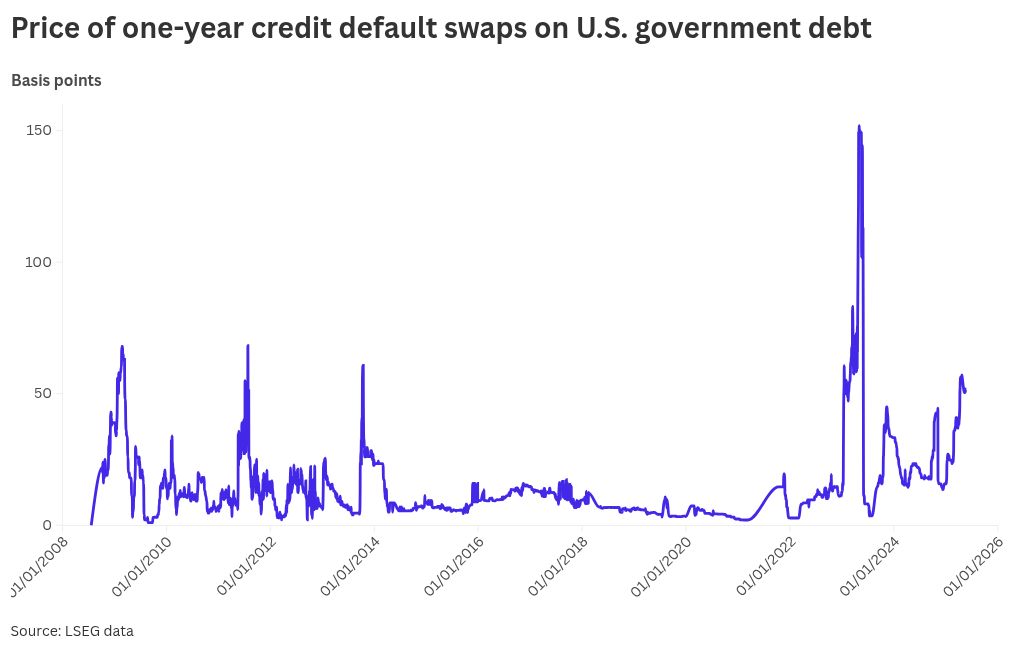

The march higher in U.K. government bond yields since the launch of the Labour government’s debut budget plan in October

The prospect of public spending cuts or further tax rises came into focus last week, as 30-year gilt yields hit their highest level since 1998. Despite initially falling after Labour’s election victory in July, 2-year gilt yields have also climbed back above 4.5%, while the 10-year yield reached levels not seen since 2008.

Waning investor confidence in the U.K. was particularly highlighted by a concurrent fall in sterling, which on Friday hit its lowest level against the U.S. dollar since November 2023.

Loading chart…

Borrowing costs are also rising in the euro area and the U.S., and economists point out that the U.K. is being weighed on by external factors including the return of Donald Trump to the White House and expectations for broadly higher interest rates than previously expected this year.

But the surge in U.K. yields is nonetheless a major headache for the U.K. government, which has pledged to reboot economic growth while ensuring debt declines as a share of the economy within five years. U.K. public sector net debt currently stands at nearly 100% of GDP.

“The rise in gilt yields has a self-reinforcing feedback loop through the U.K.’s debt sustainability, by increasing borrowing costs used for budgeting purposes,” ING Senior European Rates Strategist Michiel Tukker said in a Friday note.

Tukker cited analysis by the independent Office of Budget Responsibility which indicates that the recent rise in yields — if sustained — would wipe out the government’s estimated headroom of £9.9 billion ($12.1 billion) for meeting its self-declared fiscal rules. Those regulations commit Labour to covering day-to-day government spending with revenues, as well as a goal of moving toward a decline in the U.K.’s debt to GDP ratio on a longer timeframe.

<live_story id="108054111" contenturl="https://capi-bl-web.cnbc.com/api/v1/id/108054111" type="live_story" slug="UK's Labour government raises taxes by £40 billion in new budget plan" title="UK's Labour government raises taxes by £40 billion in new budget plan" liveurl="/2024/10/30/uk-budget-labour-rachel-reeves-october-2024.html" branding="cnbc" subdomain="https://www.cnbc.com" url="https://www.cnbc.com/2024/10/30/uk-budget-labour-rachel-reeves-october-2024.html" tagname="UK's Labour government raises taxes by £40 billion in new budget plan" contentclassification revisionid="14867599" state="Publish" sectionhierarchy="[object Object],[object Object],[object Object]" historicalurl bodyteaser="

cscs

” iscontemplate=”No” datepublished=”2024-10-30T05:59:36+0000″ datelastpublished=”2024-10-30T20:37:08+0000″ datefirstpublished=”2024-10-30T05:59:36+0000″ datemodified=”2024-10-30T20:37:08+0000″ settings=”[object Object]” association=”[object Object],[object Object]” description=”Nearly four months after taking office, the U.K.’s new Labour government unveiled its debut budget plan on Wednesday. ” headline=”UK’s Labour government raises taxes by £40 billion in new budget plan” shorterheadline=”UK’s Labour government raises taxes by £40 billion in new budget plan” section=”[object Object]” createdby=”Jennifer” editedby=”Ryan.Browne@nbcuni.com” seotitle=”UK Budget: Labour’s Rachel Reeves unveils plan with tax rises” summary=”Nearly four months after taking office, the U.K.’s new Labour government unveiled its debut budget plan on Wednesday. ” linkheadline=”UK’s Labour government raises taxes by £40 billion in new budget plan” publisher=”[object Object]” about=”

This was CNBC’s live blog covering the October 2024 U.K. budget.

” featuredcontent=”

LONDON — Nearly four months after taking office, the U.K.’s new Labour government on Wednesday unveiled a debut budget plan that includes £40 billion ($51.8 billion) worth of tax rises to plug a hole in the public finances and allow for investment in public services.

One of the changes that is expected to be among the biggest revenue-raisers for the U.K. Treasury is a hike in the amount employers pay out in National Insurance (NI) — a tax on earnings. British Finance Minister Rachel Reeves also detailed increases to capital gains tax and private school fees, a freeze on fuel duty and the abolition of the controversial "non-dom" tax regime.

A freeze on income tax and National Insurance thresholds for workers — seen as a stealth tax by many — was one of the surprise moves in Wednesday’s announcement.

Reeves also outlined a significant rise in borrowing to fund public sector investment, and committed to a higher day-to-day budget for the National Health Service and £5 billion to fund Labour’s housing plan, which includes the construction of 1.5 million homes over the course of this parliament.

She repeated her claim that Labour this summer exposed a £22 billion "black hole" in the previous Conservative government’s spending plans, which the opposition party has previously refuted. Reeves further announced plans to catalyze £70 billion of investment through the National Wealth Fund, the U.K.’s newly created sovereign wealth fund.

Meanwhile, the independent Office for Budget Responsibility released updated U.K. forecasts saying real GDP growth will pick up from close to zero last year, to 1.1% this year, 2% in 2025, and 1.8% in 2026. That compares with previous forecasts for 0.8% growth in 2024 followed by 1.9% in 2025 and 2% in 2026.

Reeves had faced backlash for not holding the budget closer to Labour’s July 4 election win, with critics saying the delay has cast a cloud of uncertainty over the economy and businesses.

” coverageenddate=”2024-10-30T16:40:00+0000″ relation=”[object Object]”>

The Institute for Fiscal Studies think tank said Friday there is a “knife edge,” chance of the U.K. achieving the former fiscal rule, but that Finance Minister Rachel Reeves could “get lucky.”

She otherwise faces an “unenviable set of options,” said IFS Associate Director Ben Zaranko, including bringing forward upcoming changes to how debt is calculated to free up more headroom, paring back current spending plans and announcing more tax rises, which could be conditional on changes within the coming years. The minister could also opt to do nothing and break her rule.

Economists Ruth Gregory and Hubert de Barochez at research group Capital Economics also said U.K. gilts may be trapped in a “vicious circle,” in which “the rise in U.K. yields puts a strain on public finances, therefore calling for an even bigger tightening of fiscal policy, but in turn putting additional strain on the economy.”

Pound vs dollar.

Bank of America Global Research strategists on Friday said that it was unlikely Labour would breach its rules and would instead announce further fiscal consolidation — measures to reduce public debt, generally public spending cuts or tax hikes — in the spring or earlier.

That would potentially be achieved through spending cuts, they added, coming off the back of the £40 billion in tax hikes that Labour announced in October.

A Treasury spokesperson told CNBC: “This Government’s commitment to fiscal rules and sound public finances is non-negotiable.”

“The Chancellor has already shown that tough decisions on spending will be taken, with the spending review to root out waste ongoing. And over the coming weeks and months, the Chancellor will leave no stone unturned in her determination to deliver economic growth and fight for working people.”

UK in ‘slow growth trap’ — but not a mini-budget crisis

Former U.K. Finance Minister Vince Cable told CNBC on Friday that higher bond yields were being seen in many countries and were not an “emergency panic situation” — but that markets had realized Britain was stuck in a “slow growth trap.”

“We’ve been there for many years, since the Financial Crisis, then Brexit, then a problem with Covid[-19] and Ukraine war, and we’re stuck with relatively high inflation, very slow growth, and so the markets are marking the U.K. down, relatively speaking. But this is not a panic situation, it’s not a crisis of the old-style balance of payment sell-off situation,” Cable said.

Labour should have gone for a broader range of tax rises rather than focusing on a hike in National Insurance — a levy on wages — which has been slammed by the U.K. business community, Cable said. However, he added that the market has broader concerns over U.K. growth and the global economic picture, which is clouded by external factors, such as the weaker Chinese outlook.

Cable also downplayed comparisons with the U.K. mini-budget crisis in 2022, when then-Prime Minister Liz Truss’s announcement of sweeping tax cuts triggered massive volatility in the bond market.

“The Truss moment was a prime minister just taking a reckless leap into the dark with a big increase in the budget deficit on the assumption this will somehow trigger economic growth. Well, that clearly isn’t what’s happened this time. The argument is about whether they’ve done enough tightening and whether they’ve done it in the right way, but it’s a different kind of problem,” Cable told CNBC.

That sentiment was broadly reflected in wider analysis. Bank of America strategists called comparisons with the mini-budget “overblown,” noting that the bar for the Bank of England to intervene in the gilt market, as it did at the time, was high.

Capital Economics said last week’s higher gilt yields were an economic headwind but not a crisis, with smaller and slower moves than after the mini-budget. David Brooks, head of policy at consultancy Broadstone, said there did not appear to be any “systemic issues at play” in the liability-driven investment (LDI) funds, which were the biggest concern back in 2022.