US Federal Reserve Chair Jerome Powell speaks at the Economic Club of Chicago in Chicago, Illinois, on April 16, 2025.

Kamil Krzaczynski | Afp | Getty Images

The Federal Reserve heads into its closely watched policy decision Wednesday with a strong incentive to do absolutely nothing.

Faced with unresolved questions over President Donald Trump’s tariffs and an economy that is signaling both significant strengths and weaknesses, central bank policymakers can do little for now except sit and wait as events unfold.

“It’s going to be awkward at this meeting. The Fed doesn’t have a forecast to convey anything about the next couple meetings,” said Vincent Reinhart, a former long-time Fed official and now chief economist at BNY Investments. “The Fed’s got to wait for two things: It’s to see that the policy actually goes into place … But then, when it’s demonstrated, it’s got to see how inflation expectations react. So that’s why the Fed’s got to delay, then go slow.”

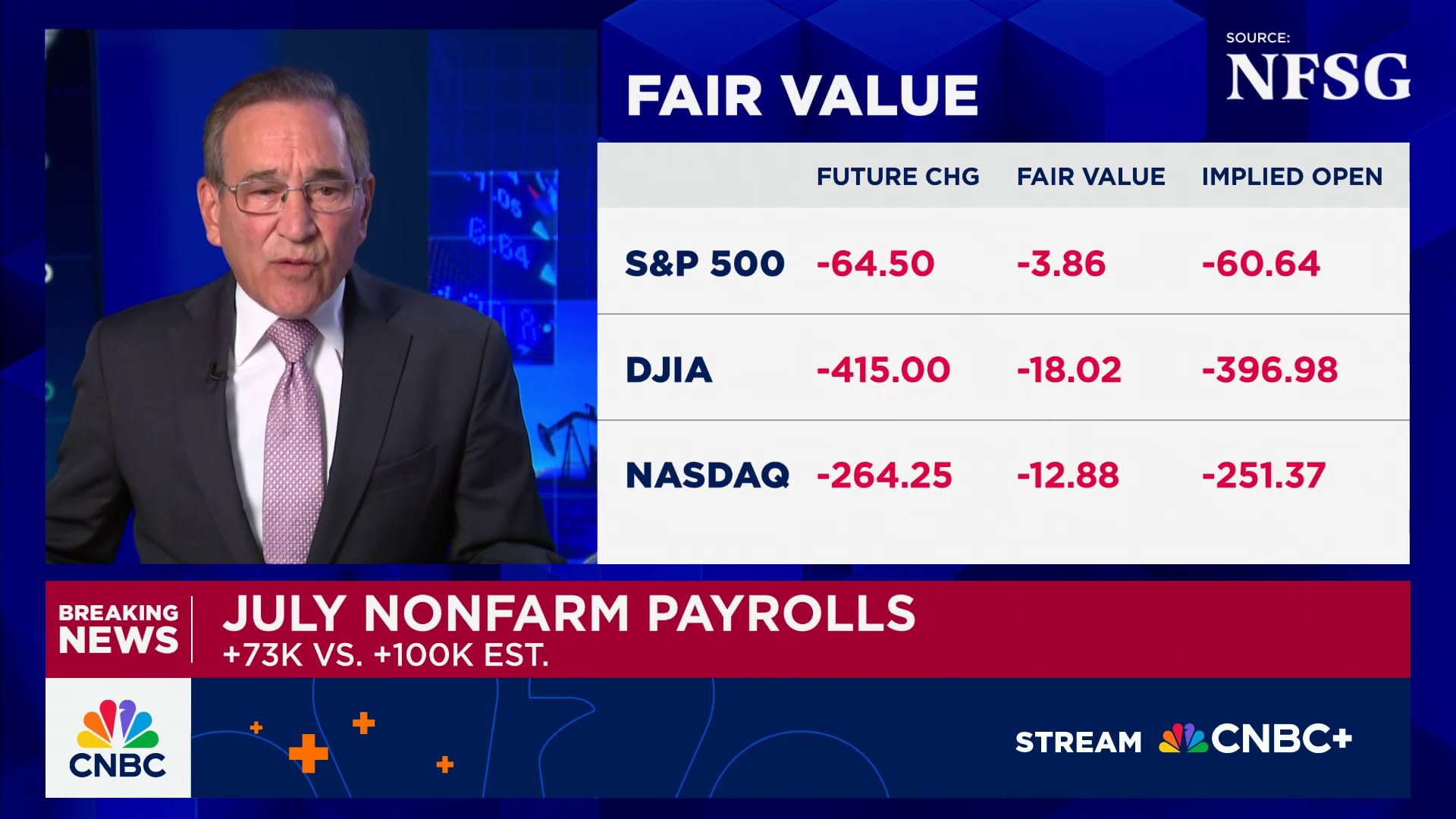

Indeed, futures market pricing is implying almost no chance of an interest rate cut at this week’s meeting, and only about a 1-in-3 probability of a move at the June 17-18 session, according to the CME Group’s FedWatch gauge.

Market expectations have shifted over the past week in response both to mixed economic signals as well as signs that President Donald Trump is getting at least a bit less aggressive in his tariff approach. The White House has signaled that several trade deals are nearing completion, though none have been announced yet.

Reinhart said his firm has two cuts plugged in for this year, a bit tighter of a path than the market expectations for three reductions starting in July. A week ago, markets were betting on as many as four cuts, starting in June.

Direction from Powell

Fed Chair Jerome Powell will be left at his post-meeting news conference to explain the thinking from him and his colleagues on where they see policy heading.

“The other unsatisfying part is they don’t know what they’re going to do in June,” Reinhart said. “So he’s going to have to say everything’s on the table. He always says it, but this time, he’s going to have to mean it.”

Powell, though, is sure to face questioning about how policymakers see the recent barrage of data, which has painted a picture of economy loaded with pessimism from consumers and business executives that has yet to feed into hard numbers such as spending and employment.

While gross domestic product fell at a 0.3% annualized rate in the first quarter, it was largely the product of a surge in imports ahead of Trump’s April 2 tariff announcement. The April nonfarm payrolls report showed that hiring continued at a solid pace, with the economy adding a better-than-expected 177,000 jobs for the month.

At the same time, manufacturing and service sector surveys show deep concern about inflation and supply impacts from tariffs. Also, consumer optimism is at multi-year lows while inflation expectations are at multi-decade highs.

It all adds up to a tightrope for Powell and Co. to walk at least through the June meeting.

No ‘dot plot’ this time

“The Fed is going to project in their statement, in their press conference, patience. Wait to see more data,” said Tony Rodriguez, head of fixed income strategy at Nuveen. “Too much uncertainty to act right now, but prepare to act if they begin to see weakness in the employment market.”

Nuveen also expects just two cuts this year and two more next year as the Fed navigates slowing growth and tariff-fueled price increases.

“Our expectation is you’re going to see nothing at this meeting,” Rodriguez said. “They just need to see more hard data, which we don’t think will become really clear until call it June or July. I would think of the September meeting as being the first cut.”

The Fed at this meeting does not update its economic projections nor its “dot plot” of individual member expectations for interest rates. That will come in June. So the rate-setting Federal Open Market Committee will be left to tweaks in the post-meeting statement and Powell’s news conference to drop any possible hints of its collective thinking.

“We think it will take a couple of months for enough hard data evidence to accumulate to make the case for a cut,” Goldman Sachs economist David Mericle said in a note. Goldman expects the Fed to cut in July, September and October in an effort to head off economic weakness, which the firm expects to take priority over inflation concerns.

One wild card in the equation: Trump, as he did during his first term, has been urging the Fed to cut rates as inflation edges closer to the central bank’s 2% objective.

However, Reinhart, the BNY economist, does not see the Fed bending to Trump’s will nor breaking ranks despite public statements from some members showing division on policy.

“The White House has done Jay Powell a favor in keeping his committee together. Because generally, when a family is criticized from from the outside, it’s less willing to criticize each other,” Reinhart said. “Do you criticize Jay Powell now and line yourself up the president? Probably not, if you worked your whole life in the Federal Reserve system.”