research, told CNBC’s “Squawk Box Europe” on Friday.

“There is the hope is that by doing that and by going more into perhaps the upper income groups and the particularly profitable companies — and the promise to do that temporarily — perhaps you avoid a kind of typical strong effect on growth of these measures,” she continued.

However, the Goldman Sachs analysts estimate the impact of the package on economic growth will turn from a 0.3 percentage point boost in 2024 to a 0.5 percentage point drag in 2025 and 2026; while UBS said the historically large 2% of GDP fiscal consolidation would be “likely to hurt growth.”

Statistics agency Insee this week forecast 1.1% growth for the French economy this year, which Natixis’s Camatte described as “maybe a bit too optimistic, even if it’s not unrealistic.”

“My worry is for the trajectory beyond 2025, because measures to reduce the deficit beyond 2025 are undocumented and when you are doing debt sustainability analysis, the trajectory of France is clearly a risk,” he said.

In the near-term, ratings agencies would be in a wait-and-see mode given the lack of specific detail around the budget, he added, though a negative outlook from S&P or Fitch could not be ruled out.

“At this stage it’s more keep calm and let’s decide next year to see if the spending cuts are credible or not,” Camatte said. However, he expects agency Moody’s, which has maintained a better rating on France, to go into a negative outlook this year before downgrading next year.

Rabobank’s Van Harn was even more downbeat, arguing that sharp spending cuts would “put a lid on economic growth” and that “a rating downgrade by one of the major rating agencies seems likely.”

“Stark austerity has its price. Economic growth, which is already weak, will be hampered by a sharp turn in France’s fiscal stance. The government would do well to consider the economic side effects of their policy, but the lack of political capital risks that Barnier will be forced to make the wrong decisions,” he said Friday.

“Given the risks already highlighted by [Fitch] and the comparatively optimistic nature of its earlier projections, we see a rating downgrade as likely. While clearly not a positive from a spread perspective we believe that the market is already largely pricing for such a move.”

— CNBC’s Charlotte Reed contributed to this story