U.S. dollar banknotes and a label with the word “Recession” are seen in this illustration taken March 19, 2025.

Dado Ruvic | Reuters

Chances that the U.S. is heading for a recession are close to 50-50, according to a Deutsche Bank survey that raises more questions about the direction of the U.S. economy.

The probability of a downturn in growth over the next 12 months is about 43%, as set by the average view of 400 respondents during the period of March 17-20.

Though unemployment remains low and most data points suggest continuing if not slowing growth, the survey results reinforce the message from sentiment surveys that consumers and business leaders are increasingly concerned that a slowdown or recession is a growing risk.

Federal Reserve Chair Jerome Powell last week acknowledged the worries but said he still sees the economy as “strong overall” featuring “significant progress toward our goals over the past two years.”

Still, Powell and his colleagues at the two-day policy meeting that concluded Wednesday lowered their estimate for gross domestic product this year to just a 1.7% annualized gain. Excluding the Covid-induced retrenchment in 2020, that would be the worst growth rate since 2011.

Additionally, Fed officials raised their outlook for core inflation to 2.8%, well above the central bank’s 2% goal, though they still expect to achieve that level by 2027.

The combination of higher inflation and slower growth raise the specter of stagflation, a phenomenon not experienced since the early 1980s. Few economists see that era replicated in the current environment, though the probability is rising of a policy challenge where the Fed might have to choose between boosting growth and tamping down prices.

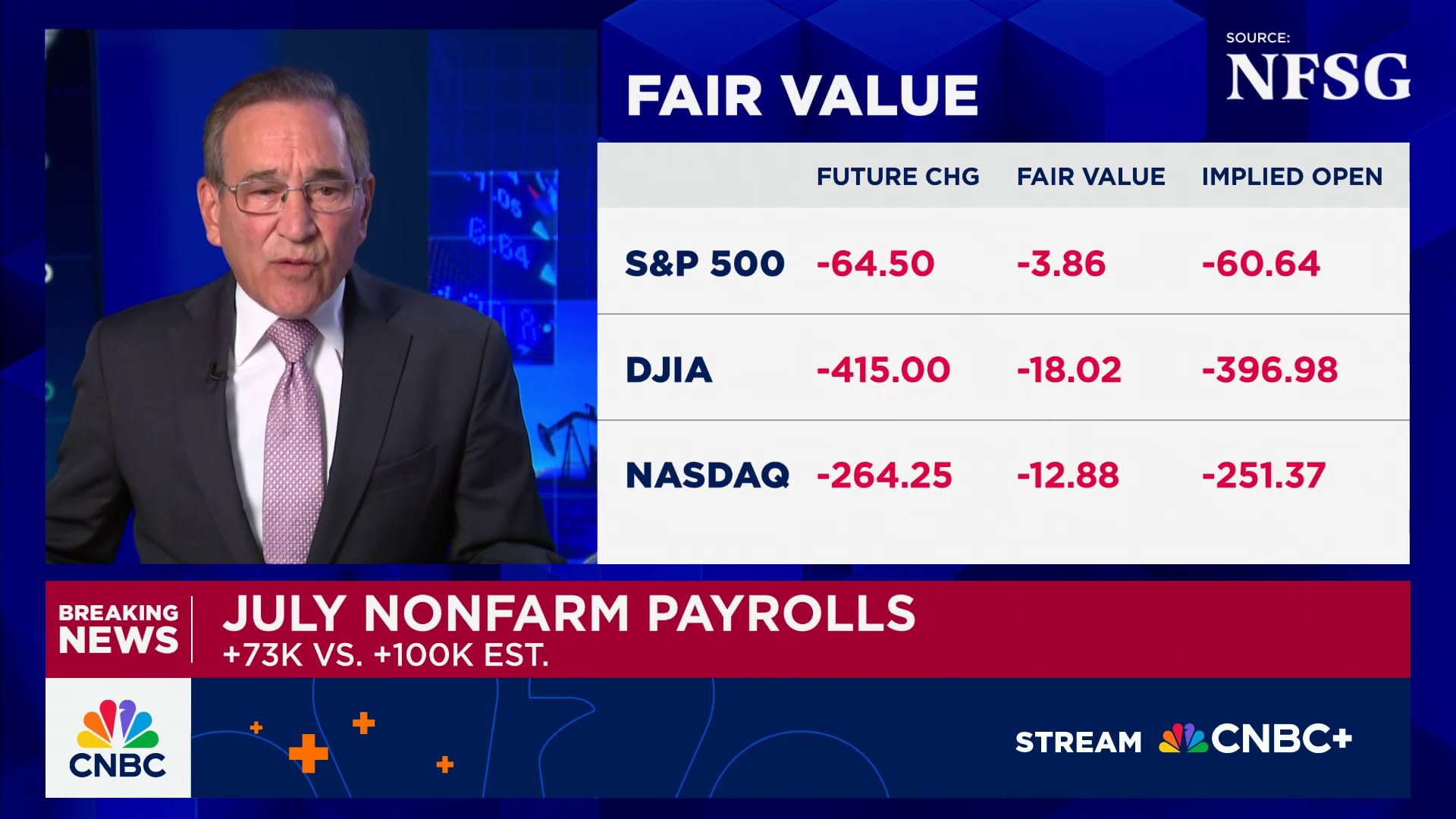

Markets have been nervous in recent weeks about the prospects ahead. Bond expert Jeffrey Gundlach at DoubleLine Capital told CNBC a few days ago that he sees the chances of a recession at 50% to 60%.

“The recent equity market correction was punctuated by the ‘uncertainty shock’ of ever-evolving tariff policy, with investors concerned it could morph into a slowdown or even recession,” Morgan Stanley said in a note Monday. “What’s really at the heart of the conundrum, however, is that the U.S. might be at risk for a bout of stagflation, where growth slows and inflation remains sticky.”

Powell, however, doubted that a repeat of the previous bout of stagnation is in the cards. “I wouldn’t say we’re in a situation that’s remotely comparable to that is likely,” he said.

Barclays analysts noted that “market-based measures are consistent with only a modest slowing in the economy,” though the firm expects a growth rate this year of just 0.7%, barely above the recession threshold.

UCLA Anderson, a closely watched and widely cited forecasting center, recently turned heads with its first-ever “recession watch” call for the economy, based largely on concerns over President Donald Trump’s tariffs.

Clement Bohr, an economist at the school, wrote that the downturn could come in a year or two though he said one is “entirely avoidable” should Trump scale back his tariff threats.

“This Watch also serves as a warning to the current administration: be careful what you wish for because, if all your wishes come true, you could very well be the author of a deep recession. And it may not simply be a standard recession that is being chaperoned into existence, but a stagflation,” Bohr said.

Get Your Ticket to Pro LIVE

Join us at the New York Stock Exchange!

Uncertain markets? Gain an edge with CNBC Pro LIVE, an exclusive, inaugural event at the historic New York Stock Exchange.

In today’s dynamic financial landscape, access to expert insights is paramount. As a CNBC Pro subscriber, we invite you to join us for our first exclusive, in-person CNBC Pro LIVE event at the iconic NYSE on Thursday, June 12.

Join interactive Pro clinics led by our Pros Carter Worth, Dan Niles and Dan Ives, with a special edition of Pro Talks with Tom Lee. You’ll also get the opportunity to network with CNBC experts, talent and other Pro subscribers during an exciting cocktail hour on the legendary trading floor. Tickets are limited!