Morgan Stanley’s Mike Wilson sees a meaningful rotation back into U.S. stocks, and he sees one beaten-up group as a winner.

“It started out with a low-quality rally, which is what we expect – meaning a short squeeze,” the firm’s chief investment officer told CNBC’s “Fast Money” on Monday. “Then, what we noticed is the revision factors on the Mag Seven are actually starting to stabilize a bit. So, the last couple of days though stocks have acted better, and that can take the index higher. How high? 5,900. So, we’re almost there.”

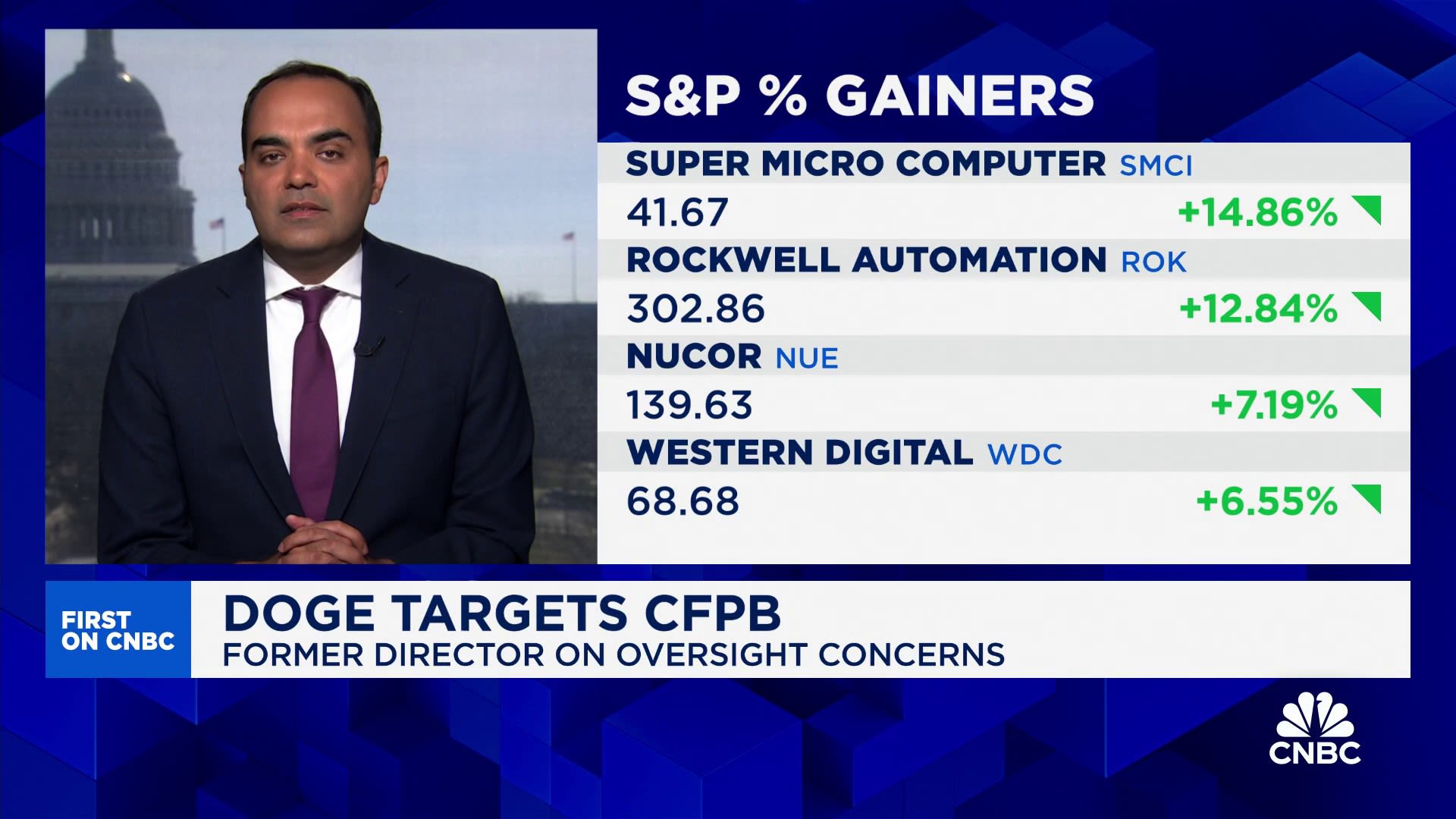

The major indexes had a notable start to the week. The S&P 500 gained roughly 1.8% and closed at 5,767.57 — about 6% below its all-time high. Meanwhile, the Dow jumped almost 600 points while the Nasdaq Composite surged more than 2%.

The “Magnificent Seven” had a big role in Monday’s rally. Its members include Apple, Nvidia, Meta Platforms, Amazon, Alphabet, Microsoft and Tesla. The electric vehicle maker registered its best daily performance since November.

But Wilson, who’s also the firm’s chief U.S. equity strategist, suggests a narrow window for gains. He focused his Monday research note on the idea.

“Stronger seasonals, lower rates and oversold momentum indicators support our call for a tradeable rally from ~5500,” he wrote. “A weaker dollar and stabilizing Mag 7 EPS [earnings per share] revisions can drive capital back to the US. Beyond the tactical rally, volatility will likely persist this year.”

And, he won’t rule out new lows for the year.

“Whatever rally we’re getting now, we think probably end up fading into earnings, into May and June,” he added. “Then, we’ll probably make a more durable low later in the year.”

According to Wilson, the market weakness is mostly tied to fundamentals and technicals.

‘Nothing to do with tariffs’

“The reason the markets are lower over the course of the last three or four months has nothing to do with tariffs,” said Wilson. “It’s mostly to do with the fact that earnings revisions have rolled over. The Fed stopped cutting rates. You had stricter enforcement on immigration. You have [Department of Government Efficiency]. All of those things are growth negative.”

Wilson’s S&P 500 year-end target is 6,500, which implies a nearly 13% gain from Monday’s close.

“Could we make a new high in the second half of the year as people look forward to 2026? Yeah,” Wilson said.

Join us for the ultimate, exclusive, in-person, interactive event with Melissa Lee and the traders for “Fast Money” Live at the Nasdaq MarketSite in Times Square on Thursday, June 5th.

Disclaimer