A customer shops for produce at an H-E-B grocery store on Feb. 12, 2025 in Austin, Texas.

Brandon Bell | Getty Images

Early economic data for the first quarter of 2025 is pointing towards negative growth, according to a Federal Reserve Bank of Atlanta measure.

The central bank’s GDPNow tracker of incoming metrics is indicating that gross domestic product is on pace to shrink by 1.5% for the January-through-March period, according to an update posted Friday morning.

Fresh indicators showed that consumers spent less than expected during the inclement January weather and exports were weak, which led to the downgrade. Prior to Friday’s consumer spending report, GDPNow had been indicating growth of 2.3% for the quarter.

While the tracker is volatile and typically becomes a more reliable measure much later in the quarter, it does coincide with some other measures that are showing a growth slowdown.

“This is sobering notwithstanding the inherent volatility of the very high frequency ‘nowcast’ maintained by the Atlanta Fed,” Mohamed El-Erian, chief economic advisor at Allianz and president of Queens’ College Cambridge, said in a post on social media site X.

The gauge had pointed to GDP gains as high as 3.9% in early February but has been on a decline since then as additional data has come in.

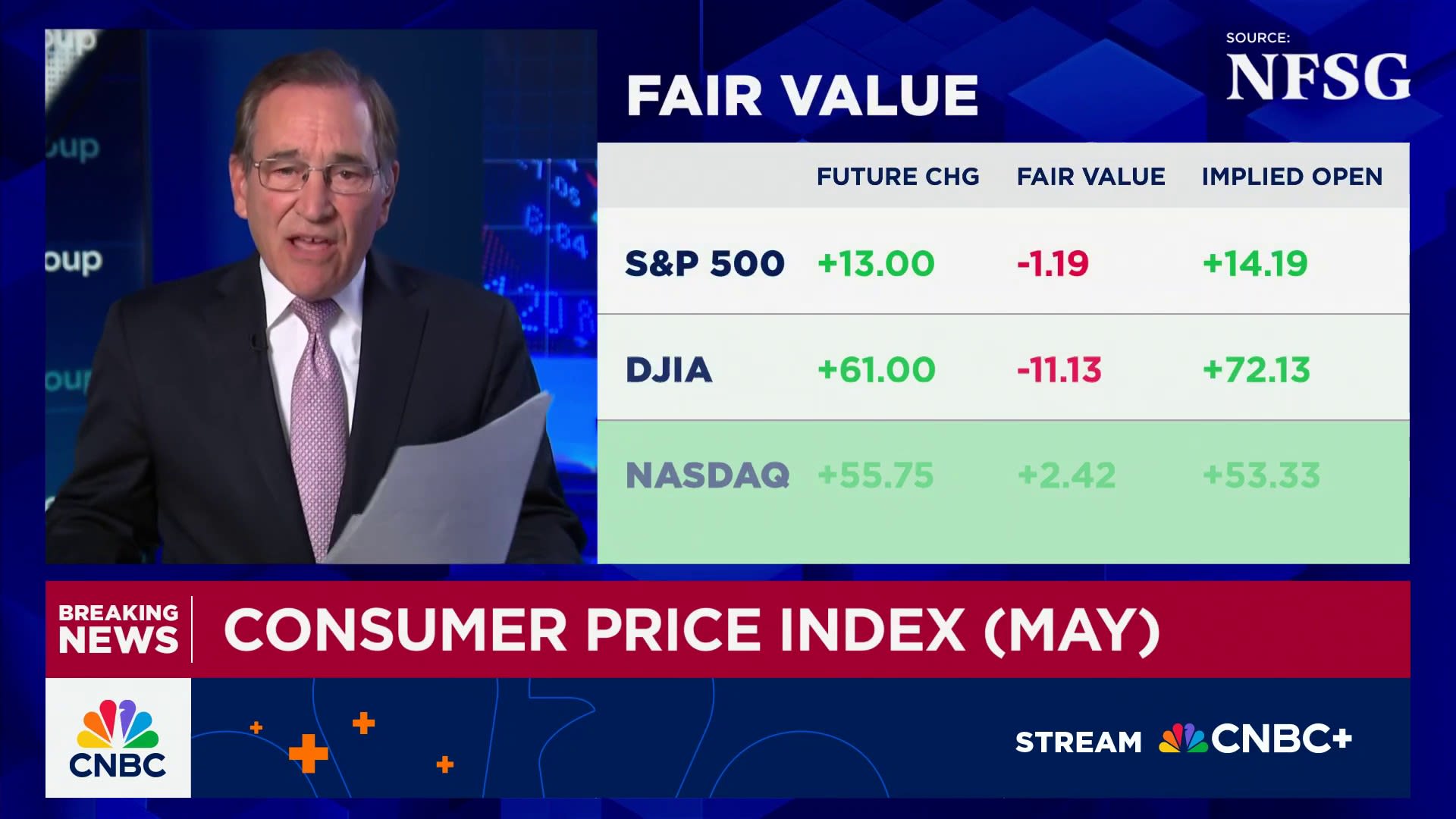

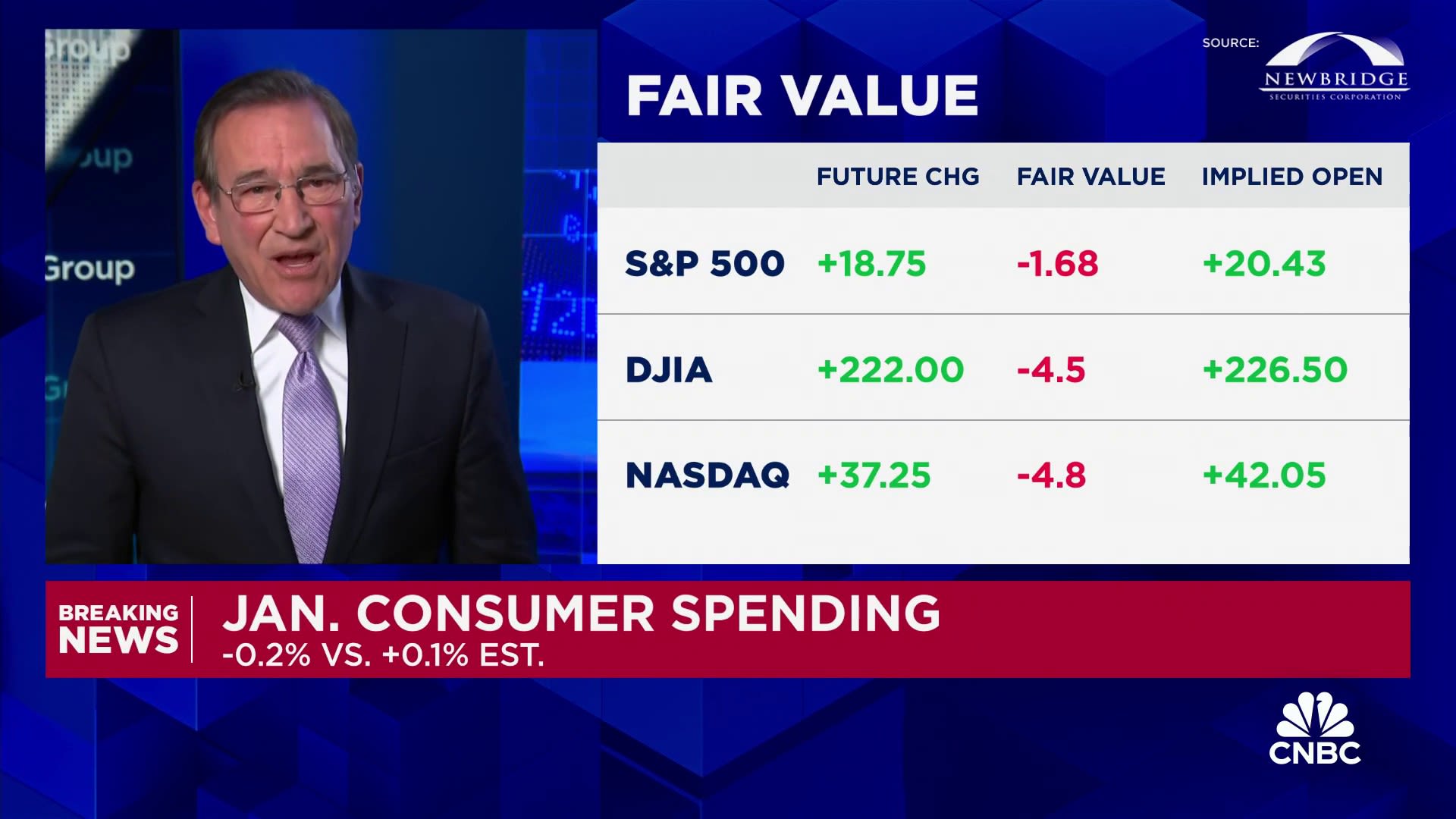

On Friday, the Commerce Department reported that personal spending fell 0.2% in January, missing the Dow Jones estimate for a 0.1% increase. Adjusted for inflation, spending fell 0.5%. As a result, that shaved a full percentage point off the expected contribution to GDP, down to 1.3%, according to the GDPNow calculation.

At the same time, the contribution of net exports tumbled from -0.41 percentage point to -3.7 percentage points.

The combination of data and its impact on the growth outlook comes with surveys showing decreasing consumer confidence and worries about rising inflation. The Commerce Department also reported that an inflation measure the Fed favors moved lower during the month, as the core personal consumption expenditures price index fell to 2.6%, down 0.3 percentage point from December.

The week also brought some concerning news out of the labor market as initial unemployment claims hit a level that was last higher in early October.

In addition, the bond market also has been pricing in slower growth. The 3-month Treasury yield this week moved above the 10-year note, a historically reliable indicator of a recession at the 12- to 18-month horizon.

The economic and policy uncertainty has led to a bumpy start to the year for the stock market. The Dow Jones Industrial Average is up 2% in 2025 amid wild fluctuations in a volatile news cycle.

“My sense is that the complacency that has crept into asset markets is about to be disrupted,” said Joseph Brusuelas, chief U.S. economist at RSM.

Markets increasingly believe the Fed will respond to the slowdown with multiple interest rate cuts this year. Traders in the fed funds futures market increased the odds of a quarter percentage point reduction in June to about 80% as of Friday afternoon and raised the possibility of three such cuts total this year.