Jamie Dimon, CEO of JPMorgan Chase, leaves the U.S. Capitol after a meeting with Republican members of the Senate Banking, Housing and Urban Affairs Committee on the issue of de-banking on Feb. 13, 2025.

Tom Williams | Cq-roll Call, Inc. | Getty Images

JPMorgan Chase CEO Jamie Dimon said Monday that markets and central bankers underappreciate the risks created by record U.S. deficits, tariffs and international tensions.

Dimon, the veteran CEO and chairman of the biggest U.S. bank by assets, explained his worldview during his bank’s annual investor day meeting in New York. He said he believes the risks of higher inflation and even stagflation aren’t properly represented by stock market values, which have staged a comeback from lows in April.

“We have huge deficits; we have what I consider almost complacent central banks,” Dimon said. “You all think they can manage all this. I don’t think they can,” he said.

“My own view is people feel pretty good because you haven’t seen effective tariffs,” Dimon said. “The market came down 10%, [it’s] back up 10%. That’s an extraordinary amount of complacency.”

Dimon’s comments follow Moody’s rating agency downgrading the U.S. credit rating on Friday over concerns about the government’s growing debt burden. Markets have been whipsawed over the past few months over worries that President Donald Trump‘s trade policies will raise inflation and slow the world’s largest economy.

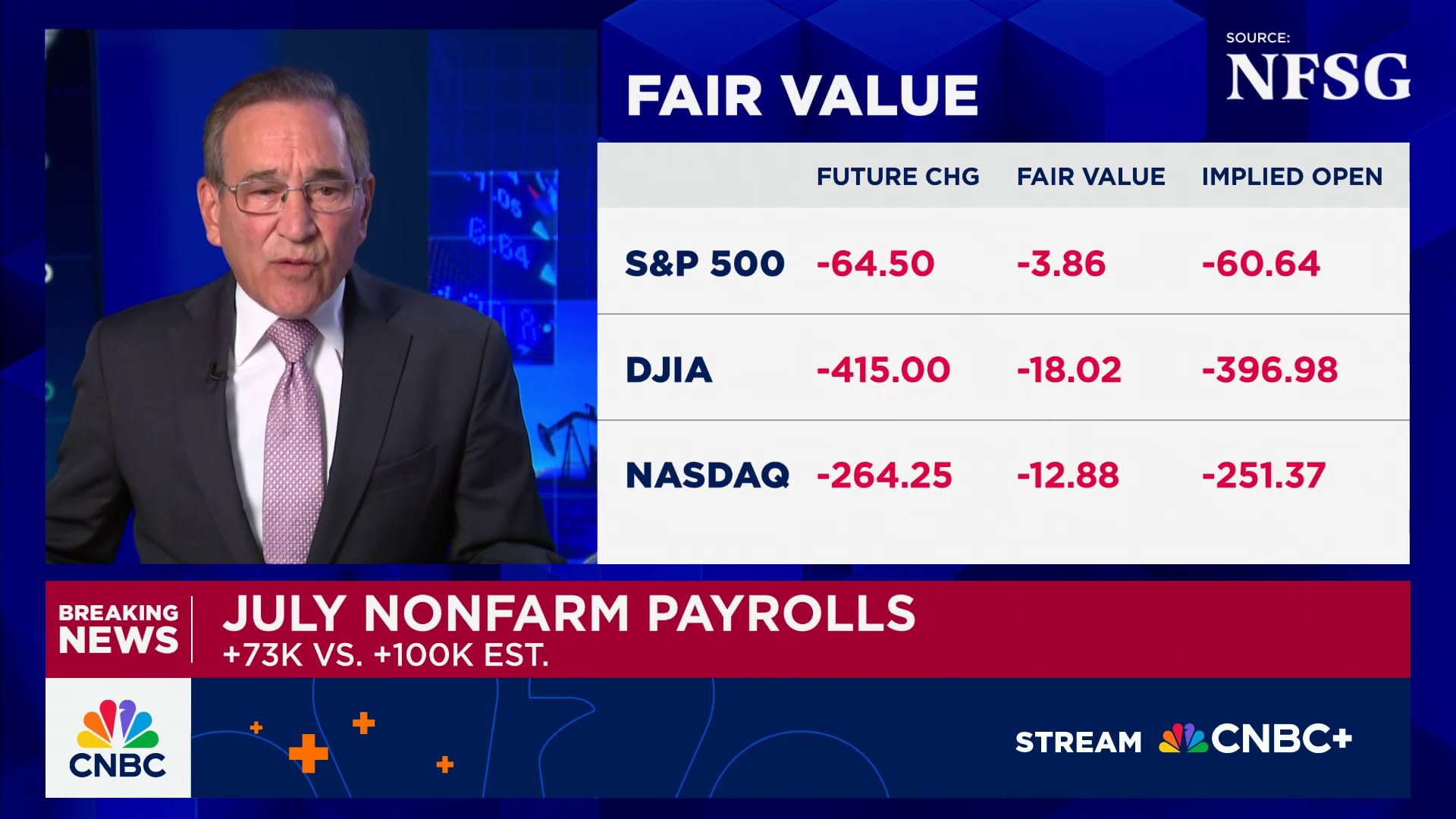

Dimon said Monday that he believed Wall Street earnings estimates for S&P 500 companies, which have already declined in the first weeks of Trump’s trade policies, will fall further as companies pull or lower guidance amid the uncertainty.

In six months, those projections will fall to 0% earnings growth after starting the year at around 12%, Dimon said. If that were to happen, stocks prices will likely fall.

“I think earnings estimates will come down, which means PE will come down,” Dimon said, referring to the price to earnings ratio tracked closely by stock market analysts.

The odds of stagflation, “which is basically a recession with inflation,” are roughly double what the market thinks, Dimon added.

Separately, one of Dimon’s top deputies said corporate clients are still in “wait-and-see” mode when it comes to acquisitions and other deals.

Investment banking revenue is headed for a “mid-teens” percentage decline in the second quarter compared with the year-earlier period, while trading revenue was trending higher by a “mid-to-high” single-digit percentage, said Troy Rohrbaugh, a co-head of the firm’s commercial and investment bank.

On the ever-present question of Dimon’s timeline to hand over the CEO reins to one of his deputies, Dimon said nothing has changed from his guidance last year, when he said he would likely remain for less than five more years.

“If I’m here for four more years, and maybe two more” as executive chairman, Dimon said, “that’s a long time.”

Of all the executive presentations given Monday, consumer banking chief Marianne Lake had the longest speaking time at a full hour. She is considered a top successor candidate, especially after Chief Operating Officer Jennifer Piepszak said she would not be seeking the top job.