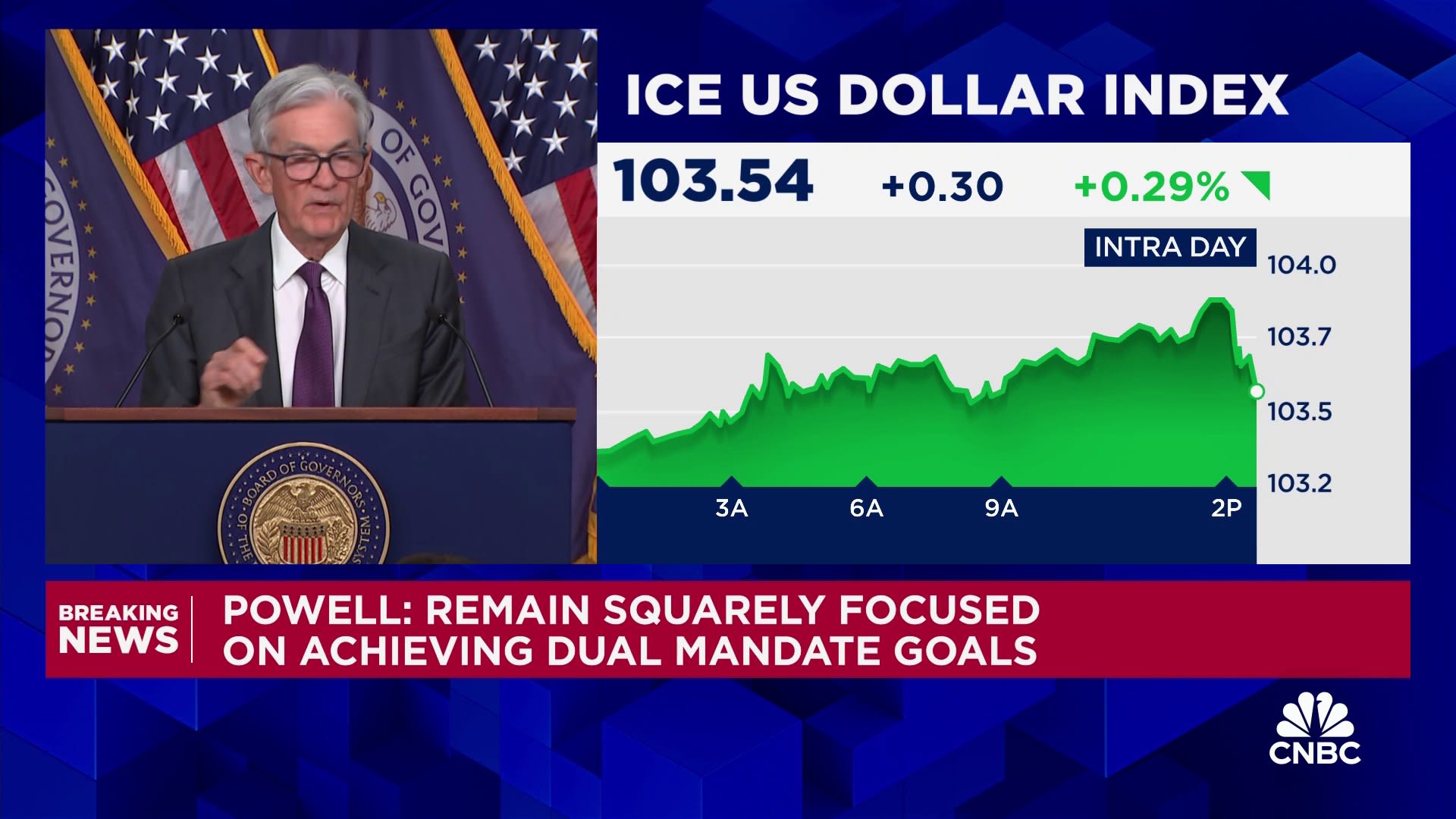

Federal Reserve Chair Jerome Powell speaks during a news conference following the Nov. 6-7, 2024, Federal Open Market Committee meeting at William McChesney Martin Jr. Federal Reserve Board Building in Washington, D.C.

Andrew Caballero-Reynolds | AFP | Getty Images

Inflation is stubbornly above target, the economy is growing at about a 3% pace and the labor market is holding strong. Put it all together and it sounds like a perfect recipe for the Federal Reserve to raise interest rates or at least to stay put.

That’s not what is likely to happen, however, when the Federal Open Market Committee, the central bank’s rate-setting entity, announces its policy decision Wednesday.

Instead, futures market traders are pricing in a near certainty that the FOMC will actually lower its benchmark overnight borrowing rate by a quarter percentage point, or 25 basis points. That would take it down to a target range of 4.25% to 4.5%.

Even with the high level of market anticipation, it could be a decision that comes under an unusual level of scrutiny. A CNBC survey found that while 93% of respondents said they expect a cut, only 63% said it is the right thing to do.

“I’d be inclined to say ‘no cut,'” former Kansas City Fed President Esther George said Tuesday during a CNBC “Squawk Box” interview. “Let’s wait and see how the data comes in. Twenty-five basis points usually doesn’t make or break where we are, but I do think it is a time to signal to markets and to the public that they have not taken their eye off the ball of inflation.”

Inflation indeed remains a nettlesome problem for policymakers.

While the annual rate has come down substantially from its 40-year peak in mid-2022, it has been mired around the 2.5% to 3% range for much of 2024. The Fed targets inflation at 2%.

The Commerce Department is expected to report Friday that the personal consumption expenditures price index, the Fed’s preferred inflation gauge, ticked higher in November to 2.5%, or 2.9% on the core reading that excludes food and energy.

Justifying a rate cut in that environment will require some deft communication from Chair Jerome Powell and the committee. Former Boston Fed President Eric Rosengren also recently told CNBC that he would not cut at this meeting.

“They’re very clear about what their target is, and as we’re watching inflation data come in, we’re seeing that it’s not continuing to decelerate in the same manner that it had earlier,” George said. “So that, I think, is a reason to be cautious and to really think about how much of this easing of policy is required to keep the economy on track.”

Fed officials who have spoken in favor of cutting say that policy does not need to be as restrictive in the current environment and they do not want to risk damaging the labor market.

Chance of a ‘hawkish cut’

If the Fed follows through on the cut, it will mark a full percentage point lopped off the federal funds rate since September.

While that is a considerable amount of easing in a short period of time, Fed officials have tools at their disposal to let the markets know that future cuts will not come so easily.

One of those tools is the dot-plot matrix of individual members’ expectations for rates over the next few years. That will be updated Wednesday along with the rest of the Summary of Economic Projections that will include informal outlooks for inflation, unemployment and gross domestic product.

Another tool is the use of guidance in the postmeeting statement to indicate where the committee sees policy headed. Finally, Powell can use his news conference to provide further clues.

It is the Powell parley with the media that markets will be watching most closely, followed by the dot plot. Powell recently said the Fed “can afford to be a little more cautious” about how quickly it eases amid what he characterized as a “strong” economy.

“We’ll see them leaning into the direction of travel, to begin the process of moving up their inflation forecast,” said Vincent Reinhart, BNY chief economist and former director of the Division of Monetary Affairs at the Fed, where he served 24 years. “The dots [will] drift up a little bit, and [there will be] a big preoccupation at the press conference with the idea of skipping meetings. So it’ll turn out to be a hawkish cut in that regard.”

What about Trump?

Powell is almost certain to be asked about how policy might position in regard to fiscal policy under President-elect Donald Trump.

Thus far, the chair and his colleagues have brushed aside questions about the effect Trump’s initiatives could have on monetary policy, citing uncertainty over what is just talk now and what will become reality later. Some economists think the incoming president’s plans for aggressive tariffs, tax cuts and mass deportations could aggravate inflation even more.

“Obviously the Fed’s in a bind,” Reinhart said. “We used to call it the trapeze artist problem. If you’re a trapeze artist, you don’t leave your platform to swing out until you’re sure your partner is swung out. For the central bank, they can’t really change their forecast in response to what they believe will happen in the political economy until they’re pretty sure there’ll be those changes in the political economy.”

“A big preoccupation at the press conference is going to the idea of skipping meetings,” he added. “So it’ll turn out to be, I think, a hawkish easing in that regard. As [Trump’s] policies are actually put in place, then they may move the forecast by more.”

Other actions on tap

Most Wall Street forecasters see Fed officials raising their expectations for inflation and reducing the expectations for rate cuts in 2025.

When the dot plot was last updated in September, officials indicated the equivalent of four quarter-point cuts next year. Markets already have lowered their own expectations for easing, with an expected path of two cuts in 2025 following the move this week, according to the CME Group’s FedWatch measure.

The outlook also is for the Fed to skip the January meeting. Wall Street is expecting little to no change in the postmeeting statement.

Officials also are likely to raise their estimate for the “neutral” rate of interest that neither boosts nor restricts growth. That level had been around 2.5% for years — a 2% inflation rate plus 0.5% at the “natural” level of interest — but has crept up in recent months and could cross 3% at this week’s update.

Finally, the committee may adjust the interest it pays on its overnight repo operations by 0.05 percentage points in response to the fed funds rate drifting to near the bottom of its target range. The “ON RPP” rate acts as a floor for the funds rate and is currently at 4.55%, while the effective funds rate is 4.58%. Minutes from the November FOMC meeting indicated officials were considering a “technical adjustment” to the rate.